Bitcoin Market Weakening After Macro-Based Sell-Off, On-Chain Data Suggests

Key bitcoin (BTC) on-chain metrics have flipped bearish this week, suggesting the top cryptocurrency by market cap may extend its recent price losses in the short term.

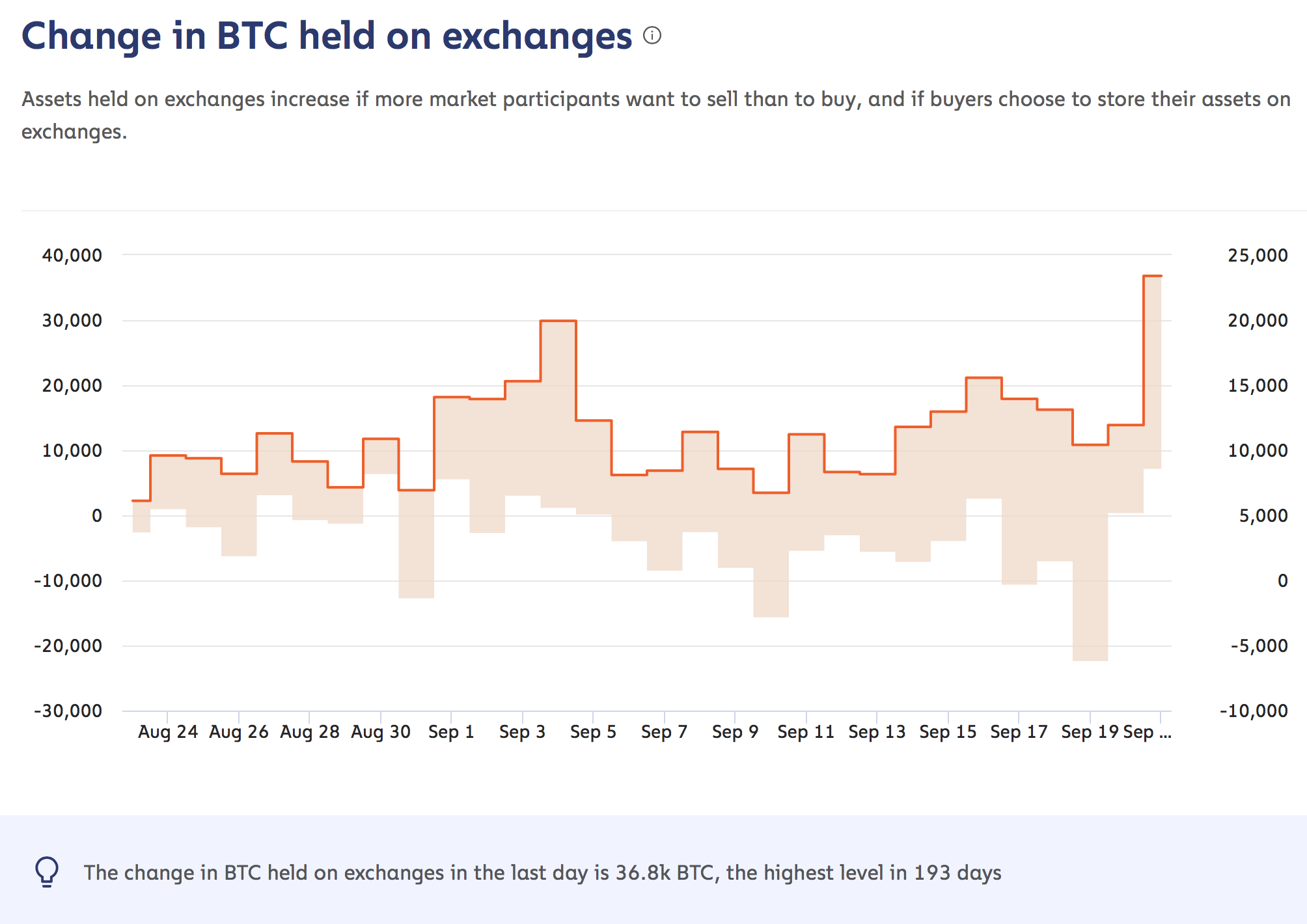

- On Tuesday, the net inflow of bitcoin to exchanges (measured by the total change in exchange balances) was 36,800 BTC, according to data source Chainalysis.

- That's the biggest single-day rise since the markets crash on March 12 sent prices to a 2020 low.

- "Since Sept. 20, the net daily inflow of bitcoins to exchanges have been increasing and trade intensity has been declining," Philip Gradwell, an economist at Chainalysis, told CoinDesk.

- This, he said, "indicates a weakening market."

Change in BTC held on exchanges

- The uptick in net inflows represents an increase in selling pressure, since investors typically move coins from their wallets to exchanges when they see a possible need to liquidate their holdings.

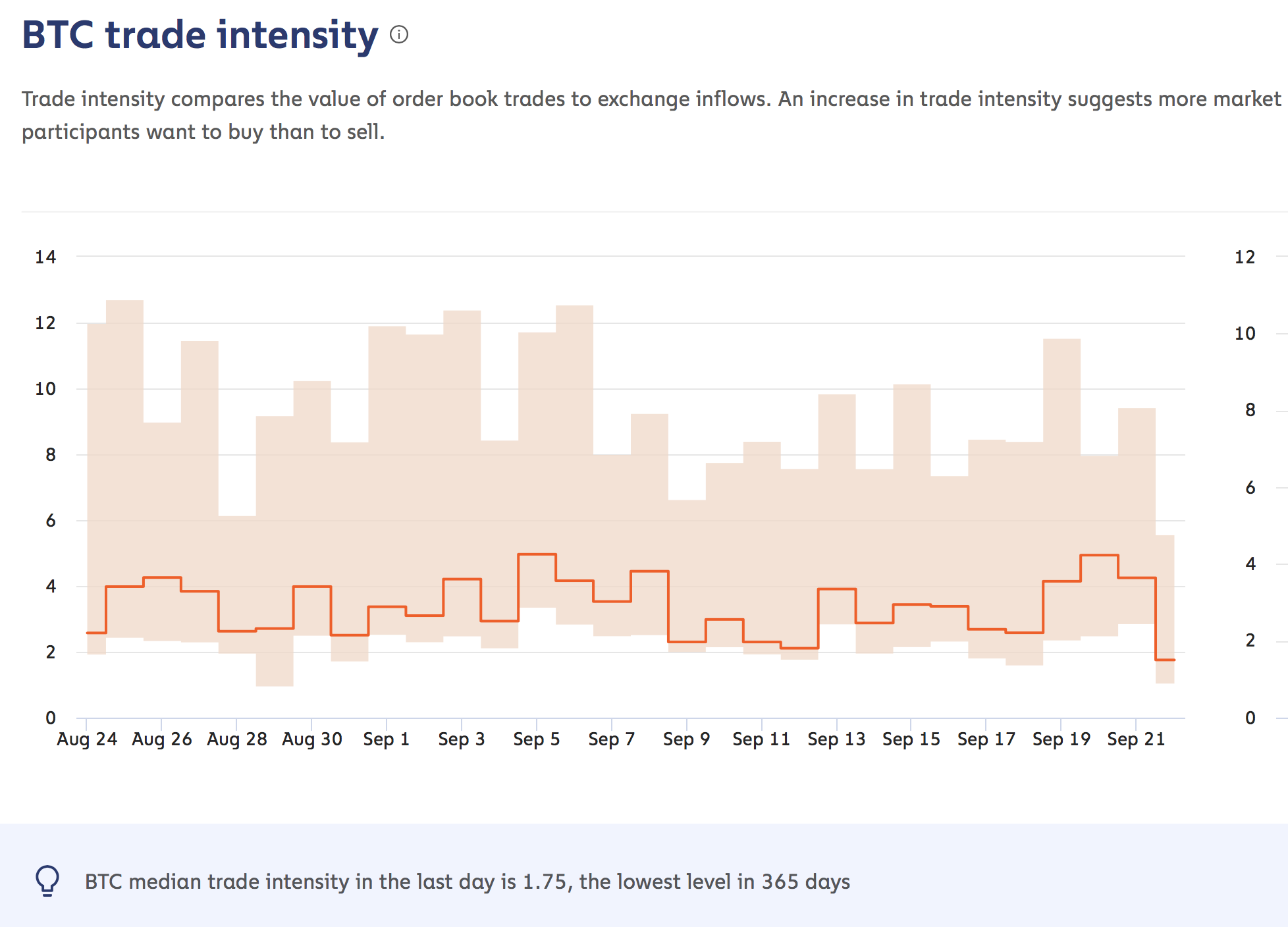

- Further, bitcoin's trade intensity, which measures the number of times an inflowing coin is traded, fell to a one-year low of 1.75 on Tuesday.

- That's a sign there were not enough buyers to absorb the spiking inflow of coins.

BTC trade intensity

- Trade intensity has declined from 4.93 to 1.75 in the last three days.

- "There is a lot of inventory building on exchanges and fewer buyers willing to trade. These conditions tend to lead to price declines," Gradwell said.

Long-term bull bias intact

- Bitcoin fell by over 4.5% on Monday as investors bought the safe-haven U.S. dollar, but sold equities, gold and other fiat currencies on renewed coronavirus concerns.

- The drop set the stage for a continuation of the pullback from August highs above $12,400, according to the technical charts.

- Immediate supports are seen at $10,000 and $9,868 (Sept. 8 low).

- However, while bitcoin may suffer deeper declines in the short-term, the overall bias remains bullish.

- "We are still above $10,000, only the third time bitcoin has maintained this price level for multiple weeks, and long-term investors are buying bitcoin in increasing amounts," Gradwell noted.

- The options market is also showing bullish bias on the longer time frames.

- The three- and six-month put-call skews remain below zero, a sign that bullish call options are drawing higher demand or prices compared to bearish put options.

- At press time, bitcoin is trading near $10,477, up slightly on the day, according to CoinDesk's Bitcoin Price Index.

DISCLOSURE

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.