Bitcoin Prices Down As Mt. Gox Concerns Escalate

Uncertainty about the future of major bitcoin exchange Mt. Gox is growing in light of its recent decision to take down its website amid escalating, as-yet-unconfirmed rumors that it has been the victim of widespread theft and could be nearing a lengthy or even permanent shutdown of its services.

Mt. Gox, through intermediary sources, told CoinDesk that it has no comment on the news at this time.

Now, the market is reacting to the lack of information about the developments.

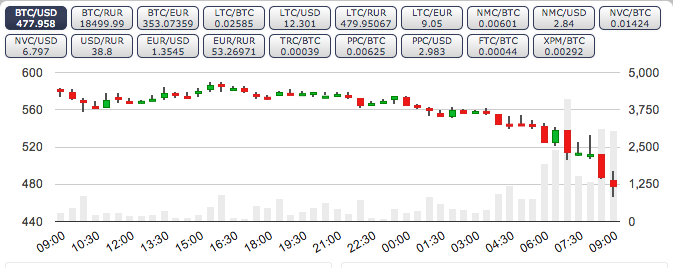

At press time, prices at major bitcoin exchanges have recorded steep declines in just the last few hours, fueled by consumer uncertainty about the impact of a worst-case scenario at the once-leading bitcoin exchange.

Prices fall

After holding steady at roughly $550 throughout most of the day, the price of bitcoin on BTC-e declined sharply to a low of $480. From 9:00 pm to 12:00 pm EST, the exchange saw prices fall rapidly from $546.

The price of namecoin, novacoin, peercoin and primecoin also declined on the news.

Mt. Gox was likewise a hot discussion point on the exchange's community chat room, with users debating the future of the exchange and what it will mean for bitcoin prices in the short and long term. Others debated the fate of coins still held in the exchange, though for now, we know only that Japanese regulators are unlikely to step in to mitigate any damage.

Screen Shot 2014-02-25 at 12.26.16 AM

Bitstamp followed a similar trajectory, declining from $505 at 9:00 pm to lows of $452 at 12:00 pm.

Further, data from Bitcoincharts suggests the price of bitcoin was $135 on Mt. Gox at the time it halted services.

Bitcoin businesses brace for worst

Prices were no doubt also affected by a joint announcement from bitcoin business leaders suggesting indirectly that Mt. Gox is no longer trustworthy. Comments on the official releases suggest, however, that wording changes have been made to original statements.

For example, user comments on the posts suggested the original postings contained the word "insolvent", though current versions do not.

Together, Coinbase, Kraken, Bitstamp, BTC China, Blockchain and Circle discussed how they plan to ensure faith in the bitcoin ecosystem:

Though the major businesses moved swiftly to distance themselves from Mt. Gox, such actions seem to have done little to stem the damage – at least as far as prices are concerned,.

Image credit: Bitcoin symbol via Shutterstock

DISCLOSURE

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.