Bitcoin's role in the future of micropayments

Different payment processors have different opinions on the definition of a microtransaction, commonly known as a miniscule payment for a good or service.

Small businesses in the US like to require that customers make at least a $10 transaction on a credit or debit card. That’s because some processors charge more for smaller transactions in order to make money on every purchase.

PayPal, for example, sets its fees higher when payments are below $12, which it considers a microtransaction. Paypal's normal rate is 2.9% + $0.30, while there is a higher 5% + $0.05 micropayments rate.

Can it really be considered that something below twelve dollars is a microtransaction?

Perhaps that rate is an example of how far there is to go in the payments industry for processing small amounts of money, although it is fair to point out that processors need to generate revenue from each payment made.

Yet something needs to happen, however, because theses activities should at some point require some degree of change to reflect new concepts like digital media.

Publishers, for example, would do well to accept small payments for reading content.

Bloomberg BusinessWeek has to cannibalize its own print business by charging only $2.49 a month for the digital edition of its magazine, available on tablets. That’s because it has to, as most people move from printed content to online consumption.

But what if publishers made a decision to put up microtransaction-based digital currency paywalls for pennies on the dollar to read individual articles?

BitWall

One company that is embracing this idea is BitWall, which just completed the summer 2013 session with six other bitcoin startups at Boost VC, an incubator in San Mateo, California.

BitWall utilizes Coinbase’s payment processing for bitcoin transactions. This is because Coinbase recently announced support for off-block chain transactions since micropayments could eventually drastically enlarge the ledger’s overall size.

Nic Meliones, BitWall’s CEO, believes that Coinbase’s system of off-block chain transactions helps his business.

“Transactions from readers to publishers are off-block chain (i.e. in-network) when they are signed up for BitWall,” via Coinbase, he says.

The idea is that Coinbase aggregates the small payments as a processor and then posts a larger amount on the block chain.

BitWall users are also given the option to view content for free with ads or also get 3 hours of free access for a tweet.

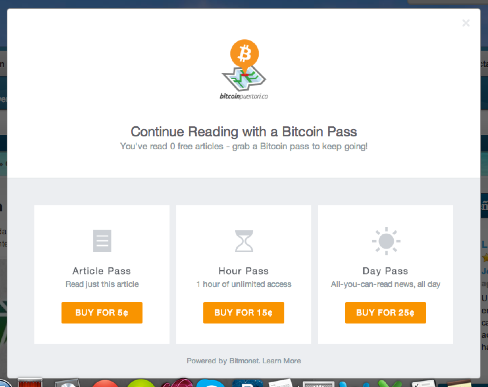

BitMonet

Another bitcoin microtransaction effort comes from BitMonet, which is a free and open project that enables publishers to encourage small amounts of money for pieces of content.

BitMonet has a WordPress plugin that bloggers can link to a bitcoin address, which is a snap to use and doesn't require any HTML modification on a webiste.

BitMonet’s lead developer, Ankur Nandwani, is working on the project solely because of his own interest in bitcoin.

“Microtransactions is a really interesting use-case. And if done properly, it can be the driving force behind bitcoin adoption,” says Nandwani.

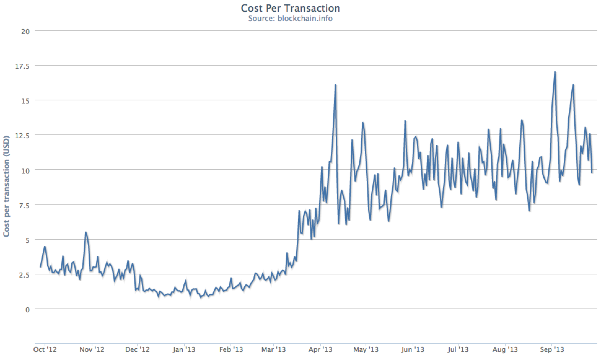

BitMonet uses BitPay as the processing platform, which can pose a bit of a problem since unlike Coinbase every BitPay transaction requires a 0.99% transaction fee plus the 0.0005 BTC network fee if a sender wants fast payment.

This gives Coinbase clients some advantage over other processors.

“People talk about off-the-block chain microtransactions to overcome them, but until and unless they are supported by all the clients, it would be hard to carry out microtransactions at a larger scale”, says Nandwani.

Microtransactions and block chain bloat

In fact, there are some solutions being bandied about on how to solve this microtransaction quandary. One of the ways to overcome this could come from an update to the bitcoin client itself.

The process is a bit complicated, but Nandwani best explains it when he says it involves, “sending a bigger amount, and then adjusting it between the sender and receiver, and then ultimately broadcasting the transactions when no more transactions are to be carried out.”

There are other options on the table that have been discussed on Reddit. However, it is clear that the best path forward is probably a change to the bitcoin client and thus the network itself.

Bitcoin is a protocol, and as such there should be a consensus solution available.

Coinbase’s implementation of a no-fee solution for the time being helps to promote this idea, as once senders and receivers are utilizing this in merchant and person-to-person transactions it will hopefully take off in terms of adoption.

Conclusion

Small transactions are a wave of the future, but it is going to ultimately require the cooperation of payment processors in order for it to gain traction.

In places such as Africa, small transactions are already being used for all sorts of things. Kenya’s M-PESA is an example of a mobile phone-based digital currency that allows the mostly unbanked to send via SMS small daily amounts of money for things like utilities.

There are also some ideas to use microtransactions as a system to speed up or otherwise bypass regular everyday processes.

Meliones, the BitWall CEO, noted that there are some in the bitcoin community that believe small transactions could enable drivers to pass people in traffic by offering a small payment as a rewards.

Other incentive-based ideas also include gamification, a concept that offers small rewards for solving puzzles or performing small amounts of work in order to earn a small fee for doing so.

What will be interesting is what developers come up with in this regard, once the friction of payments is lessened overall.

What do you think about microtransactions?

What is something that you would be willing to pay a small fee for if it was easy to and worth it to you?

How do you think it affects what bitcoin miners provide to the network as a whole? Let us know in the comments section below.

DISCLOSURE

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.