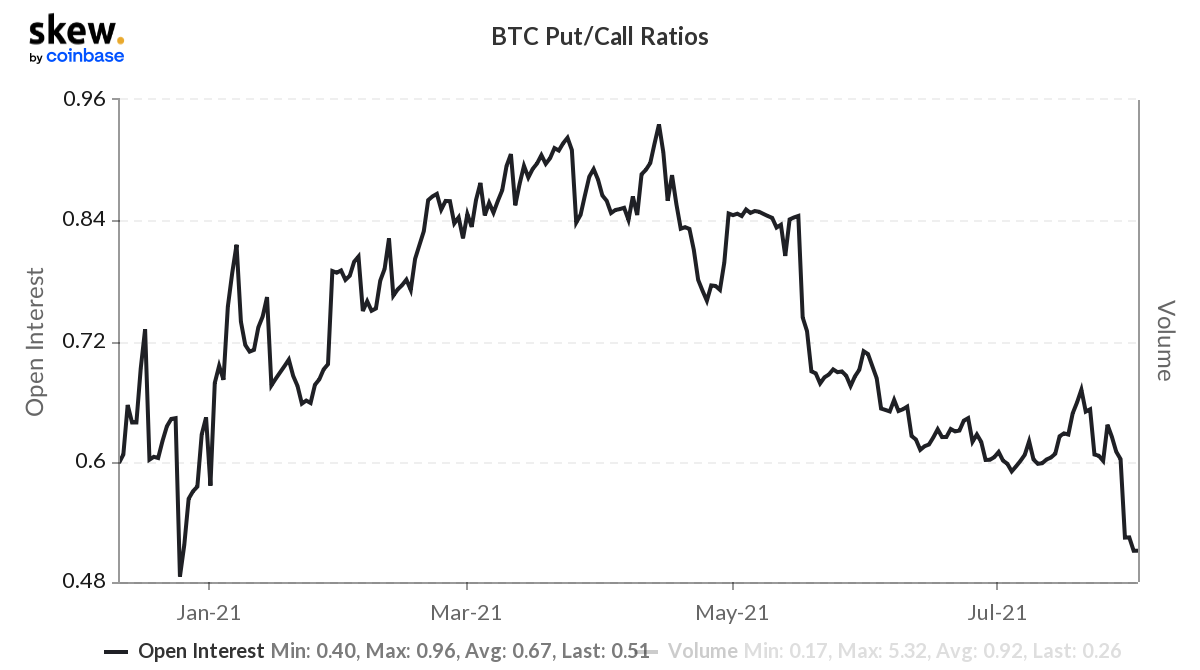

Bullish Flows Push Bitcoin's Put-Call Ratio to 2021 Low

Bitcoin's put-call open position ratio dropped to the lowest level this year on increased activity in calls, or bullish bets.

The ratio slipped to 0.51 on Monday, hitting the least since Dec. 25 and extending the slide from the July high of 0.67, data provided by crypto derivatives research firm Skew show.

According to Skew's Twitter feed, about 2,000 bitcoin call option contracts with a strike price of $140,000 and an expiry date of Dec. 31 changed hands on Sunday. Similar volume was seen in the December expiry call with a strike price of $200,000.

"All this activity in calls has brought the put-call ratio to YTD lows," Skew tweeted on Monday. A call option gives the holder the right but not the obligation to buy the underlying asset at a predetermined price on or before a specific date. A call buyer essentially purchases insurance against bullish moves by paying a premium to the seller. A put option gives the purchaser the right to sell.

Bitcoin put-call open interest ratio

Data shared by over-the-counter desk Paradigm and analytics firm Genesis Volatility show investors bought Aug. 6 expiry calls at $44,000 and simultaneously sold calls at $50,000, a so-called bull call spread, last week, pulling the put-call open positions ratio down.

The bull call spread involves buying call options at, below or above the spot market price and selling an equal number of calls with the same expiry at a higher strike price.

It's a limited-risk, limited-reward strategy designed to benefit from an increase in the underlying asset. The maximum profit is earned if the asset expires at or above the short call's strike price, that is $50,000 in this case, on the settlement day. The maximum loss is limited to the net premium paid while setting the strategy. It is arrived at by subtracting the compensation received for selling the $50,000 call from the premium paid for buying the $44,000 call.

Traders also bought September expiry call spreads at $64,000-$124,000 strikes last week. Other metrics measuring the implied volatility or price differential between call and puts also paint a bullish picture.

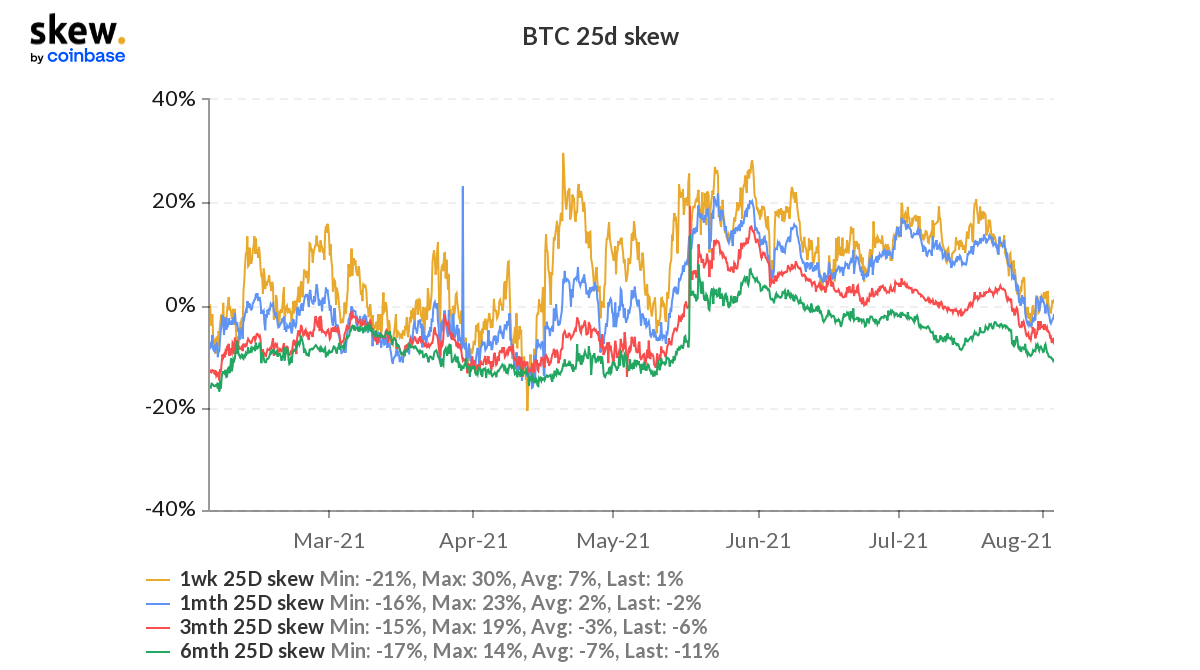

Bitcoin put-call skews

For the first time in nearly 10 weeks, short-term, medium-term and long-term put-call skews are displaying negative values, a sign of calls drawing higher demand or prices than puts.

Bitcoin is currently trading near $38,500, representing a 1.7% drop on the day.

DISCLOSURE

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.