CME Sees Record High Open Interest for Bitcoin Futures on Wave of Institutional Inflows

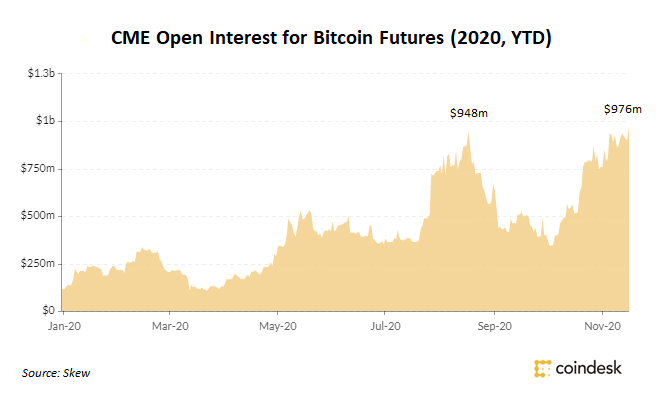

Open interest for bitcoin futures traded on CME Group's exchange reached a record high of $976 million Monday amid a surge of institutional capital inflows to the leading cryptocurrency and its derivative markets.

- Open interest, or the total number of outstanding derivative contracts, on CME Group's bitcoin futures market reached its highest level since mid-August as iconic players in traditional markets, like Stanley Druckenmiller and Bill Miller, expressed optimistic opinions about bitcoin.

- The previous record high of $948 million came shortly after another famed investor, Paul Tudor Jones, said he owns bitcoin and planned to take positions in bitcoin futures.

- So far in 2020, bitcoin has rallied 144%, according to Messari market data.

- Expanding on the growth craze in CME's bitcoin market, a spokesperson for the firm told CoinDesk, "The number of large open interest holders (LOIH) is once again at a record 102 holders and we are averaging 101 holders so far in November."

- CME's growth relative to other exchanges is "indicative of institutional investors wanting exposure to bitcoin," said Phillip Gradwell, chief economist for the blockchain surveillance software firm Chainalysis, in an email to CoinDesk. It also demonstrates "the increasing separation of fiat and pure crypto markets," he said.

CME bitcoin futures open interest since Jan. 2020

Update (November 17, 21:08 UTC): This article has been updated with additional data from CME Group.

DISCLOSURE

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.