Bitcoin Drops as Investors Buy $22K and $20K Puts

Bitcoin is falling a day after the options market saw increased demand for out-of-the-money or lower strike put options at $22,000 and $20,000.

The leading cryptocurrency was trading at a three-week low of $30,700 at press time, representing a 3.5% drop on the day. The decline has flipped the crucial 50-week simple moving average (SMA) support of $32,250 into resistance.

On Sunday, 500 contracts of the $22,000 put option expiring on Dec. 31 changed hands via the institution-focused over-the-counter (OTC) desk Paradigm. Similar volume crossed the tape for the $20,000 put expiring on Dec. 31.

"There was interest to buy BTC puts for December in a significant size," Darius Sit, CEO of the Singapore-based QCP Capital, said. "We made the market for most of the large block trades over the weekend. There was decent interest to sell September BTC puts as well.”

Market makers are always on the opposite side of traders/investors and run a direction-neutral portfolio. That essentially means buyers of the $20,000 and $22,000 puts expiring on Dec. 31 were investors, most likely adding downside hedges against long positions in the spot/futures market.

A put option gives the purchaser the right but not the obligation to sell the underlying asset at a predetermined price on or before a specific date. A put buyer is implicitly bearish on the underlying asset, in this case, bitcoin.

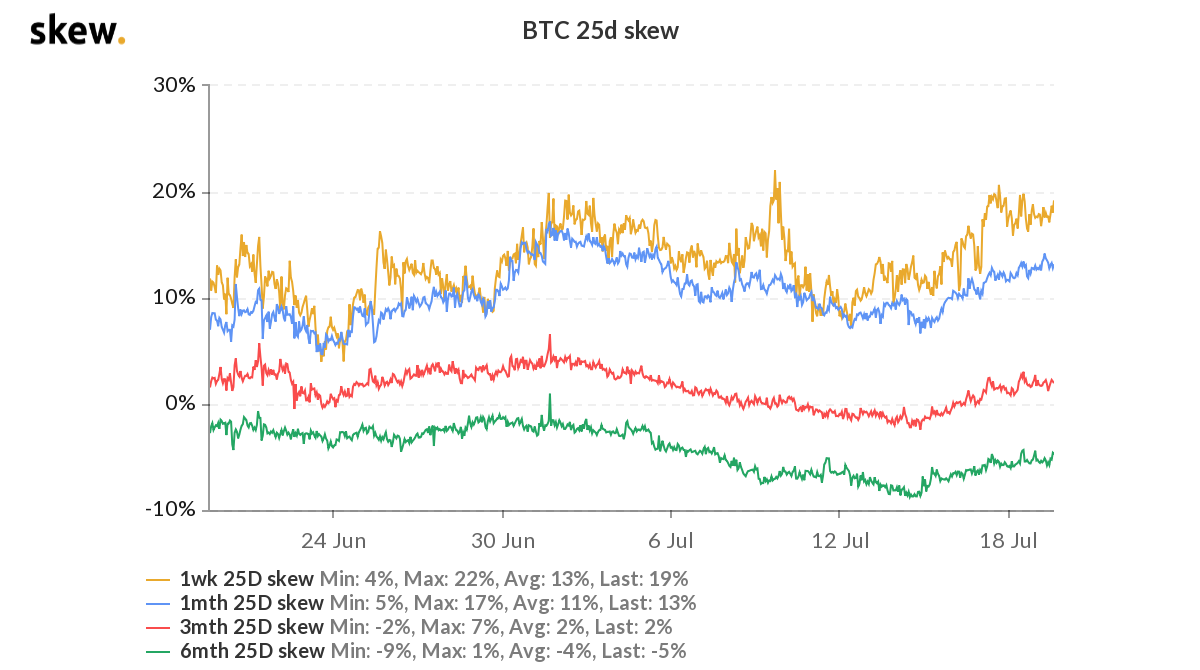

Overall, the options market is still biased bullish for the long term. The six-month put-call skew, which measures the cost of puts relative to calls, remains entrenched below zero. In plain English, longer duration calls or bullish bets are priced higher than puts.

Bitcoin put-call skews

However, the one-week, one-month and three-month put-call skews are indicating a negative bias with bearish prints.

Also read: Why Bitcoin Needs to Defend $30K

Bitcoin is currently changing hands near the lower end of the two-month-long trading range of $30,000 to $40,000.

If the support at $30,000 gives away, traders who sold puts at $30,000 over the past few weeks may resort to hedging – taking a short position in the futures or spot market – leading to a deeper decline.

DISCLOSURE

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.