Bitcoin Price Rises 3% as Gold Trades Above $2K for First Time

Bitcoin is again acting like a macro asset, drawing bids amid a record rally in gold and a broad-based sell-off in the U.S. dollar.

- At the time of writing, the cryptocurrency is trading at $11,624.63, representing a 3% gain on the day, according to CoinDesk’s Bitcoin Price Index.

- Gold is trading at a record high of $2,040 per ounce, having surpassed the $2,000 mark on Tuesday.

- Investors are flocking to gold on sinking inflation-adjusted bond yields and a weaker U.S. dollar, as noted by macro analyst Holger Zschaepitz.

- The U.S. 10-year bond, when adjusted for inflation, currently offers a yield of -1%.

- The dollar index, which tracks the value of the greenback against majors, recently reached a 26-month low of 92.55, according to data source TradingView.

- Gold and bitcoin exchange-traded funds have seen strong inflows over the past five months on the growing demand for an "alternative" currency, according to JPMorgan Chase & Co.

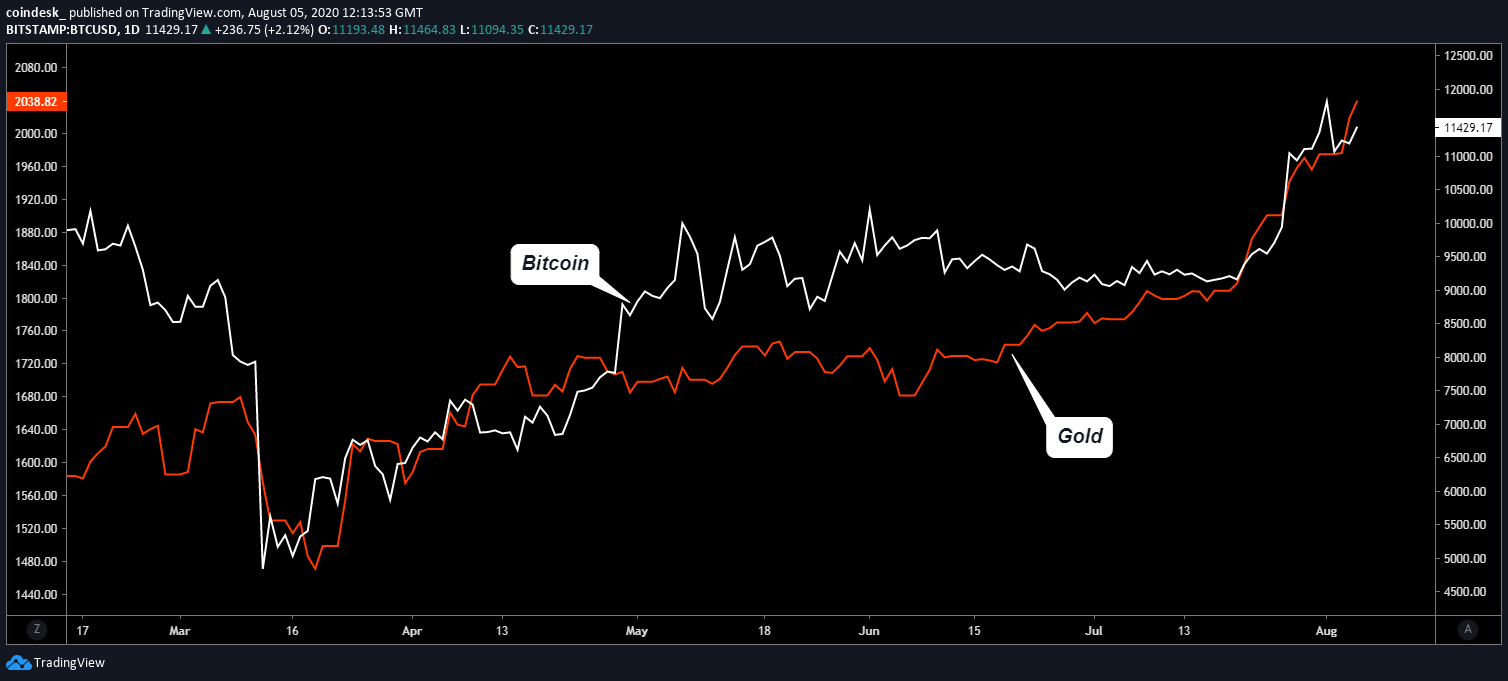

Bitcoin and gold daily chart

- Bitcoin and gold have recently rallied in tandem with the dollar losing ground across the board.

- As gold rose from $1,800 to $1,980 in the 11 days to July 28, bitcoin jumped from $9,100 to $12,100 and the U.S. dollar took a beating against other fiat currencies.

- As such, some analysts are convinced that bitcoin is now more of a macro asset, meaning it responds to large-scale events in the world's economies.

- Gold and bitcoin could continue to rise as governments and central banks are unlikely to slow or halt liquidity-boosting programs launched this year to counter the coronavirus-induced recession.

- Bitcoin may see stronger gains in the future, as it looks relatively cheap with prices still down 43% from the record high of $20,000 reached in December 2017.

- The cryptocurrency has gained nearly 60% so far this year, while gold has risen by 34%.

DISCLOSURE

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.