China's New Rules: What Do They Mean for Bitcoin?

A joint statement from China's authorities had an interesting impact on bitcoin's value last week.

The statement served as a ‘notice’ highlighting that “bitcoin is not issued by the monetary authorities”, and that it's “not the true meaning of money”. The release also states that bitcoin “cannot and should not be used as currency in circulation in the market”.

Let's examine.

China's growing presence in bitcoin

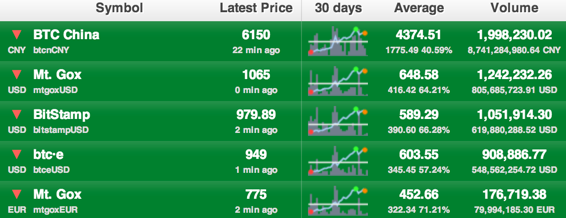

China has been a booming market for bitcoin. Since early November, the world's leading bitcoin exchange has been BTC China.

BTC China has just received $5m in venture capital funding from Lightspeed China Partners and Lightspeed Venture Partners to help expand its business operations.

A deputy governor of the People’s Bank of China recently told an economic forum that people should be free to buy and sell bitcoins. Yet, he also made clear that it would be impossible for the bank to deem bitcoin legal tender "in the near future".

Bobby Lee, CEO of BTC China, told CoinDesk his company has worked with various Chinese regulators in an effort to be compliant with China's regulations:

The government's statement makes clear that any “trading platform bitcoin internet sites” must be registered with the country’s telecommunications regulatory agencies. This is due to “a high risk of money laundering “ and “excessive speculation”.

The scam component

An exchange in Hong Kong, an administrative region that falls within China's sovereignty, recently disappeared overnight with $4.1m in customer accounts going missing as a result.

Chinese authorities have reportedly detained the suspected operators of the fraudulent exchange, which was known as GBL.

This could have been a major impetus for Chinese authorities to begin examining the impact of the cryptocurrency. Previously, the country had taken a wait-and-see approach, but GBL's scheme, which stole vast amounts of civillian money, caused the central bank and other authorities to take action.

That's why the actions of the world's largest exchange, BTC China, are even more perplexing. The company has only just made ID submission mandatory for bitcoin traders. Shouldn't this be part of its Know Your Customer (KYC) methods already?

An 'out of whack' market cap

China is making major inroads into bitcoin, which has been noted due to the infrastructure investments made into bitcoin mining there.

Those who understand the political and human rights issues facing China might be concerned about the country's influence on distributed money such as bitcoin.

Yet, no one can deny that news coming out of China frequently affects bitcoin's overall market cap.

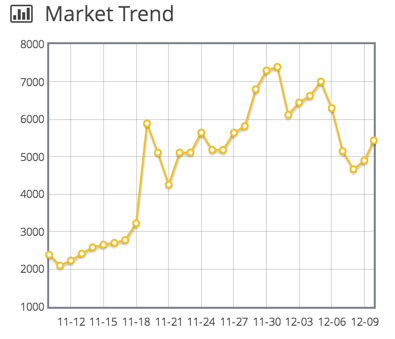

It's important to note that thirty days ago, the market cap for bitcoin was at $4bn. In a dramatic run-up, it went over $14bn. China-related news has since caused that to deflate, and volatility remains a major issue for investors who see their bitcoin fluctuate wildly in terms of fiat value.

Exchanges need banks

Bitcoin's recent price volatility and the subsequent market cap fluctuations have both been grossly misunderstood.

As nice as it would be to believe that bitcoin doesn't require banks, the reality is that without them it is very difficult to exchange between fiat and virtual currencies. Travis Skweres, CEO of US exchange CoinMKT, is one person that deals with this problem everyday. Banks aren't seeing the opportunity, and some of that has to do with perceived regulatory risks.

"The biggest impediment to growth in the industry is the ability to exchange between fiat currencies and cryptocurrency. It presents an enormous challenge to exchanges, but also an enormous opportunity for banks with an appetite for risk," Skweres said.

"Show me a bank that publicly provides banking to bitcoin companies, and I'll show you a bank that needs to hire another 100 employees," he added.

Since the news on China's new bitcoin regulations broke, the price has started to recover.

The country's influence on bitcoin cannot be denied. If China goes, so will bitcoin. Chinese people view the currency as an asset worth investing in, either by mining or trading.

The question remains as to what the government's role will be going forward. This ultimately depends on whether bitcoin will be treated like a commodity, and if China's state-controlled banking system will let the currency operate within a legal framework it deems fit.

Chinese Yuan Banknote image via Shutterstock

DISCLOSURE

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.