Bitcoin on Track for Biggest Monthly Price Loss Since May

Bitcoin appears to be set to end the seasonally bearish month of September on a negative note, because of instability in global financial markets, regulatory concerns and China’s decision to ban crypto businesses.

Despite trading 2.8% higher on the day at $42,200 on Wednesday, the leading cryptocurrency was nursing a 10% monthly decline, the biggest since May, according to CoinDesk 20 data.

The positive market sentiment seen at the start of the month was bogged down by renewed regulatory fears stemming from the U.S. Securities and Exchange Commission’s (SEC) attempts to stop the Nasdaq-listed crypto exchange Coinbase from launching its lending program offering 4% annualized yields. SEC Chairman Gary Gensler doubled down on his call for crypto regulation and compared stablecoins to poker chips. Meanwhile, China’s decision to declare all virtual currency-related businesses illegal and turmoil in its property market added to the pain.

According to analysts, however, much of the selling pressure came from new investors. “What we see here is that older market participants are sitting tight on their holdings, shown by the average lifespan of spent outputs declines,” Blockware Intelligence’s newsletter dated Sept. 17 said. “As a general rule of thumb, high spending from older entities is bearish, low spending from older entities is bullish.”

Large traders appear to have bought the dip, keeping hopes of a year-end rally alive. The supply controlled by entities holding at least 1,000 BTC to 10,000 BTC has gone up 60,000 BTC this month, according to blockchain data firm Glassnode. Entities are clusters of addresses controlled by the same network entity. This would include both businesses like exchanges and custodians and individuals.

Analysts told CoinDesk last week that China’s stricter ban may have a limited negative impact at worst and that the cryptocurrency is likely to remain resilient to the Federal Reserve taper (scaling back of stimulus) expected to begin next quarter.

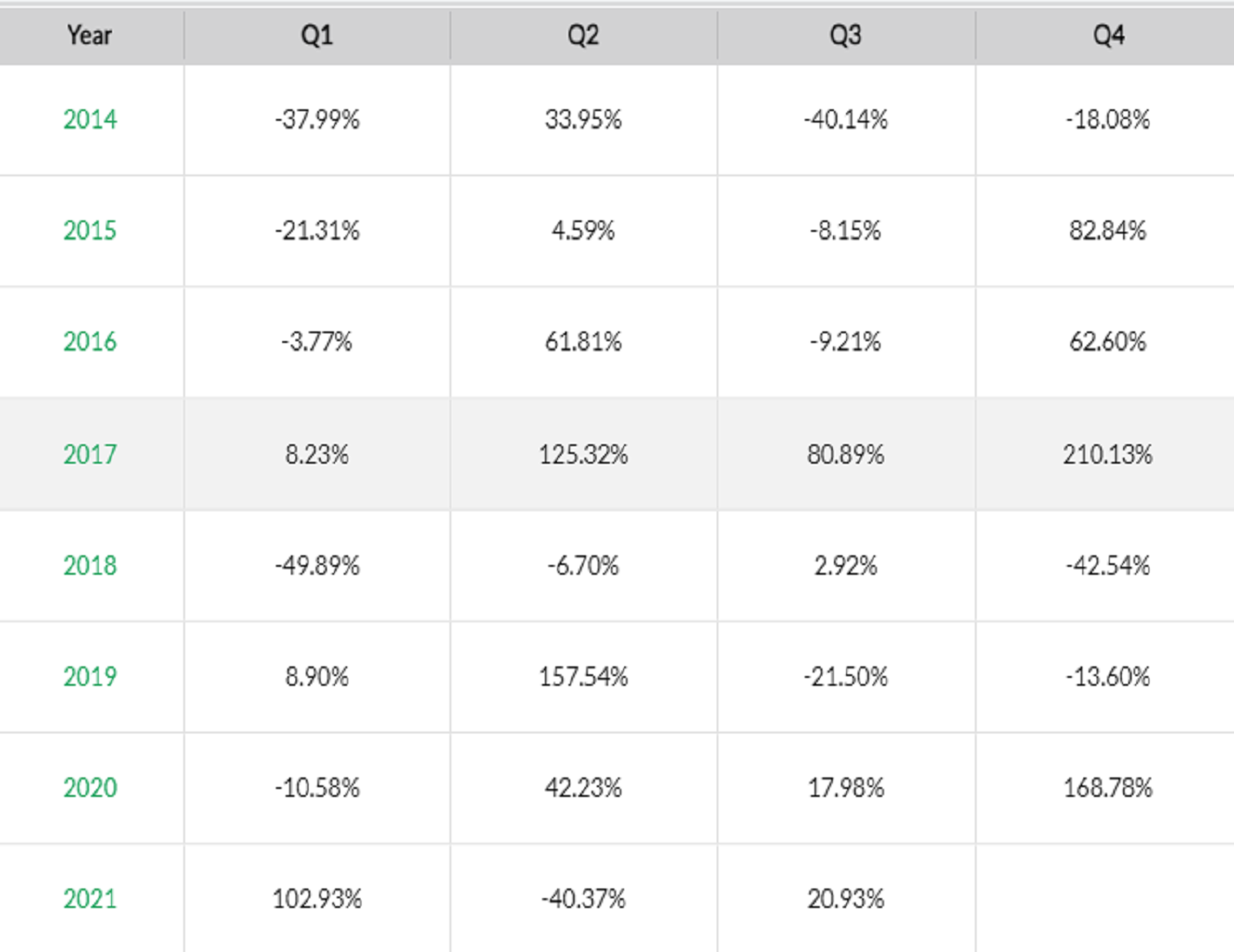

Historically, bitcoin has charted the biggest quarterly gains in the October-to-December period.

Bitcoin charted triple-digit price rally in Q4 2020 (Skew)

Focus now will be on how the U.S. debt ceiling saga unfolds. According to the Treasury estimates quoted by Brookings, Congress needs to raise or suspend the debt ceiling or the government won’t have the cash to pay all its obligations.

The S&P 500 fell 2% on Tuesday after a vote on a stopgap spending measure, coupled with debt ceiling suspension, was blocked in the Senate. A continued sell-off in stocks could weigh over bitcoin.

“We see that bitcoin’s 90-day correlation with S&P 500 has increased considerably during this [September] risk-off period. At the same time, bitcoin’s correlation with gold has decreased,” crypto exchange Luno said in its weekly research note. “Although bitcoin has many similar characteristics as gold, it still behaves as a risk-on asset and highly correlates to the stock market during market turmoil.”

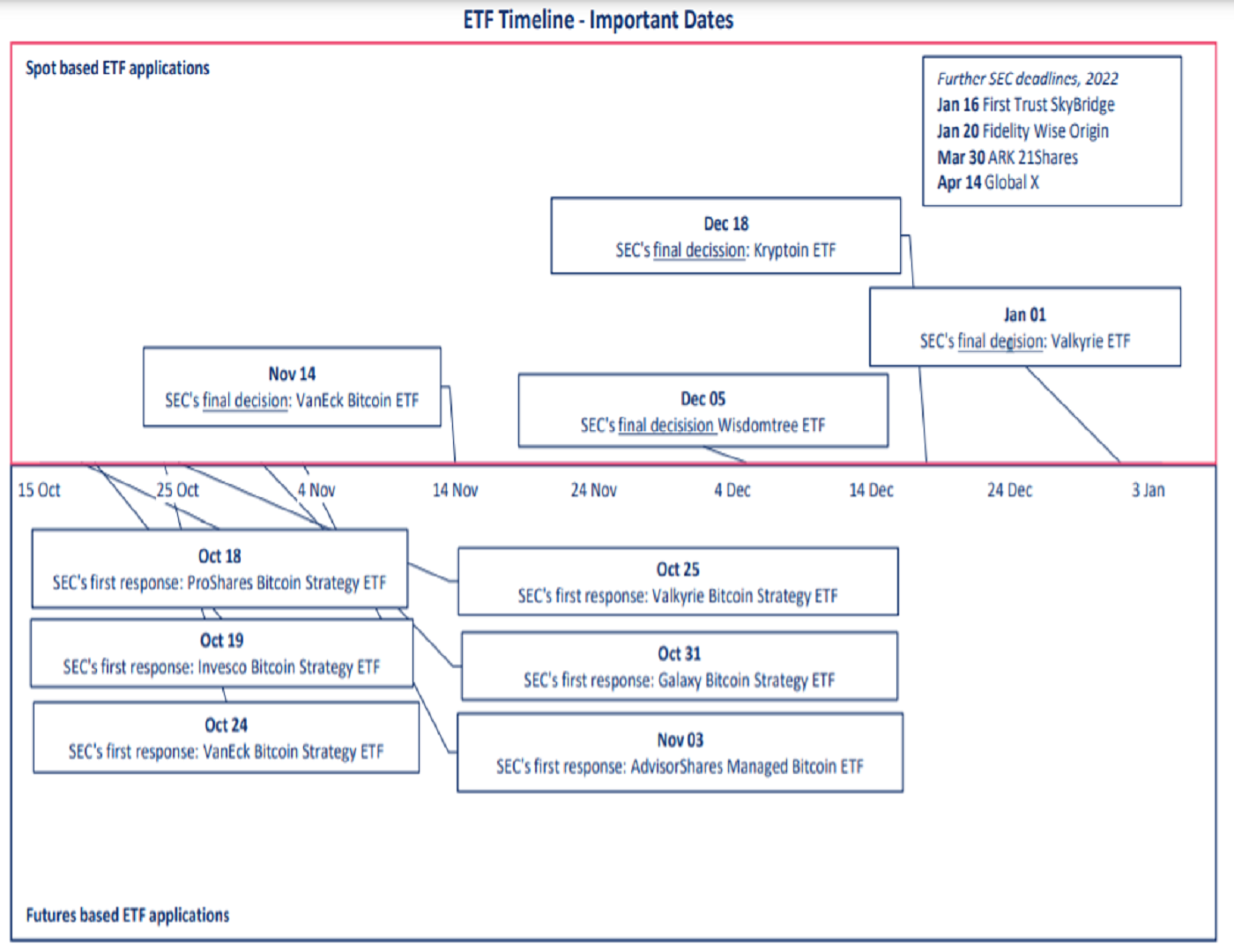

Traders will also keep a close eye on the SEC’s final verdict on several bitcoin exchange-traded fund (ETF) applications and the regulators’ first response on futures-based ETFs.

(Arcane Research)

“The final decision date for the spot ETFs (illustrated within the red rectangle in the chart) is rapidly approaching. VanEck will receive the final verdict by Nov. 14th, while the verdict for other funds follows shortly,” Arcane Research’s weekly note dated Sept. 28 said. “We expect that we will see action in the market running up towards these dates.

“The futures-based ETFs receive their first response shortly as well. Within the next 40 days, six futures-based bitcoin ETF applications will receive the first response from the SEC,” Arcane Research said.

DISCLOSURE

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.