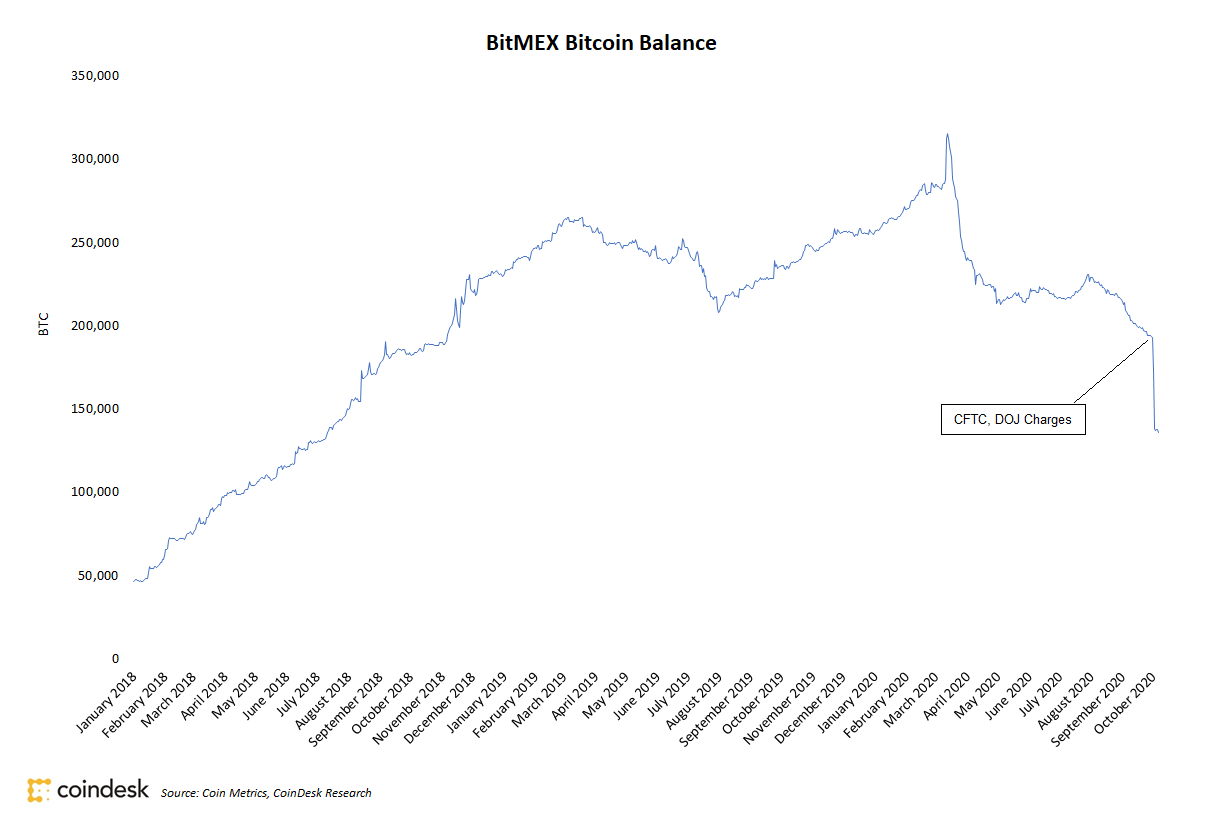

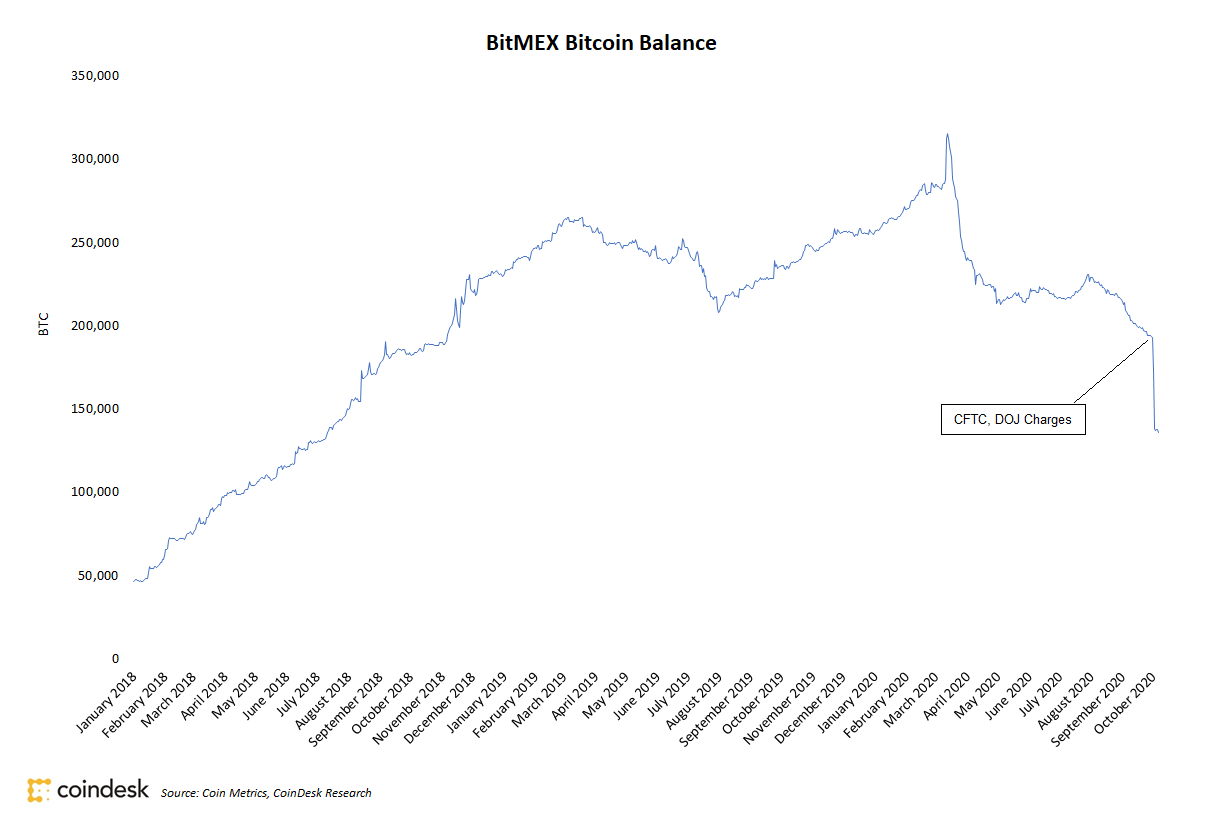

BitMEX Says It's 'Business as Usual' Despite 30% Drop in Bitcoin Balance After CFTC, DOJ Action

One week after charges were brought by the U.S. Commodity Futures Trading Commission and Department of Justice, nearly 30% of BitMEX’s bitcoin (BTC) balance has been withdrawn by customers.

- A spokesperson for the derivatives exchange told CoinDesk that, despite the significant withdrawals, “It is business as usual for the BitMEX platform.”

- Total BTC held on BitMEX addresses dropped from 192,986 BTC on Sept. 30 to 135,619 BTC Tuesday, a 29.73% decline, according to data provided by Coin Metrics.

- Aggregate open interest for BitMEX BTC futures also took a hit in the past week, falling by over $100 million from $732 million on Sept. 30.

- The “fundamentals” of the exchange “remain strong,” however, according the spokesperson, specifically BitMEX's “resilient open interest and liquidity.”

The total amount of coins held on BitMEX addresses since Jan. 2018

- On-chain transaction data reviewed by CoinDesk suggests that much of the withdrawn coins were deposited to addresses at Binance, which also prohibits American users, and U.S.-based Gemini and Kraken.

- Even though customers are withdrawing coins, one BitMEX balance that is not shrinking is the exchange's Insurance Fund, a pool of funds nominally used to prevent auto-deleveraging of traders’ positions.

- Since Thursday, the fund has grown by nearly 20 BTC (or over $200,000) to 36,588 BTC (or over $388 million), by far the largest insurance fund of any cryptocurrency derivatives exchange.

- The Seychelles-based business consistently ranks fourth by 24-hour volume and second by open interest, according to bitcoin futures data from Skew.

DISCLOSURE

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.