Why Citigroup’s ‘Three Risks Facing Bitcoin’ is Misguided

In the wake of massive problems that brought down the Japan-based bitcoin exchange Mt. Gox, some seem to think that bitcoin is experiencing a crisis of sorts.

For those who have long known about the problems and possible hazards of Mt. Gox, however, this news doesn’t seem incredibly startling.

For the financial establishment, though, Mt. Gox’s ineptitude appears to be bitcoin’s fatal blow.

An example of this thinking comes from a report written by Citigroup currency strategist Steven Englander.

In his note to clients outlined in the Wall Street Journal and titled “Bitcoin Becomes Even More Speculative”, three risks are pointed out:

1) Bitcoin traders and potential investors lose confidence in the security and safety of bitcoin transactions and holdings.

2) Other digital currencies start eating into bitcoin’s market share, taking away some of the first-mover advantage.

3) “Competition emerges from conventional financial institutions using generic bitcoin technology, without the decentralization and within the conventional regulatory framework.”

Or, more concisely:

3 Risks for Bitcoin? 1. Joe Public Runs Off In Fear 2. New, Better Currencies 3. Big banks take the good, junk bad http://t.co/mUmHvjk45y— Bitcoin (@Bitcoin) February 26, 2014

Let’s examine those possibilities.

1. Joe Public Runs Off

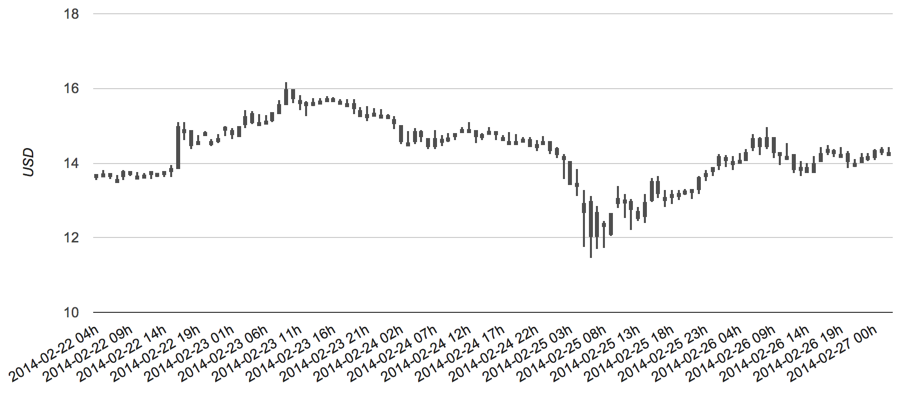

It doesn’t appear that bitcoin traders have been deterred from the wreckage of Mt. Gox. In fact, the price has rebounded somewhat. This would refute the claim made that bitcoin is becoming more speculative – people are buying in, and staying in.

The reality is that unlike the failure of Mt. Gox last April, there is better infrastructure around bitcoin than there was previously.

At that time, prices hit $259.34 on the Bitstamp exchange and then crashed down to a low of $45 when Mt. Gox went down. That constitutes an 83% price decrease in the value of bitcoin.

Fast-forward to this week and the big Mt. Gox shock, Bitstamp’s high was $646 and dropped to just $400, a 38% decrease. The numbers aren’t swinging nearly as wildly.

In fact, traders who got in around that $400 mark were in at a good position to take advantage the swing back up to almost $600 again, just a few days later.

Travis Skweres is the co-founder and CEO of US-based exchange CoinMKT. He sees the Mt. Gox issue as a mere blip:

“While it’s true that the recent events at Mt. Gox have been troubling, bitcoin itself as a currency and protocol are all still the same.

If anything, this paves the way for more legitimate companies to step in and build out the ecosystem.”

2. New, Better Currencies

Englander makes the assessment that bitcoin will only have a first-mover advantage in the short term. He thinks that other currencies will take away from its popularity.

The most popular alternative cryptocurrency right now is litecoin. The founder of litecoin, Charlie Lee, took the source code of bitcoin and tweaked it for his creation. Litecoin creates more coins over time and thus confirms transactions faster. It currently trades at around US$14.

Charlie Lee has publicly said that he believes that litecoin is the “silver to bitcoin’s gold”. He is a strong believer in the value of gold, and created litecoin as a viable alternative.

There's nothing wrong with altcoins, but the idea that litecoin or some other cryptocurrency is going to suddenly rise up and take over bitcoin doesn’t sound plausible.

As cryptocurrencies gain traction, there will be room for a few global ones and other smaller specific ones. This is similar to what we see in fiat currencies today.

Jeremy Liew is a venture capitalist with Lightspeed Venture Partners. He believes that the open ethos of bitcoin means that it will remain a bellwether within the decentralized currency space. He said:

“I think [bitcoin being usurped by another digital currency] is unlikely – there’s too much network effect around bitcoin already.

The beauty of the open source nature of bitcoin is that any ‘bugs’ get fixed if there is sufficient consensus to do so.”

3. Big Banks Take the Good, Junk Bad

It makes sense that banks would like to replicate the positive aspects of bitcoin. The problem is, they will not have a lot of tolerance for its decentralized nature.

The article ”Why Bitcoin Matters to Bankers” by American Banker newspaper's Marc Hochstein is a fascinating read. It takes a deep look at the financial industry’s mind-set toward the concept of transactions without a third party.

It’s not something that gels with the status quo, to say the least.

Dan Held, Product Manager at Blockchain.info, echoed that sentiment:

It is obvious, however, that decentralization is going to have to mean some sort of standardization. Regulation is coming, and it should lend legitimacy to cryptocurrencies, as well as help grow a new economy around their efficient financial technologies.

Or, as Liew the Lightspeed VC, puts it:

And finally...

For a long time, Mt. Gox carried a price premium. It held the top end of bitcoin valuations across all USD/BTC exchanges. Some have speculated that that came from it having the highest exchange trading volume for US dollars.

Others believe that, because users could not easily obtain US dollar withdrawals, it created an incentive for leaving their bitcoin with Mt. Gox.

Whatever the reason, Held believes that Mt. Gox’s prices always reflected the risk that people were taking by doing business with the exchange, even at the end:

Now, prices are back up and bitcoin business continues.

“I don’t think the market sentiment was shaken that much by Mt. Gox’s insolvency,” said Held.

Balance image via Shutterstock

DISCLOSURE

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.