Bitcoin Prices Rise 15% to Reach Post Mt. Gox Crisis High

The price of bitcoin is up more than 15% today on the CoinDesk Bitcoin Price Index (BPI), having reached a high of $677.58 before settling to $659.50 at press time.

The $659 figure was roughly $90 more than the opening price of $560, and marked the highest CoinDesk BPI prices observed since mid-February, when troubled bitcoin exchange Mt. Gox was removed from the average amid escalating concern about its financial state.

Press time lows on both BTC-e and Bitstamp were the highest observed since 23rd February, when Mt. Gox CEO Mark Karpeles abruptly resigned from his board of director position at the Bitcoin Foundation.

Indeed, the rise in the price of bitcoin was significant at points today, with most price gains happening within a roughly three-hour flurry of buying activity peaking at 16:00 pm GMT.

Exchange prices rise

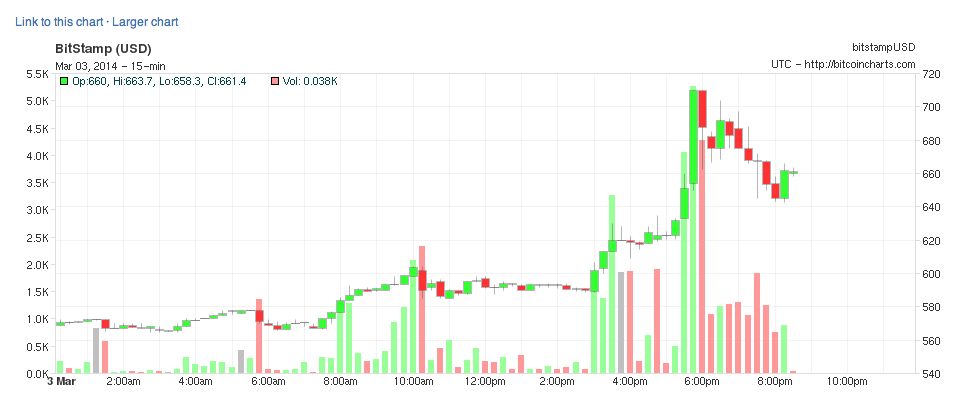

At press time, prices on major Slovenia-based bitcoin exchange Bitstamp had risen from an opening price of $565 to a low of $658. Volume reached its height on the exchange at around 18:00 pm (GMT).

Screen Shot 2014-03-03 at 3.48.59 PM

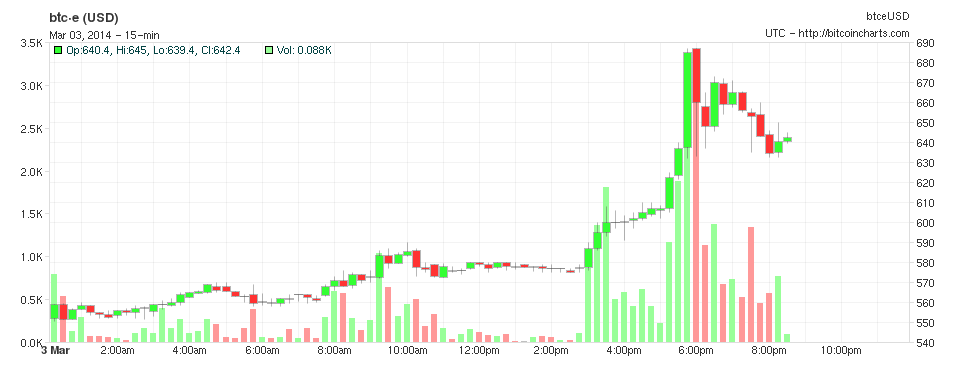

Likewise, prices on BTC-e increased from an open of $554 to a low of $639 at press time. Here, too, volume peaked at around 17:45 pm before cooling.

Screen Shot 2014-03-03 at 3.50.52 PM

Suspected causes

Speculation was rampant as to the exact cause of the increases, with message boards suggesting that a single buyer had moved the market. Others attributed the rise to the general feeling of optimism from investors following the demise of troubled Japan-based bitcoin exchange Mt. Gox and the UK's decision to ease bitcoin taxes.

Further, the price jump happened in spite of negative news stories such as the ongoing unrest in Ukraine and renowned investor Warren Buffet's high-profile rebuff of bitcoin.

The most plausible theory presented may be that no one news story was the impetus for the increase, but that rather prices recovered due to more complex market factors.

For example, some reddit users suggested bitcoin prices now revolve more correctly around hype cycles, and that the increased publicity has brought an influx of new buyers looking to take advantage of a weakened market.

Screen Shot 2014-03-03 at 3.53.39 PM

While prices are recovering, however, it remains to be seen if the market can reach the lofty goals some members expressed would occur at the onset of 2014.

Do you still believe the price of 1 BTC will hit $10,000? Weigh in below.

Image credit: Price increase via Shutterstock

DISCLOSURE

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.