BlockFi Rate Cut on Bitcoin Deposits Leaves Rivals Scratching Heads

Crypto lending platform BlockFi is cutting interest rates on a number of crypto asset deposits, just about three months after the company lowered rates in March.

BlockFi says its decision was made based on the changing market dynamics and borrowing demand from institutional investors.

But unlike the last time, other leading top crypto lending desks such as Genesis and Canada-based Ledn are not following BlockFi’s lead move, at least for bitcoin deposits. Some of the executives at the firms are seeing increased borrowing demand compared with the previous quarter, so they need to attract the deposits to lend them out.

An outlier move

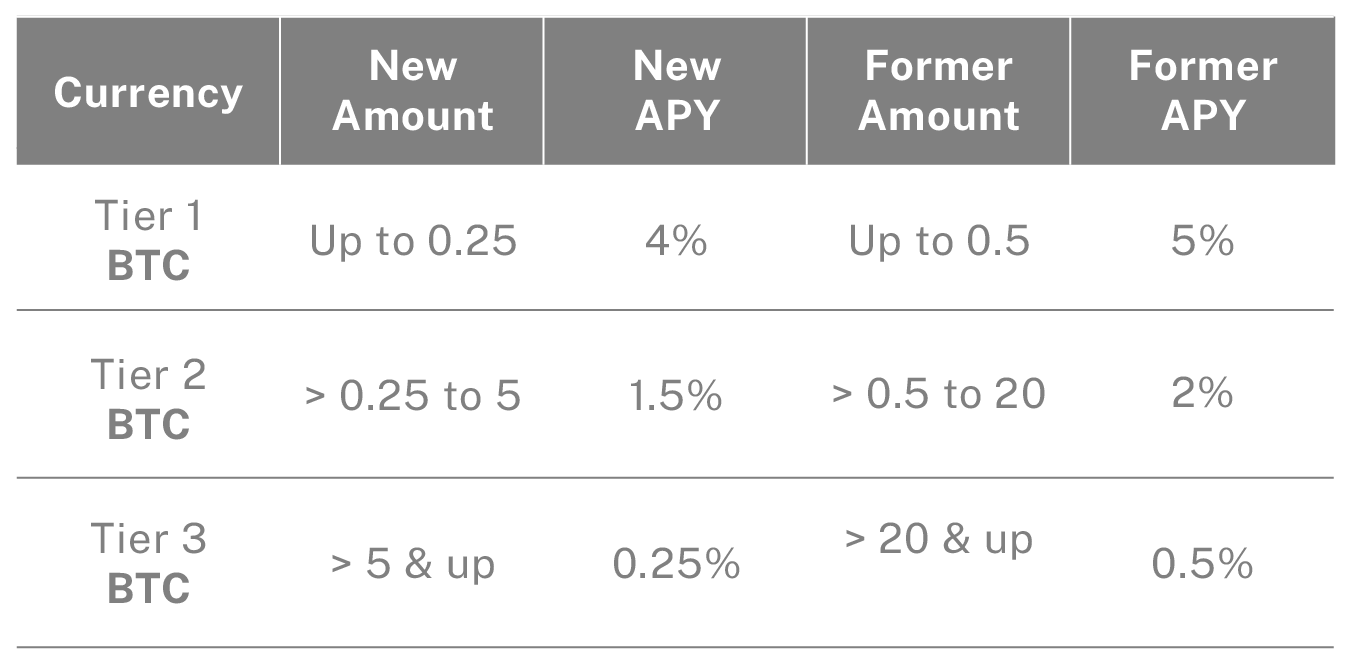

New APYs for bitcoin deposits for BlockFi Interest Account.

BlockFi, in the announcement, said the decision was made due to “shifting market conditions.”

“Rates on cryptocurrencies held in BIA (BlockFi Interest Account) are primarily driven by demand by institutional investors for borrowing these assets,” Rishi Ramchandani, director of business development at BlockFi in Asia, told CoinDesk in an email response. “When institutional investors demand changes, that affects the rates we can offer our BIA clients.”

Ramchandani said borrowing demand from BlockFi’s clients “continues to be stronger than ever,” but that the tenure of the loans “has gone down” along with the rates.

BlockFi’s decision led to a string of snarky comments on Twitter.

More significantly, other major lending desks told CoinDesk they are not planning to lower their rates in the near future.

“Genesis is not lowering bitcoin rates on July 1, despite BlockFi’s rate reduction,” Matthew Ballensweig, head of institutional lending at Genesis, wrote in an email to CoinDesk. “Genesis can still pay 2.0% and more with no maximum quantity, as it still sees a robust institutional bitcoin lending market.” Genesis is owned by Digital Currency Group, which also owns CoinDesk.

The Canadian crypto lender Ledn will also keep interest rates for bitcoin deposits unchanged, according to an executive at Ledn. Ledn’s APY for bitcoin accounts with at least 2 BTC is 2.25%. Ledn is cutting deposit rates on the stablecoin USDC to 9.5% from 12% starting on July 1.

Hong Kong-based crypto lender Babel told CoinDesk via a spokesperson that it is not lowering interest rates for bitcoin deposits. Babel cut rates for tether deposits in May.

All three companies told CoinDesk they are seeing increased bitcoin borrowing demand from clients.

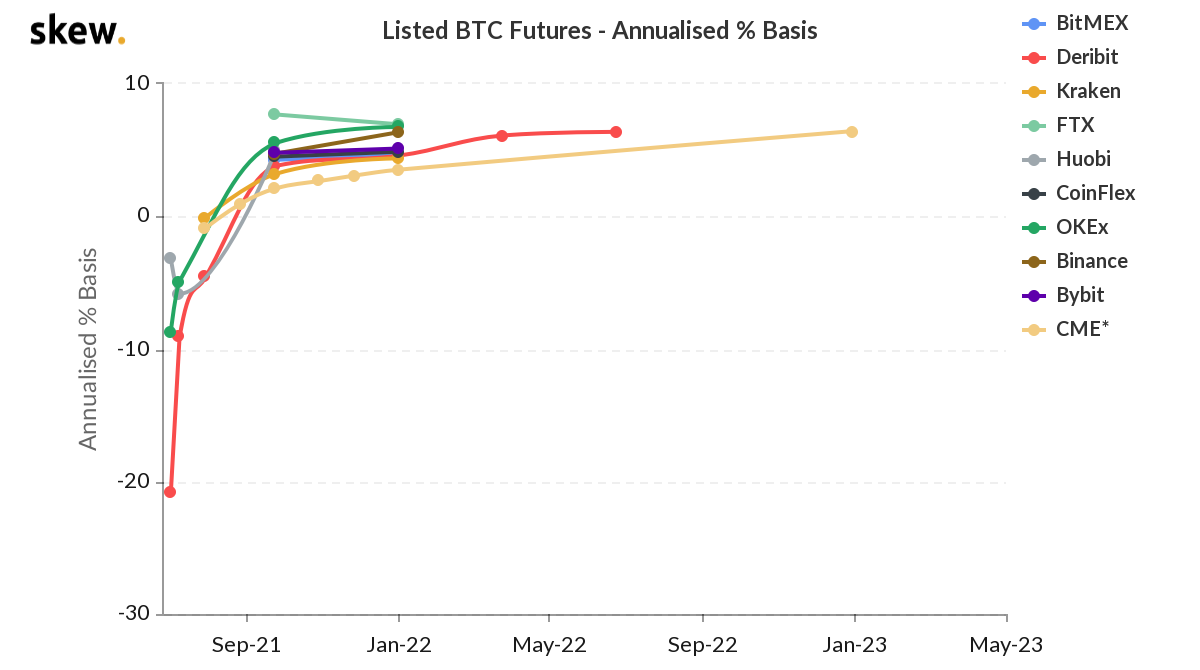

Some traders are betting the premium between spot cryptocurrency prices and futures, which has flattened recently, could widen again. So they’re borrowing bitcoin to short the spot market against a long position in the futures market.

That’s a contrast with the “cash and carry” arbitrage strategy that some traders pursue when futures draw a significant premium to the spot price; in that case, they buy bitcoin and short the futures to bet on a convergence of the two prices when the futures contract matures.

“Given the compression in the near-dated futures and spot basis spread, there are actually more opportunities to deploy bitcoin than last month,” Ballensweig said.

In Genesis’s first-quarter report in 2021, the company cited the wide spreads between bitcoin futures and spot markets as one reason for “lackluster” borrowing demand in the quarter. The company dropped its interest rates in March along with BlockFi.

“Borrowing BTC to short spot and long futures to bet on a widening curve doesn’t make sense when the basis is trading wide,” the report read.

According to data source Skew, bitcoin’s July expiry futures listed on major exchanges such as Binance, Huobi, OKEx, Deribit and Kraken are currently drawing an annualized basis of -20% to 3%.

Mauricio Di Bartolomeo, co-founder of Ledn, said that a lowered interest rate for USDC helps to reduce the cost of bitcoin-backed loans.

Dan Burke, managing director of institutional sales in Asia-Pacific at BitGo, said decentralized finance (DeFi) offers another source of borrowing demand for bitcoin from institutional clients, who are looking to convert bitcoin to wrapped bitcoin. These “synthetic” versions of bitcoin are configured to run on the Ethereum blockchain, where they can be deployed in DeFi trading and lending protocols for extra returns or yield.

“From our institutional client base, we are seeing quite the opposite” from BlockFi, said Gary Pike, director of sales and trading at B2C2. “This may be because we only deal with institutions whereas BlockFi deals with retail as well.”

BlockFi’s CEO Zac Prince recently said the average balance held in an account on the platform rose fivefold in the past year, with the average balance of a retail client having jumped from $10,000 to $50,000.

“BlockFi largely borrows from retail and lends to institutional,” BitGo’s Burke said. “Some of the other lending platforms are also trading the assets themselves. It’s up to the users to decide what is riskier.”

GBTC in play?

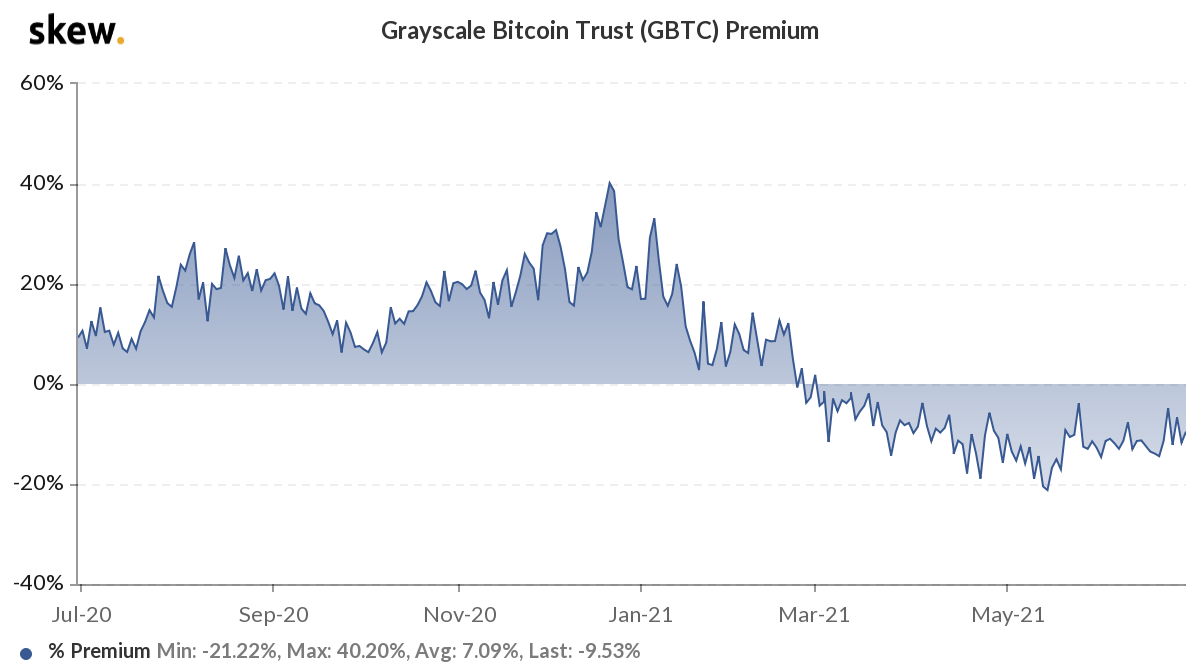

Another possible factor behind BlockFi’s decision is the so-called Grayscale Bitcoin Trust (GBTC) arbitrage trade, several market participants said.

The Grayscale arbitrage trade refers to a strategy used by investors to borrow bitcoin and deliver those to the trust in exchange for GBTC shares – relevant when the Grayscale trust shares used to trade at a premium to the net asset value (NAV) of the fund, which is more closely tied to the value of its assets, or the underlying bitcoin.

After a six-month lockup, the shares could be sold in the secondary market to retail investors at a premium. After paying back the lender for the borrowed BTC, the investors would take the rest for profit. (Grayscale is also owned by DCG, CoinDesk’s parent company.).

As CoinDesk reported, BlockFi was one of the biggest GBTC holders as of February, when the company revealed that it holds $1.7 billion in shares of GBTC, about 5.66% of the total outstanding.

Max Boonen, director and founder of B2C2, said in a recent interview with New Money Review that some firms had taken advantage of the GBTC arbitrage trade in order to offer attractive interest rates on crypto deposits.

“They could borrow bitcoin from their clients (with or without collateral), put the bitcoin into GBTC, hold the GBTC shares for the six-month lock-up period, then sell them on the secondary market with a premium attached,” Boonen said.

At press time, GBTC shares are trading at a discount to the NAV, so the Grayscale carry trade has lost its charm.

The arbitrage trade “used to be a cash cow when GBTC was trading at a large premium,” said Jeff Dorman, chief investment officer at Los Angeles-based Arca.

BlockFi did not immediately respond to CoinDesk’s request for comment about GBTC trading.

On its Terms of Service page, BlockFi tells depositors:

BlockFi raised $350 million in a Series D funding round in March and there have been rumors it is raising another round of funds worth several hundred million dollars at a valuation near $5 billion.

Dorman speculated the additional funds might serve “until revenue opportunities return.”

BlockFi declined to comment on the new funding round. But Andrew Tam, chief marketing officer at BlockFi, told CoinDesk his company is “on track” to exceed its $500 million revenue goal for 2021.

“BlockFi’s business is healthier than ever,” Tam said.

The company has faced challenges as it grows. Most recently, it incorrectly deposited to users’ accounts as part of a botched round of promotional payments. Instead of rewarding users with the stablecoin gemini dollar (GUSD) as planned, it sent BTC, sometimes millions of dollars' worth, to certain users. In March, the platform was attacked with fake sign-ups and abusive language on its web page.

DISCLOSURE

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.