Bitcoin Options Open Interest Hits 2021 Low as Frenzy Cools, or Maybe It's Soccer

The bitcoin options-trading boom that saw traders make ambitious bullish bets early this year has cooled in the wake of the recent price sell-off and subsequent consolidation.

"After the large June expiry, open interest has dropped to levels last seen at the end of 2020," Luuk Strijers, chief commercial officer at Deribit, the world's largest options exchange by open interest and trading volume, said. "Open interest and volume have declined in both the dollar and bitcoin terms in recent weeks due to overall bearish sentiment caused by China's regulatory crackdown and other factors."

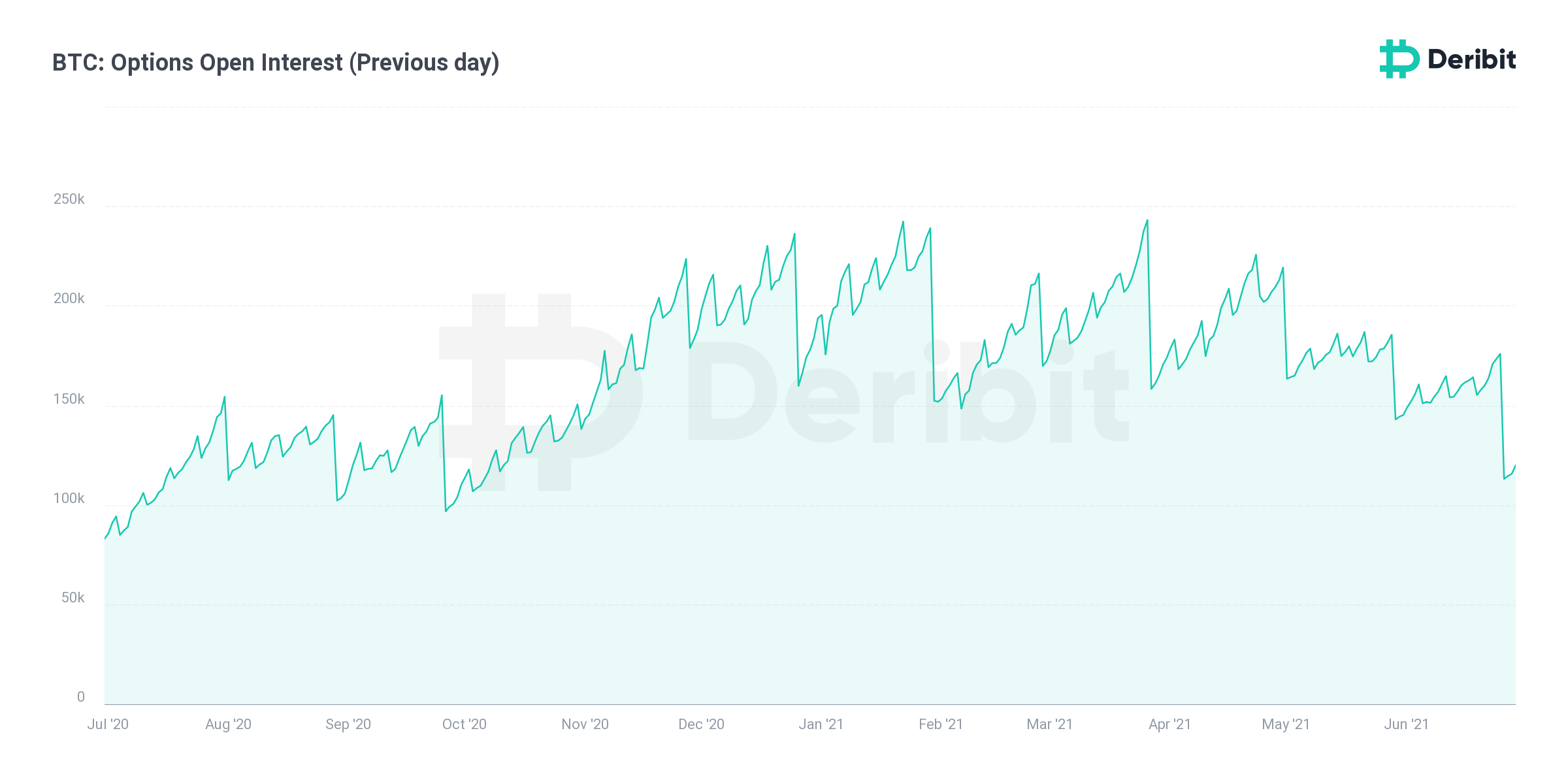

Bitcoin options open interest on Deribit

Open interest in bitcoin options listed on Deribit, or the number of open positions, fell to almost 120,000 BTC on Monday, the lowest level since October. The tally peaked near 250,000 BTC in late March. On Deribit, one option contract represents one BTC.

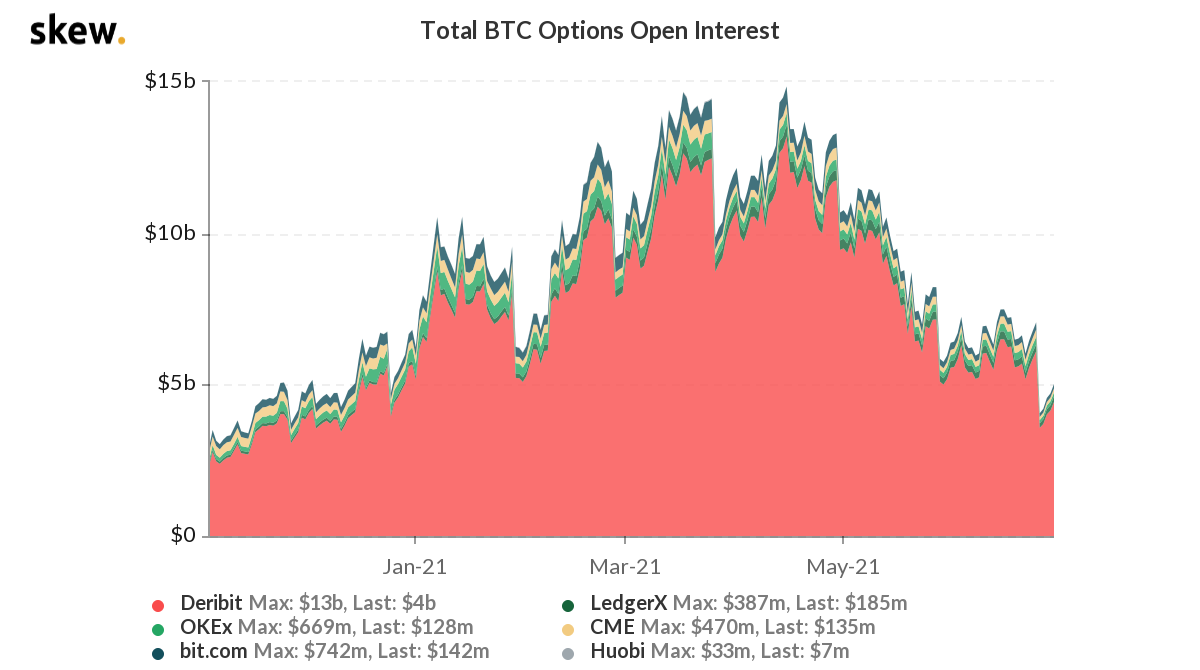

The nominal value has more than halved to $4 billion, also the lowest since late 2020. Other exchanges like OKEx, Chicago Mercantile Exchange (CME), LedgerX, Huobi, bit.com and Huobi have registered a similar drop in open interest.

Open interest reached a record high of nearly $15 billion during the height of the bull market in mid-April and has been falling since in nominal and bitcoin terms. The cryptocurrency peaked above $64,800 in mid-April and recently hit five-month lows below $30,000.

The data highlights that though options are mainly hedging instruments, they were widely used for speculation during the bull run.

Bitcoin options open interest

"This is more like a correction in the open interest just like there has been a correction in bitcoin's price," Martin Cheung, an options trader from Pulsar Trading Capital, told CoinDesk in a Telegram chat. "Price volatility has come off sharply, so we are now seeing less demand for options, which are hedging instruments."

Bitcoin's one-month implied volatility has declined to near 90% from the high of 153% observed on May 23, according to data firm Skew.

Options are derivative contracts that give the purchaser the right but not the obligation to buy or sell the underlying asset, in this case, bitcoin, at a predetermined price on or before a specific date. A call option gives the right to buy, and a put option gives the right to sell.

Traders often take upside (calls) or downside (puts) protection based on their spot or futures market exposure when price turbulence is high. When volatility drops, however, the existing hedges are often squared off, and traders are less likely to take new hedges.

Hedging, or speculation

Often, particularly during a strong bull or bear run, options are used for speculation. For instance, traders piled into the deep out-of-the-money (OTM) call option at $80,000 strike in March and April in hopes that the rally would continue through the seasonally strong second quarter. That lifted open interest.

However, the cryptocurrency crashed in May and has been restricted mainly to a range of $30,000 to $40,000 this month. The downdraft may have forced traders to reassess their bullish expectations.

"When markets become range bound, there is less demand for hedging," Shilliang Tang, chief investment officer of LedgerPrime, a $130 million crypto hedge fund, said in a Telegram chat. "Also, there is less call buying as funds adjust expectations amid consolidation and absence of a V-shaped recovery."

LedgerPrime bought deep OTM calls in the first quarter as the bullish momentum was quite strong and switched to "carry trading" – buying spot and shorting futures – in the second quarter. As of last week, its quant fund was up 78% year to date, versus bitcoin's 22% gain.

According to some observers, the slowdown in the options market is a sign the price sell-off has crowded out a significant chunk of retail participation.

"It's likely those new to crypto are licking their wounds now, and with no strong market narrative except the potential ether fork,” Chris Dick, a quant trader at B2C2, said in a Telegram chat. “There is little catalyst for retail to re-enter the market."

Soccer absorbing the attention

According to Gary Pike, a trader at B2C2, retail traders with holdings under water may be less inclined to take additional risk, especially with summer in full swing and the distraction of sports.

“Soccer tournaments are continuing worldwide and drawing more attention away from retail crypto trading," Pike said, adding that he’s confident that activity will pick up.

"The catalyst will come, and volumes will return to exchanges, if not from an event, then due to traditional players resuming after the summer break," Dick said.

While retail activity may have cooled, institutional participation on Deribit remains strong.

"We are seeing growing interest in institutional on-boarding and a pickup in block trading volumes," Deribit's Strijers said, adding that it shows institutional demand is still strong. A block trade is the one involving large number of securities and is negotiated privately over the counter or outside of the open market for that security.

According to LedgerPrime's Tang, there is still ample demand from options yield generation/harvesting strategies, which seek to benefit from a prolonged price consolidation.

DISCLOSURE

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.