Bitcoin and Intrinsic Value: a Layman’s Response to Alan Greenspan

Editor’s note: Matt Mihaly, a bitcoin fan and entrepreneur, recently wrote this article in response to Alan Greenspan's recent comments on bitcoin. Alan Greenspan is an American economist who served as Chairman of the US Federal Reserve from 1987 to 2006.

Mr Greenspan,

I saw your recent comments regarding bitcoin on Bloomberg. I understand your skepticism – it wasn’t until early summer of this year that I appreciated what Bitcoin represents as a force for disruption. When I first looked at Bitcoin in 2010, I thought it looked like a techno-novelty and would likely soon collapse. It did, actually, collapse in 2011, thus confirming in my mind that it was a fad, and best ignored. Oops.

Fast forward to today, and while it is still very much the tool of a relatively technologically-savvy tiny fraction of the world population, it’s been remarkably tenacious. Its price as pegged to fiat currency is very volatile, but has trended unsteadily upwards for years now, consistently, until its recent large run-up appeared to catch your attention.

Specifically, what you said was:

I’m not an economist, and I can’t speak to you as one. I do have some experience with virtual currencies though, and think I have a handle on why Bitcoin is so potentially revolutionary.

When you tell us that Bitcoin has no intrinsic value, I can’t disagree, but I also don’t think that’s relevant.

Houses don’t have any (or very minimal) intrinsic value either, and one only has to tour Detroit, with its legions of abandoned houses, to see that that’s the case.

Does that mean houses generally don’t have any value? I don’t think so, and as a homeowner, I sure hope not. Indeed, I’m sure that my house has value, because I’m sure someone else will be willing to buy it from me if I choose to sell it.

But why would someone buy the house if it has no intrinsic value? As we know from places like Detroit, it’s possible for the value of a house to simply disappear, or come very close to it (pipes can be stripped for copper, and a few other things may be worth salvaging, but that’s fractions of a penny on the dollar).

So where does that value come from if it isn’t intrinsic to the house itself?

I’ll come back to that question, and explain how it’s related to bitcoin’s value. But first, I want to tell you a story. I’ll try to keep it brief.

Virtual Swords

Once upon a time, at the end of the last millennium, I founded and led the first games company to sell virtual goods or virtual currency for real money.

We sold (and still sell) ‘credits’ – virtual currency that is bought for real money, which players can use to buy other things in our games. Players can buy virtual weapons, new abilities for characters, virtual pets, virtual gold, virtual housing, upgrades to ships, or even custom work from the development team. What they can’t do is sell those credits back to us for real money.

When I first started selling credits, a lot of people, including almost everyone in the games industry who was aware of what we were doing (not a huge number of people as we were operating at the periphery of the industry), thought it was ridiculous. The general criticism was along the lines of: “Why would someone pay real money for a fake sword?”

I mean, they have a point right? Why would you give up real money to get this fake currency – credits – which you could only use to buy other fake things? How could the credits possibly have value?

Here’s the thing though. We started selling credits in 1997. The only way to pay was via check or cash, mailed to us (though that changed quickly). Players had to go through the hassle, in other words, of actually sending us a letter and waiting for it to arrive to buy credits. This was days in most cases. Even with that amount of hassle, they wanted to buy these virtual things.

The Farmville 2 game, by Zynga.

16 years later, people are still buying these credits, and they’re even used to pay other people for third-party services around our games in a couple of cases.

Other companies, like Electronic Arts and Zynga, have collectively sold billions of dollars worth of their equivalent of credits in the last decade. The idea that these ‘fake’ currencies and ‘fake’ items have real value is pretty difficult to dispute given the amount of money consumers have poured into them.

Even in games that don’t directly sell the currency, there’s often a robust business being done by third parties in obtaining and re-selling currencies that must be earned by playing the game.

Why do these virtual currencies, which are often hard to convert back to cash, if at all, continue to have value?

It’s their context. In this case, the context is our games. Although they’re free to play forever without paying, a percentage of players (a high % in our case) eventually buy credits. Those credits can get them something they want, and whether you want to classify a virtual sword as a ‘good’ or a ‘service’ doesn’t matter – it allows a player to achieve a desired result within a context that matters to that player.

And that’s the point I’m making here – a virtual sword has value because of the context in which it exists.

A virtual sword on a game you don’t play is more or less worthless to you. A print-out of the data that makes up that virtual sword is worthless to you. The item only has value because of the context the game service provides.

Further, we’ve found that the stronger we make that context – the more engrossing and all-encompassing the game world becomes – the more people want to buy things within it.

The stronger the context, the more potential value things that are part of that context can have.

Motor City

An abandoned house in Detroit. (Credit: Reuters/Rebecca Cook)

Let’s go back to Detroit. Why does my house in the Bay Area hold value far above what it could be salvaged for, while hundreds of houses in Detroit were simply abandoned as valueless?

Once again, the context. Detroit is a large part of the context that informs the value of houses in it, and it’s grown vastly weaker than when it reigned as one of America’s premiere cities. As a result, the houses in it have lost value, and some have become worthless.

The Bay Area, on the other hand, is having an extended tech-driven renaissance that’s created enormous wealth and buoyed demand for real estate. It’s context is strong.

Of course, context is not simply local. It’s simultaneously local, regional, national, global and more.

The entire housing market in the US took a dive, as you well know, Mr Greenspan, a few years ago. There, the national context was so strongly affected that it overrode almost any positive influence from regional or local contexts within the US – if you owned a house anywhere in the US, it probably lost value in 2008 and 2009.

Thus, we can see that the value of a house is not really intrinsic, but is largely dependent on the context within which it exists.

What’s all this have to do with Bitcoin?

The Currency and the network

Confusingly, when the anonymous creator of the Bitcoin protocol named it, he chose to use the same word to refer both to the unit of value that is traded (bitcoin, with a lower-case b) and the payment network over which bitcoin travels and the way in which it’s stored, referred to as Bitcoin (with a capital B).

A good analogy is email: Without a network to carry email over, there’d be no value in composing an email – it wouldn’t have anywhere to go when you hit ‘send’.

Similarly, bitcoin would be worth nothing without the payment network that it sits on. You could have all the bitcoin in the world and if there wasn’t a network behind it, nobody would care. There’d be no context – just meaningless digital bits sitting on a hard drive.

Now, we know that payment networks are valuable. Just ask Visa, Mastercard, Paypal, Western Union, and Moneygram.

We also know that methods of storing value persistently are valuable. Most of the world’s governments have a gold reserve. The US government alone holds over 8,000 tons of it.

But what a hassle! Someone has to actually store that gold, which weighs 8,000 tons, and selling it means physically transporting it.

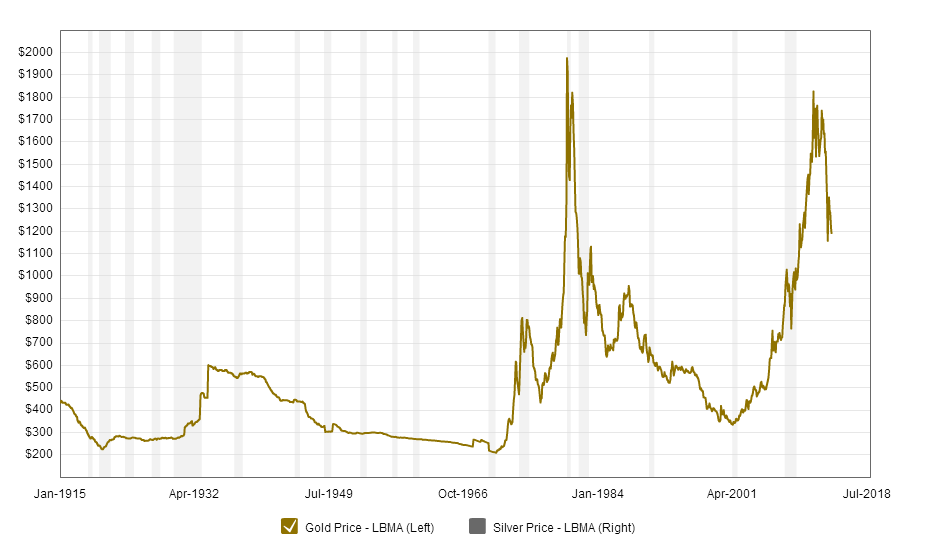

Still, gold is valuable and commands the price it does mainly because people have agreed it’s valuable, even though it experiences wide volatility in value over time, and even though it’s fairly inconvenient.

Price of gold, adjusted for inflation, 1915-today. Look at that volatility!

Bitcoin is both of these things — a payment network and a way of storing value. You could transfer a million dollars for the cost of a few cents, on a holiday.

Paypal won’t let you do that, and even if you could transfer that much at once, they’d charge you multiple percentage points for it.

Visa/Mastercard certainly won’t let you do it, as they’re built on credit, and if Western Union would let you, they’d charge you even more than Paypal would.

You could send a bank wire, but that’ll cost you $25 or more, and if sent after the wire cut-off time, you’re out of luck until the next day. And, of course, that assumes you even have a bank account to begin with, a service that only about half of adults worldwide have access to.

And unlike gold, bitcoin is practically free to store (though like any other asset, security precautions need to be taken).

What we have, then, is a nearly frictionless way to send and store value of virtually any magnitude. I don’t think it takes a lot of imagination to understand why that might be a context that’s strong enough to create substantial value within it.

As Erik Voorhees (a prominent early adopter of Bitcoin) recently wrote:

Because the Bitcoin network is useful, and because only scarce bitcoin currency units are permitted on this network, the bitcoins themselves have a price. Indeed, they must have a price until the network is no longer useful, or the coins are no longer scarce.

This is not magic. It is not a Ponzi scheme or elaborate fraud. It’s just the market pricing something that it finds useful. As the network grows in usage, its utility subsequently grows, and thus scarce bitcoins appreciate further.

You see, Mr. Greenspan, it all comes back to context. The lower-case bitcoin has value because it is scarce (limited to 21 million) and because the context of the Bitcoin payment network creates the opportunity for things within that context to have value.

Better still for Bitcoin is that Metcalfe’s Law is likely to be partly relevant at least. It states that the value of a telecommunications network is proportional to the square of the number of users connected to it. As Bitcoin grows, its utility as a network grows, and the unit of currency (bitcoin) in that network is likely to be even more valued as a result.

Bitcoin in Context

I believe, Mr. Greenspan, that the context (the payment/storage network) within which bitcoin (currency) exists grants it indisputable value, whether that value is 'less than' or 'greater than' is represented by the price of a bitcoin today. I think you’d have a difficult time disputing that.

Beyond that though, I also believe that the context within which Bitcoin (the payment/storage network) exists grants it value, and that whether it’s Bitcoin or another digital currency, the context of the modern world grants the Bitcoin payment/storage network increasingly large potential value.

There is a real demand for a digital, supra-national currency, and bitcoin is the current most likely contender to take that position. It’s not going to replace fiat currency, but it is going to sit alongside it.

Increasing the money supply is a hidden tax on everyone who holds that currency (Credit: iStockPhoto)

The US and Chinese governments are engaged in unprecedented hidden taxation of anyone holding the US dollar or the Chinese yuan in reserve by simply issuing more of them (many, many more).

That’s not possible with Bitcoin, and whether or not one believes that a deflationary or inflationary currency is preferable, it’s certainly easy to see why some people like having a store of value that cannot be devalued unilaterally by a government (though as the recent drop in price in reaction to China’s official position on financial institutions trading bitcoin shows, governments certainly have a voice in Bitcoin’s future).

The hundreds of billions of dollars remitted back to home countries by (generally) poor immigrants grows every year. They pay an average of over 9% to transfer that money. That’s highway robbery on the backs of the people who can least afford it. Bitcoin can solve that long-term.

[post-quote]

It’s currently difficult to pay a few cents for, say, reading an online article from the NY Times – the transaction costs via traditional payment transfer networks are prohibitive at that small scale.

Bitcoin can revolutionize the relationship between content publishers and consumers by reducing the friction that stops both parties from micro-transacting on a scale appropriate for that moment, vs. asking the consumer to subscribe for $10/month, or asking the consumer to front-load an online wallet with $5 and then spend it in increments.

In short, Mr Greenspan, there are a lot of reasons why Bitcoin is here to stay at one level or another. The bitcoin currency has value because the network has value. The network has value because it is and will be used to solve actual problems that actual people and institutions experience.

Is that intrinsic value? Beats me – as I said, I’m not an economist.

It’s certainly value though, and as long as that’s true – as long as the context makes it so – bitcoin will continue to be worth something no different from gold, houses in Detroit, or virtual swords in video games.

DISCLOSURE

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.