ASIC bitcoin miner arms race: the definitive CoinDesk roundup

Why do ASIC mining hardware manufacturers give their products names like Klondike and GoldStrike? It’s because bitcoin mining is like a gold rush. People are rushing to stake a claim to a limited resource, and they need the best equipment that they can to mine it.

After GPUs and FPGAs, the rush is on to produce ASIC-based miners that are faster and more power efficient than their predecessors. The market is flooded with vendors promising the next, greatest ASIC hardware. But all that glitters is not gold. Here is a roundup of what’s on offer (and what’s actually shipping, which isn’t much).

Phase 1: Avalon, ASICMiner, and clones

Let's start with one of the first companies to ship an ASIC miner: Avalon. This firm, which began shipping in January, designed its own ASIC chip, based on a 110 nm process. First-generation units operated at around 68 GH/sec, and batch three of these units, selling for around BTC72, guarantees at least 63 GH/sec, says the company.

strength was also its biggest drawback: it was able to get to market early because of the relative inefficiency of its chip. Its 110 nm process node is the second largest on the market today (after ASICMiner's), and smaller process nodes lead to better performance and power consumption. However, the company has been working on a 55 nm chip, which it says will go on sale for immediate delivery in mid-October, and is already working on third and fourth generation chip designs in parallel.

The company has also said that batch three of the version 1 ASIC miner will be its last. It is working on a two-module unit for increased performance, and a 2U 17-inch deep server blade which it is calling version 2.

Avalon has also been offering its chips to OEMs, who had been making their own equipment. “For the most part, they will give the same output," says Jaime Gladish, a bitcoin enthusiast who keeps a constant update of FPGA and ASIC products at his site, Decentralized Hashing.

One of the first to try and source Avalon chips was TerraHash, which has been producing two mining boards: a 4.5 GH/sec unit with 16 chips, and a 64 chip 18 GH/sec model. The firm will sell the boards individually, but has also been offering preassembled boxes that can take either the 4.5 GH/sec boards, or the 18 GH/sec units. The DX Mini offers up to 90 GH/sec with 20 of the smaller boards. The DX Large will take up to 10 of the bigger boards, for a total of 180 GH/sec.

The problem for this company is that it is still waiting on Avalon chips, and hasn't been able to fulfillcustomer orders. That's unfortunate, because the company had changed its policy in June to begin accepting preorders – and later decided to change its refund policy, declaring all orders final. The company would not return our calls.

Avalon says that it is still waiting for its chips, 200,000 of which it says are stuck in customs. It has 800,000 orders to fill, it admits. It has also battled allegations that it was mining with its own chips.

Hopefully, Ohio-based Krater will have better luck. Like TerraHash, the company is offering its own ASIC miner, along with the option to build mining equipment for people providing their own chips. The company promises a four-module unit, offering up to 90 GH/sec, which it calls a working clone of the Avalon miner. It, too, ordered chips – 10,000 of them – from Avalon in May. Each module in its unit will contain 80 chips, giving it a total of 125 modules, by our calculation, or 31 fully loaded ASIC mining units.

When it receives its chips, this should give it a total of around 2.8 TH/sec of shippable hashing power from its first bulk chip delivery. However, as of this week, the firm is still awaiting ASIC chips, meaning that it is at the mercy of Avalon, which is in turn at the mercy of customs, and the fabricator beyond that. Significantly, Krater’s pricing has come down from BTC125 a month ago.

Another company, based in Bulgaria, is promising an Avalon-based unit. Technobit, run by Bitcointalk member Marto74, is offering to assemble either boards or full miners with Avalon chips supplied by end users. A fully assembled miner, with boards based on the same Klondike design as the TerraHash boards, will set you back €51. But don't forget, that means you have to pay for (and source) the chips yourself, which is arguably the biggest cost.

Finally, Big Picture Mining, a collective of mining enthusiasts, had designed a small USB dongle-style ASIC miner using the Avalon chips. The unit, which was publicized at around $49, was to offer around 282MH/sec, but the collective began issuing refunds after Avalon failed to ship its chips.

originally sold shares in its operation, with the intention of producing its own 130 nm ASIC and mining with it in-house. The company has since sold some devices based on this chip, in the form of a 10-12 GH/sec mining board called Block Erupter Blade. It also sells a USB dongle, providing around 300 MH/sec. A second generation Block Erupter is due for launch soon, although no specifications were available at the time of writing.

The two biggest challenges for ASICMiner customers are the price, and the fact that the company is competing with its own customers. Prices vary online (ASICMiner doesn't sell directly, but instead auctions its devices on the forums, and sells through resellers). However, the old version has been advertised for BTC12.5, or around $1400 at current pricing), which costs you around $116 per Gigahash.

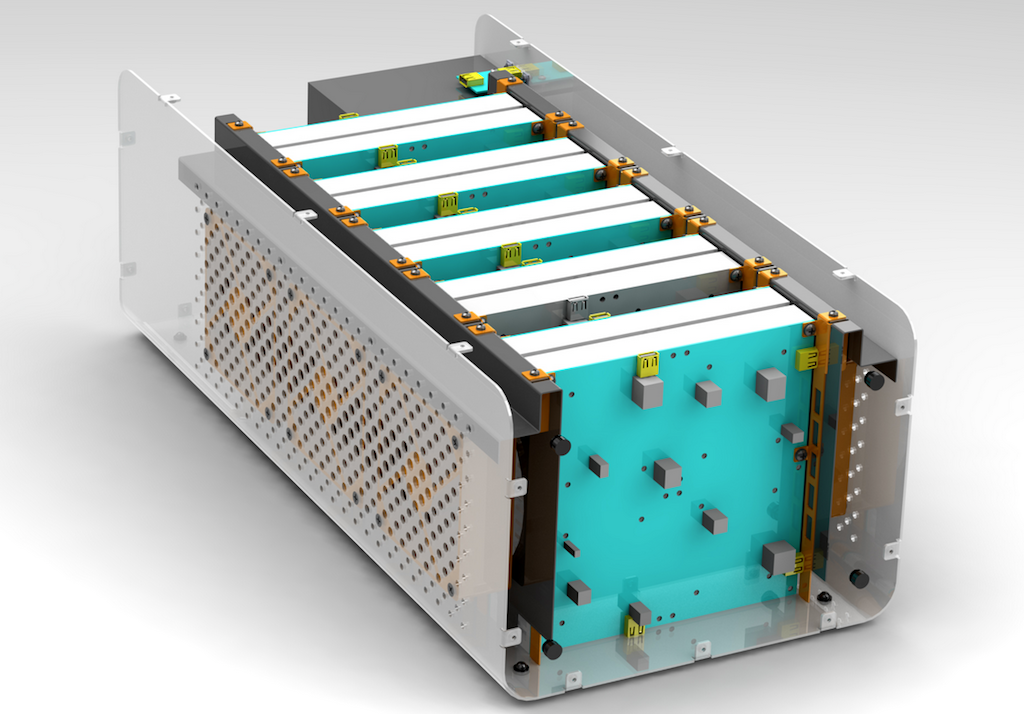

The other problem is that ASICMiner also uses its own chips to mine bitcoins, presumably using its own ASICMiner Rack, which is around 1,000 times more powerful than the first-generation Block Erupter Blade, and presumably benefits from economies of scale and bulk pricing. Its mining operation accounts for around 9% of the entire bitcoin network’s hash rate. Anyone who buys its hardware is competing with it. On the other hand, at the time of writing there are not many shipping alternatives for people that want in on the ASIC mining game.

Phase 2: Butterfly Labs and Bitfury

has been among the most contentious companies in the ASIC mining space. The firm, which experienced success with an FPGA unit last year, announced its ASIC device in June 2012. The original ship date was delayed multiple times, although the firm began shipments around the start of June. It was forced to revise the specifications for its hardware after failing to achieve the original power specifications, and now advertises 4-5 watts per Gigahash – that’s 4-5 times the original power consumption - for its 65 nm ASIC design. It gave 1000 bitcoins to charity when it missed its original target.

Butterfly Labs offers four product configurations: the five GH/sec Jalapeño, the 25 GH/sec bitcoin miner, the 50 GH/sec 'Single', and the 500 GH/sec Minirig. The latter was supposed to operate at 1500 GH/sec, but was scaled back. Minirigs have been seen in operation, and the company is updating its shipments daily here.

We’re lumping BitFury into this phase, too, based on its use of a 55 nm process node chip. The firm is promising a 25 GH/sec miner starter kit. This will cost €1000 - slightly more than the equivalent 25 GH/sec product from Butterfly Labs at current exchange rates. However, it draws just 40W, compared to BFL’s 125-130 W. The rough match on pricing disappears when we move into hundreds of GH/sec, however: the 400 GH/sec miner promised for October by BitFury will cost €7500. That's around $10,000, compared to $22,484 for Butterfly Labs' 500 GH/sec Minirig. The extra 100 GH/sec is nice, but it isn’t worth $12,500 – and BitFury thinks you can overclock it to 500GH/sec anyway.

Phase 3: 28nm process node vendors

But 55 nm won't be the smallest process node available, if other ASIC mining vendors have their way. Companies like Butterfly Labs, ASICMiner, and Avalon worked hard to get to market first in what is undoubtedly an arms race to deliver an ASIC device. Others either kept their powder dry, or simply came to the party late. Their advantage is higher performance, as they work on ASIC designs that promise a higher hash rate for your money. Several are now working on 28 nm chips, designed to offer hundreds of GH/sec for lower prices and using less energy.

One of them is HashFast, which is promising the Baby Jet, an ASIC device promising 400 GH/sec, or 500 GH/sec if overclocked. This device will use the Fast Golden Nonce chip, designed with a 28 nm process node, which the firm says will consume less than one watt per Gigahash/sec. it is promising delivery of the first units between October 20-30 for $5,600 (compared to $22,484 for the 500 GH/sec Butterfly Labs Minirig).

Another 28 nm vendor is KnCMiner, a joint venture between four year-old Swedish IT consulting firm KennemarAndCole AB (KNC), and Swedish chip design and fabrication consultancy ORSOC. That firm offers three different units: the $2,000 Mercury 100 GH/sec at a maximum 250 W, the $3,795 Saturn, which offers 200 GH/sec at 500 W, and the Jupiter, which sucks up 1 kW to deliver 400 GH/sec, and costs $7,000. Shipments begin in September for the two larger models, although orders placed today will ship in October, the firm says.

Headed by a team of chip design experts, Cointerra also hopes to score big with a 28 nm design, and it also wants to beat KnCMiner on pricing. It has confirmed that it wants to price lower than KnCMiner to account for the fact that it will deliver its units later, in the second half of the fourth quarter. It is promising a 500 GH/sec ASIC chip, enabling it to deliver a device offering greater than 1 TH/sec, say the founders.

Outliers

One or two of the next generation 28 nm players have already drawn skepticism on the forums, with people claiming that it's too good to be true. That's why we have our eyes on UK-based XCrowd, but with eyebrows raised. Not much is known about this secretive firm, which forum posts suggest is promising up to five product configurations, ranging from 15 GH/sec (for $200) to 2.4 TH/sec per second (for $8,000). Posts from the firm’s Twitter account show at least two units, with one offering 1.2 TH/sec.

The firm claims to have a team spread between London, San Francisco, and Shenzen. It was reportedly already taking preorders, until its site was attacked, forcing it to take it offline for a while.

There are some mysterious elements to the XCrowd story. On one hand, it claims not to be an ASIC developer, but will instead focus on a larger bitcoin-related initiative that it calls Project Satoko – an anonymous exchange communications protocol. Bizarrely, given the development costs presumably involved, the firm will "most likely discontinue manufacturing ASIC units after the first batch on order to focus on XCrowd”. As it hasn’t formally announced products (in spite of some forum posts), we are not including it in our accompanying table.

One of the biggest differentiators today isn’t necessarily system specification: it’s shipment date, the ability to deliver, and customer service. Customers have been angered by companies that promise units and don’t deliver, and even those companies that do begin delivering on back orders don’t always behave professionally. Representatives from Butterfly Labs posting under personal accounts have publicly insulted customers and cancelled their orders, for example.

The other thing to watch for is difficulty. If and when more ASIC miners begin to ship, they will flood the network with hashing power, and the difficulty will skyrocket. Indeed, it’s already starting to happen. Those choosing a miner will want to think carefully about projected difficulty, bitcoin value, and return on investment.

DISCLOSURE

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.