Bitcoin vs Argentine Peso: Which is Worse Off?

Global financial instability was a key catalyst for the inception of bitcoin and, following the 2008 crisis, people’s trust in the banks' ability to support their needs was badly shaken.

Even the genesis block of bitcoin included a time-stamped article about financial instability – a nod, perhaps, towards the reason for the creation of the digital currency in the first place:

The legacy of this time is still having a strong effect on global markets and the past year has been a worrying one for emerging nations.

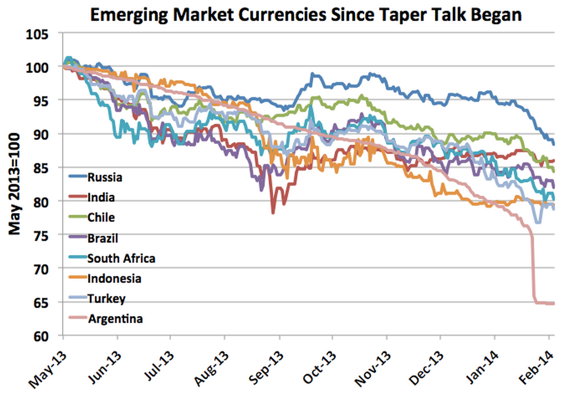

Several factors have been attributed to the fall in some developing countries’ currency values relative to the dollar.

One is the effect of the US Federal Reserve tapering its bond purchases. Some claim it has to do with China’s questionable growth numbers.

Either way, the fact remains that many emerging currencies have been on a downward slide.

All of the countries in the chart above have seen a drop in the value of their national currency relative to the dollar.

None stands out, however, more than Argentina, which devalued its peso in January in order to to retain its international reserves.

Bitcoin an alternative?

Bitcoin investor Chamath Palihapitiya is a big believer in the digital currency. He said the following about the devaluations occurring in some countries:

Argentina, Venezuela and India are dealing with a deval of their currency. Bitcoin activity has seen a meaningful uptick in each country.— Chamath Palihapitiya (@chamath) January 27, 2014

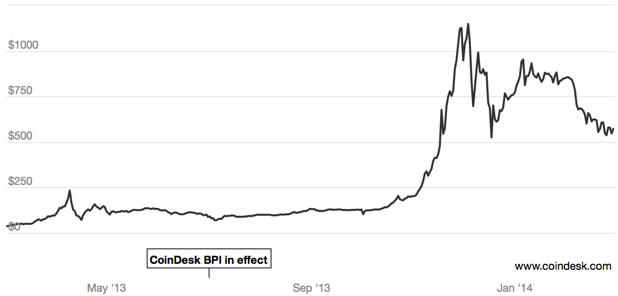

Given how bitcoin has reacted to the failure of one its oldest and most popular exchanges, Mt. Gox, with a significant rebound only days after the company’s final death throes, it seems that the cryptocurrency is irrepressible.

Mt. Gox’s failure has resulted in the loss of around 6% of the bitcoin in circulation. CEO Mark Karlpeles admitted that the exchange was robbed or has lost hundreds of thousands of BTC. He told a press conference:

All that, however, has not caused the bitcoin crisis that many predicted.

Self harm or sensible policy?

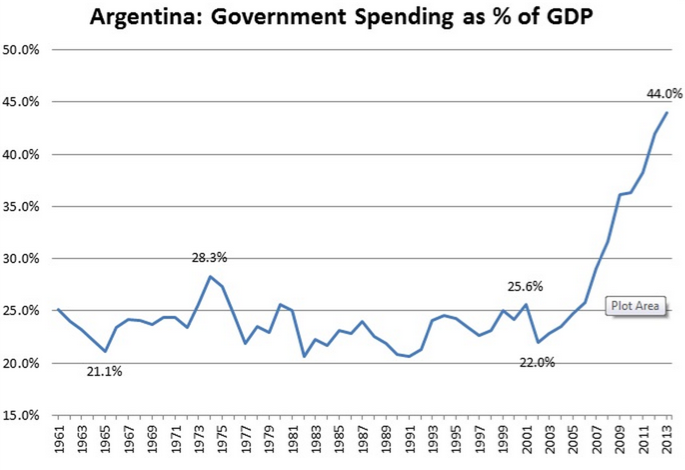

In the wake of its devaluation, Argentina has enacted other financial controls. President Cristina Fernandez de Kirchner has put in place over 30 restrictions to stave off capital flight, but this is effectively restricting how the South American nation’s citizens can move their money around.

Before its total collapse, Mt. Gox long had issues processing USD withdrawals. This problematic lack of ability to move capital is a lot like what Argentina was already doing – as policy.

The problem is, the Argentine government controls an entire currency, whereas, fortunately, Mt. Gox never could never have had that much control over bitcoin.

Argentina’s Economy Minister Axel Kicillof recently admitted to the media that:

“The US dollar is the measuring stick by which people seem to value bitcoins, so the link between the local bitcoin price and devaluation is clear – bitcoins are worth their weight in dollars,” says Mugur Marculescu, a co-founder of BitPagos – a startup that helps Argentine companies convert credit card payments into bitcoin for better stability.

BitPagos prefers to use bitcoin over the Argentine peso because no government can directly affect it, and it is providing its service for others who feel the same way.

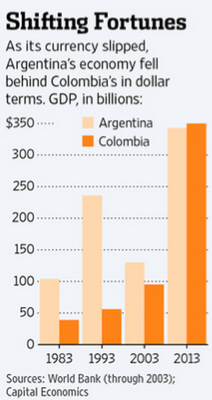

Devaluations of the peso have cause Argentina some serious economic repercussions. For example, it has allowed neighbouring Columbia to overtake it in Gross Domestic Product (GDP) figures, when previously it had been far out in front.

Ups and downs

Many in Argentina hold on to USD dollars as a way to avoid the possibility of the peso becoming worthless. Such volatility creates serious uncertainty, as investors never have the security of knowing where the exchange rate is going to go next.

So the problematic currency devaluations in Argentina are likely to keep people looking for alternatives, including bitcoin.

Of course, cryptocurrencies are volatile too – and there's still no sure bet as to when or if they will stabilize – but, the swings in bitcoin (even in the face of a major exchange implosion) are less volatile than ever before.

Investors never want to see the value of their money to go down – even if it goes down, then back up again. However, many in Argentina have more faith in bitcoin’s performance than in their own national currency.

Although bitcoin can be volatile, cannot be devalued deliberately by a central authority, especially one with an irresponsible urge to spend when money is tight.

It will be interesting to see what Argentina will do with the regulation of cryptocurrencies as a result of the nation’s growing interest in bitcoin.

“Argentina has not yet taken any regulatory stance,” said Marculescu. However, he added:

Removing the veil

Many Argentinians no longer have faith in the government to administer its financial system. Instead, they look to the dollar – and perhaps bitcoin – as a better alternative.

Most Argentinian citizens are not unbanked, but feel the tradition monetary system has only ever provided them with illusions of banking security. Now, it appears they have seen through that illusion, and are looking elsewhere for the real thing.

In comparison, bitcoin’s decentralized economy continues to improve. Many are optimistic that its early wobbles will soon stabilize to reveal a stronger structure than ever before.

Peso image via Shutterstock

DISCLOSURE

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.