Bitcoin Holds Above $41K as Hashrate Surged to All-Time High

Bitcoin held above the $41,500 resistance level over the weekend after a slide from $46,000last week. The move came as hashrates for the Bitcoin network hit lifetime highs.

- Bitcoin has shown strength this month after a slide to yearly lows of $33,000 in January. It broke above the $38,000 and $41,500 resistance level in the first week of February to monthly highs of $46,000, a level previously seen in the final weeks of 2021.

- Traders have since taken profits on the move as bitcoin saw weekly lows of $41,600 in early Asian hours on Monday but recovered to nearly $42,000 in afternoon hours.

Bitcoin hit resistance at $45,000 and has since fallen. (TradingView)

- TheRelative Strength Index (RSI) levels showed readings of 39 on Monday, suggesting an end to the weekend slide and a continuation of the uptrend to the $48,000 level.

- RSI is a price-chart indicator that calculates the magnitude of price changes. Readings above 70 suggest an asset is "overbought" and could see a correction, while below 30 imply “oversold” wherein assets may recover.

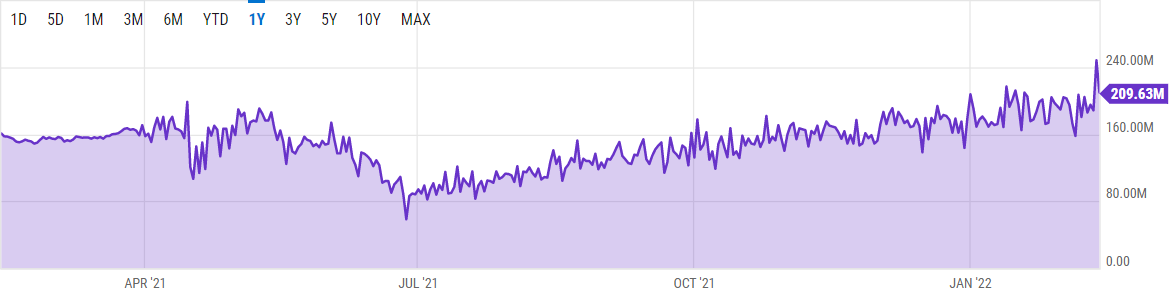

- The weekend price action came as hashrates surged to new all-time highs, as per data from analytics tool YCharts. Hashrates are a measure of the computing power required to mine blocks on the Bitcoin network, and higher rates make it much more difficult for singular entities to try and control the network in the so-called “51% attack.”

- Hashrates hit 248.11 million terahashes per second (TH/s) on Saturday, increasing from the 180 million TH/s level from last week. It currently hovers at 209.63 million TH/s, falling 15.51% in the past 24 hours, data shows.

Hashrate surged to all-time highs. (YCharts)

- Bitcoin hashrates have increased by over 50% in the past year. As of July, miners based in the U.S. accounted for 35.4% of the hashrate on the network.

DISCLOSURE

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.