Bitcoin: Gold 2.0? Try Reserve Asset 3.0

On Monday, some people (like me) were struck by a brief note published by Zoltan Pozsar, Credit Suisse’s short-term interest rate strategist, about a new world monetary order. At first blush, the full note (available here) seems to be unrelated to Bitcoin (but more on that later).

Pozsar sees the “birth of Bretton Woods III – a new world (monetary) order centered around commodity-based currencies in the East that will likely weaken the eurodollar system and also contribute to inflationary forces in the West.” Here’s what it might mean for us if his assessment of the world is accurate and how it’s related to Bitcoin.

I totally already know, but what is Bretton Woods again?

The Bretton Woods system was a system of monetary management established in 1944 as World War II was ending. It set the rules for financial relations between countries and created the International Monetary Fund, World Bank and World Trade Organization. In short, Bretton Woods outlined the rules central banks and governments played by financially.

Entire books have been written about Bretton Woods, and so I won’t pretend this piece is an exhaustive history of how things happened, but it helps to recall (as painlessly as we can) how we got from Bretton Woods I to III.

First, we need to explain one important concept. The term “countries’ reserves” is thrown around a lot with little explanation. It simply means that governments hold different types of currencies, securities or commodities (i.e. “stuff”) to react to things that are happening in the economy. For example, if your currency looks weak, you sell foreign currency and buy your own. Without “stuff” in reserve, governments and central banks can’t react. Countries are free to hold whatever “stuff” they want in reserve.

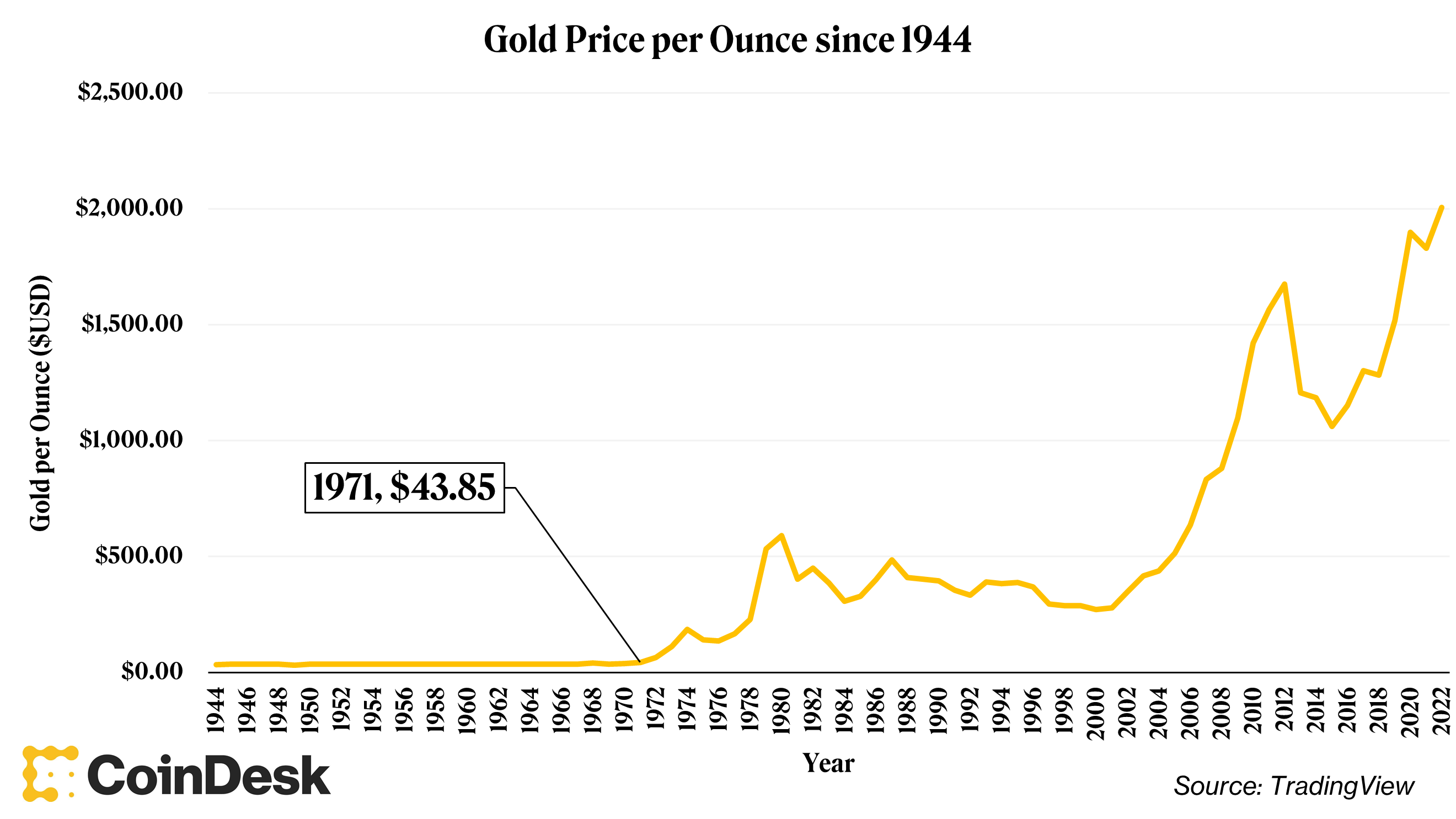

The first iteration of Bretton Woods, now called Bretton Woods I, was a gold-based system where the U.S. dollar dominated and was freely convertible into gold at $35 per ounce (about 5,600% below its current price). This is where “the U.S. dollar is backed by gold” misappropriation comes from. In 1971, a confluence of factors led to the U.S. changing its currency so that the dollar was free-floating and backed by the full faith and credit of the government, not to mention by a massive military and oil.

Gold since 1944 (TradingView)

From there, Bretton Woods II was born, where the dollar still dominates, but in a system that mostly uses “inside money.” Inside money is made up of claims that are someone else’s liability, while outside money is the type of money that is the liability of no one. In other words, the money system became largely debt-based. So when China holds U.S. Treasurys, that is inside money. When Russia sells USD to buy gold, that is outside money.

The regime we have lived in for a while now can cause a whole lot of confusion. Is it necessarily bad for Americans that China holds their debt and owes China a lot of money? Maybe, but maybe not since the U.S. has control over it (Treasurys are inside money, after all).

It also makes the inner workings of international finance annoyingly complicated. Fierce economic rivals fight (dirty, sometimes) for dominance in whatever industry, while also relying on each other for economic robustness. Proof of that is China holding $1.1 trillion of Treasurys in its own reserve. On one hand, we can’t live with each other, and on the other hand, we would be dead without each other.

So is bitcoin the ultimate outside money or something else?

Given the war in Ukraine, the world took action and seized a large portion of Russia’s reserves. As Castle Island Venture’s Nic Carter put it, U.S. President Biden “dropped a financial nuke on Russia.” An important designation was made by excluding energy-related payments, given Europe’s dependence on Russian oil and natural gas. It’s important because prices for commodities like oil and wheat have been skyrocketing. Thus, China is in a fortuitous position to strengthen its currency in the face of a commodity crisis.

Russia is one of the world’s largest commodities exporters and, because of the sanctions, Russian commodities are less desirable than commodities from other countries. The People’s Bank of China, which has massive amounts of now seizable, U.S.-based inside money, could defensively sell Treasurys to fund the purchase of “subprime” Russian commodities. In addition to giving China control over inflation, such action could lead to commodity shortages and a recession in the West.

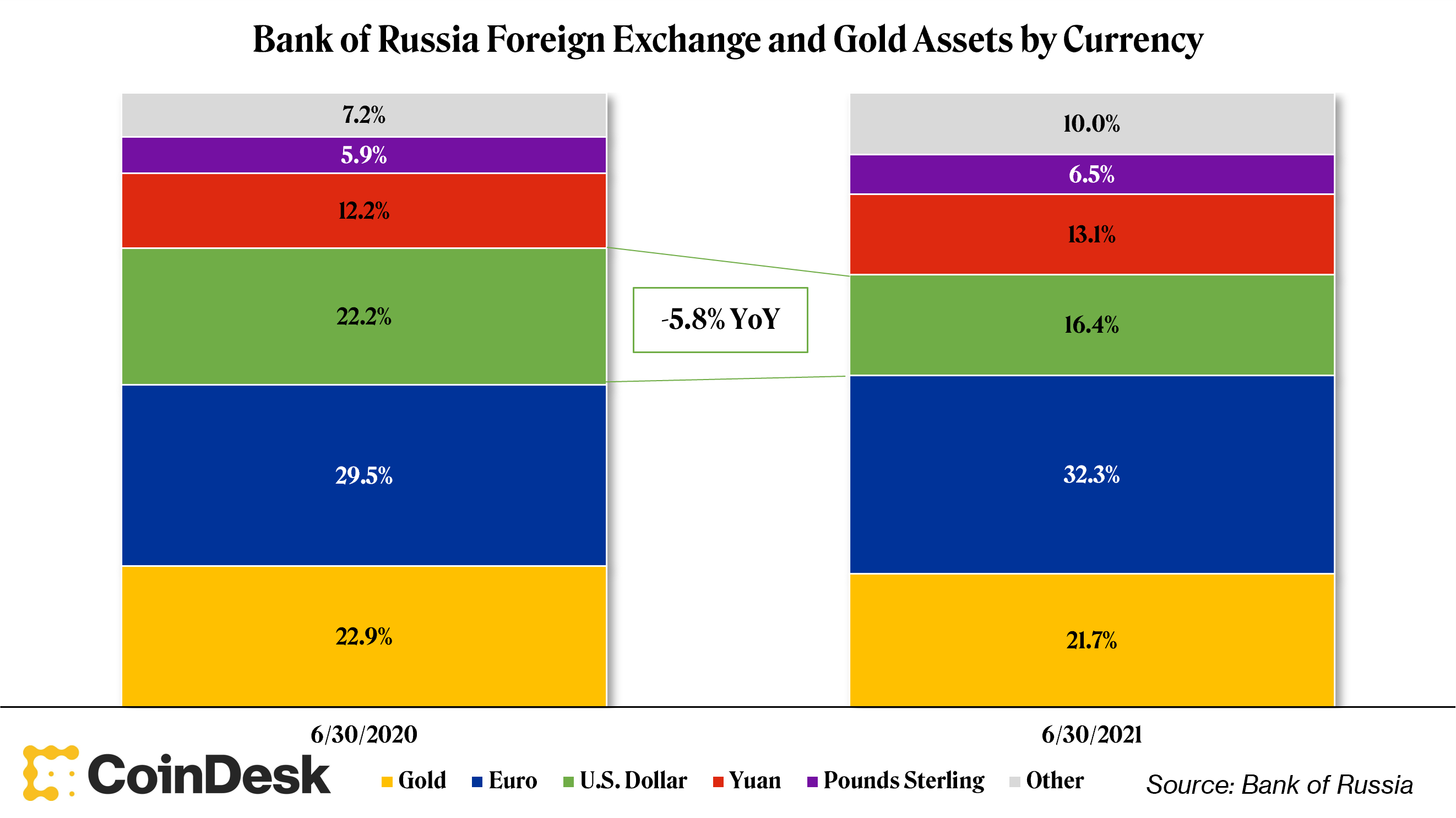

This shouldn’t be taken lightly. Although Russia has sold U.S. dollar assets for gold (and other stuff, see chart below) the past few years, the foundation of Bretton Woods II has splintered.

Russia Foreign Exchange and Gold Assets (Bank of Russia)

Tack on Russia’s partial banning from SWIFT – a messaging system that supports international bank transactions – to the new confiscation risk associated with U.S. inside money and we could be looking at the beginning of a new monetary regime, a “Bretton Woods III.” Now, we are facing a world where there may be a sharper focus on outside money, like gold and other commodities as countries boost their reserves.

Or they may turn to bitcoin.

This point is exactly the impetus for writing about this topic for the newsletter. To end his note, Pozsar wrote:

While not exactly a signal of bitcoin support, I would still call that a mic drop.

DISCLOSURE

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.