Bitcoin Fund Outflows Slow but Investors Start Exiting Ether Funds

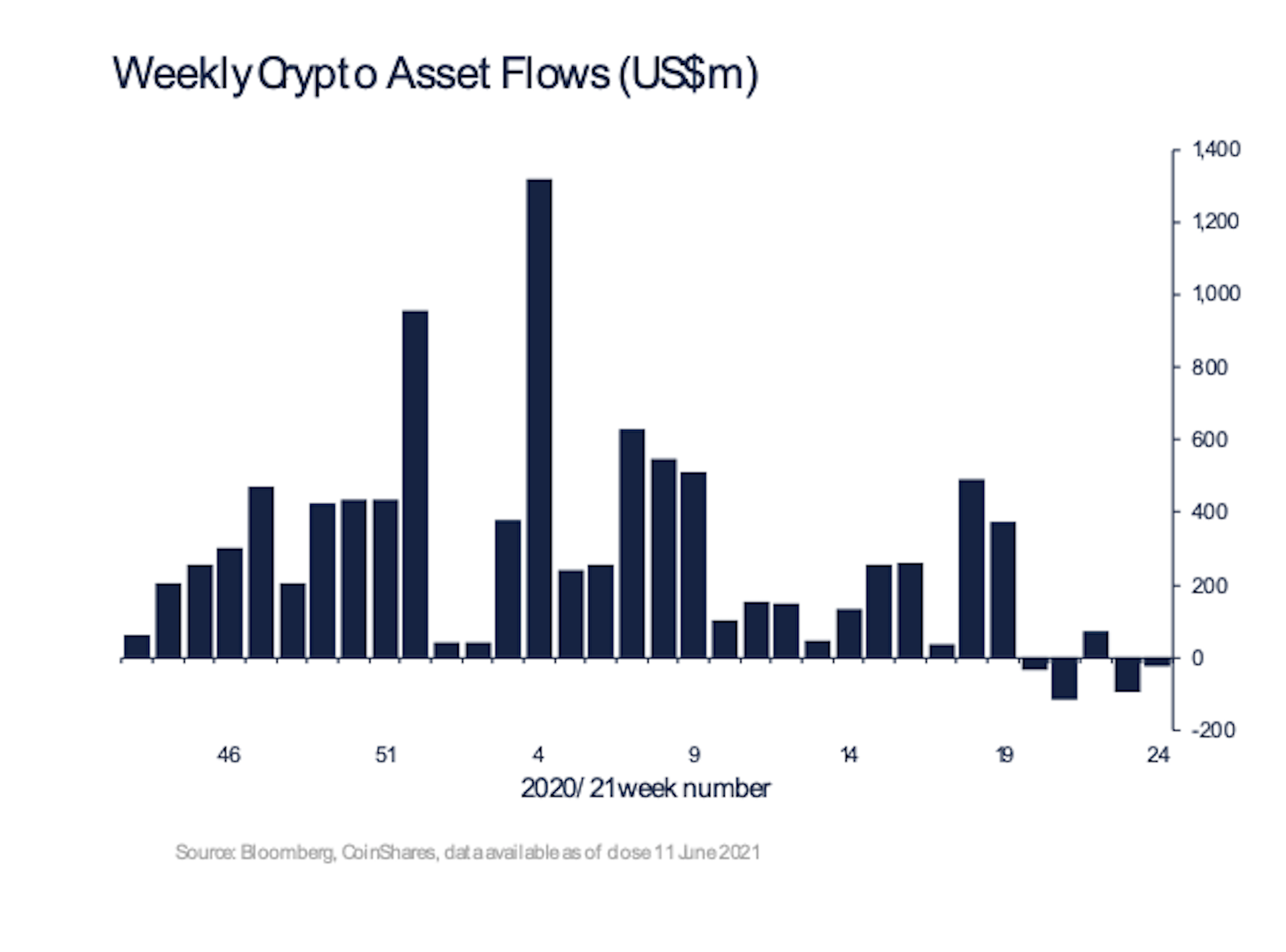

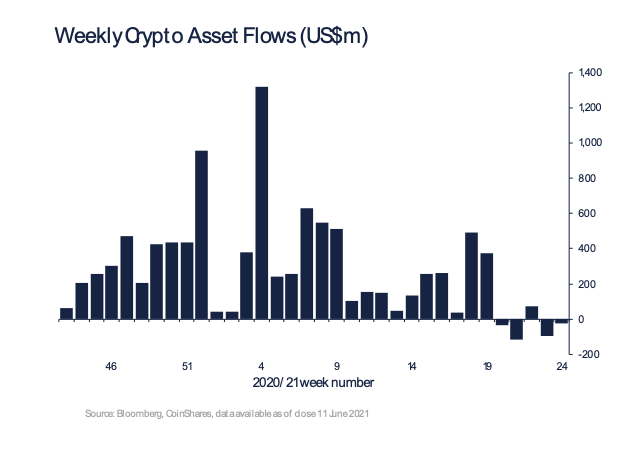

Overall, digital-asset funds experienced net outflows of $21 million during the week ending June 11, down from $94 million pulled out of funds the prior week, according to a Monday report by CoinShares.

The decline in outflows might be an early sign of bearishness has peaked.

Investors have been pulling money from bitcoin funds in recent weeks as the price of the largest cryptocurrency by market value traded below $40,000, down from the all-time high near $65,000 reached in April.

- Ether "had the largest outflows on record [since 2015] last week, totaling $12.7 million,” according to CoinShares.

- Meanwhile, outflows in bitcoin funds last week totaled $10 million, significantly less than the previous, record week of $141 million.

- “Trading activity in bitcoin investment products rose by 43% compared to the previous week," according to the report.

- XRP funds saw minor outflows totaling $2.8 million last week following a six-week run of inflows totaling $21 million.

- Flow data suggests mixed opinions among investors as sentiment weakened over the past month, according to CoinShares.

Chart shows weekly digital asset fund flows.

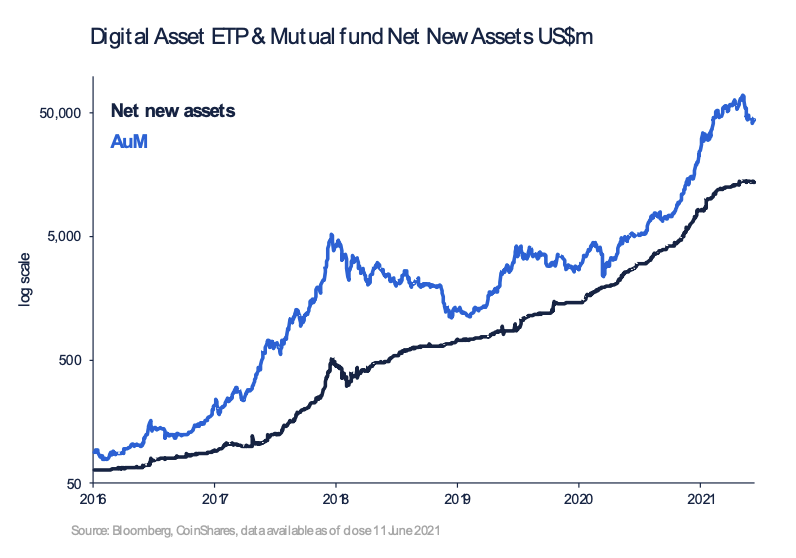

Chart shows assets under management and net-new assets across digital asset funds.

DISCLOSURE

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.