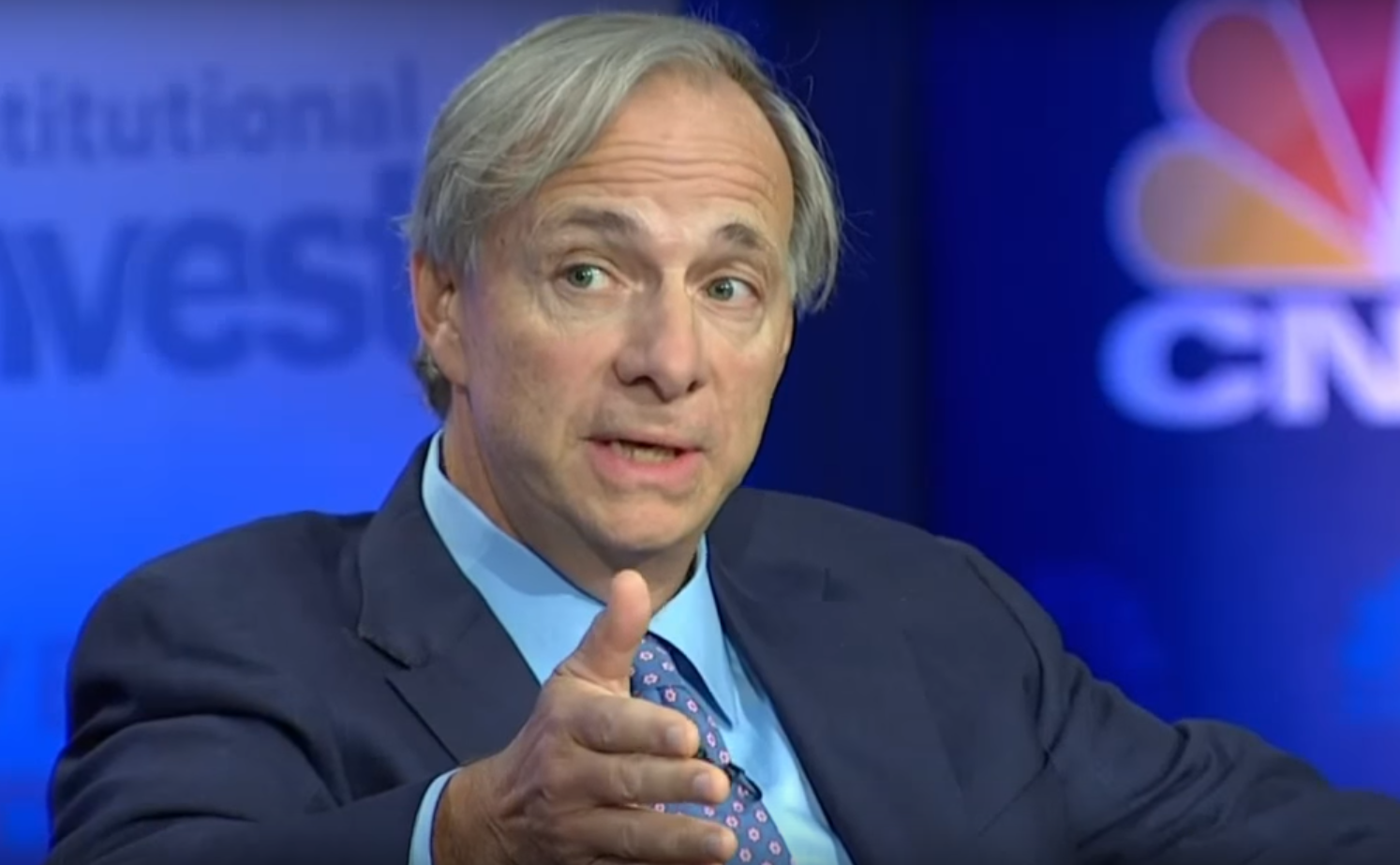

Bridgewater's Dalio Sees Governments Banning Bitcoin Should It Become 'Material'

Ray Dalio, the founder and co-chairman of Bridgewater Associates, the world's largest hedge fund, said he sees three main problems with bitcoin and other cryptocurrencies that will limit their future, including that governments will "outlaw" them should they start to become "material."

- A lack of venues that will accept cryptocurrencies for purchase. "I today can't take my bitcoin yet and buy things easily with it."

- Bitcoin and other cryptos are too volatile to be considered an effective store of wealth. That volatility also hurts bitcoin's use transactionally because vendors won't know how much they're getting, Dalio said.

- If bitcoin or other cryptos become "material," Dalio predicted governments will "outlaw" it. "They'll use whatever teeth they have to enforce that."

"I don't think digital currencies will succeed in the way people hope they would," Dalio said.

The comments are at odds with comments made by other billionaire investors including Paul Tudor Jones and Stanley Druckenmiller who say they've invested in bitcoin.

"Would I prefer bitcoin to gold? No," Dalio said.

DISCLOSURE

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.