Ben Lawsky Demonstrates 'Evolution' on Bitcoin Issues in Reddit AMA

Ben Lawsky: Friend or Foe? It's a question CoinDesk recently posed regarding the New York Department of Financial Services (NYDFS) superintendent, and one that is understandably concerning to the wider virtual currency community as New York state seeks to enact regulation in 2014.

Speculation aside, on 20th February, the bitcoin community got its chance to seek an answer when Lawsky participated in a much-anticipated Ask Me Anything session on reddit.

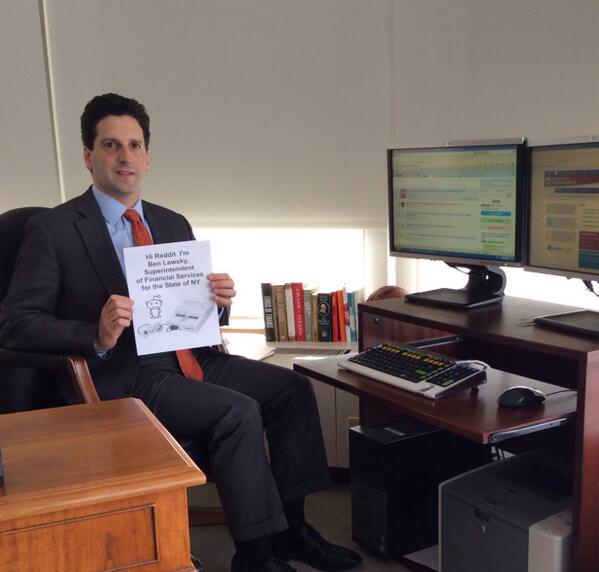

Here's my "Proof" picture for @reddit_AMA on #Bitcoin at 1230pm EST today. P.S. The SNES refs cracked us up. pic.twitter.com/6svPO3akNF— Ben Lawsky (@BenLawsky) February 20, 2014

Starting at 17:30 GMT, Lawsky received more than 200 questions over the course of the more than hour-long session. Many attempted to glean more insight into the lawmaker's understanding of virtual currency, his views on how government should pursue financial regulation and his plans for bitcoin in New York.

True to his past demeanor, Lawsky was careful in his answers, letting ample pass time between responses and sprinkling his comments with lighthearted remarks. However, perhaps most notably, he was largely positive when speaking about bitcoin and its innovative technology.

Wrote Lawsky:

Though the session was far from conclusive, the AMA gave Lawsky a platform to address major issues for the community, and provided more evidence to suggest that he intends to craft legislation that strikes a balance between the needs of law enforcement and bitcoin entrepreneurs.

Money laundering concerns remain

Echoing concerns mentioned in New York, community members were upfront about wanting to know more about the potential compliance burden Lawsky would look to put on state businesses. Likewise, Lawsky remained firm on this point, invoking terrorism when speaking about the importance of money laundering controls.

Despite this drawing of the lines, Lawsky did suggest a middle ground would likely be needed on this issue.

In particular, Lawsky said he would draw lessons from the US government's Dodd-Frank Act, which he faulted for putting an undue compliance onus on smaller banks.

Said Lawsky:

Further, he stated that he wants to provide this clarity "sooner rather than later", acknowledging the difficulty today's entrepreneurs face from the current lack of legal clarity. For example, Lawsky noted that the state has not yet determined how to regulate bitcoin ATMs, despite their increasing presence nationally.

Improving Wall Street relations

Lawsky was also asked about his treatment of Wall Street, with some members of the community raising pointed questions about what they consider to be the imbalance with which New York has dealt with criminal actions from both camps.

Lawsky did no address these critiques, but did clarify that he believes regulation should help bring banks and virtual currency firms together. He said banks will become "more comfortable with bitcoin-related activity over time", but that its price volatility and criminal associations are likely deterrents now.

Further, he suggested that regulation should be viewed as a way to bring about better relations between both financial sectors, a point he stressed in two responses.

Concluding remarks

Reaction from the community seemed mostly positive, with even Bitcoin Financial Association member Bruce Fenton, a critic of New York's handling of January's hearings, acknowledging that the discussion was beneficial.

"Mr. Lawsky seems to be taking less of a hard line than he has in the past, hopefully the feedback from investors and the community has been helpful," Fenton said.

Indeed, later in the session, Lawsky confirmed that his attitude toward virtual currencies had changed since the NYDFS hearings.

"I've personally evolved a lot on the issue the more I have learned," he said.

DISCLOSURE

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.