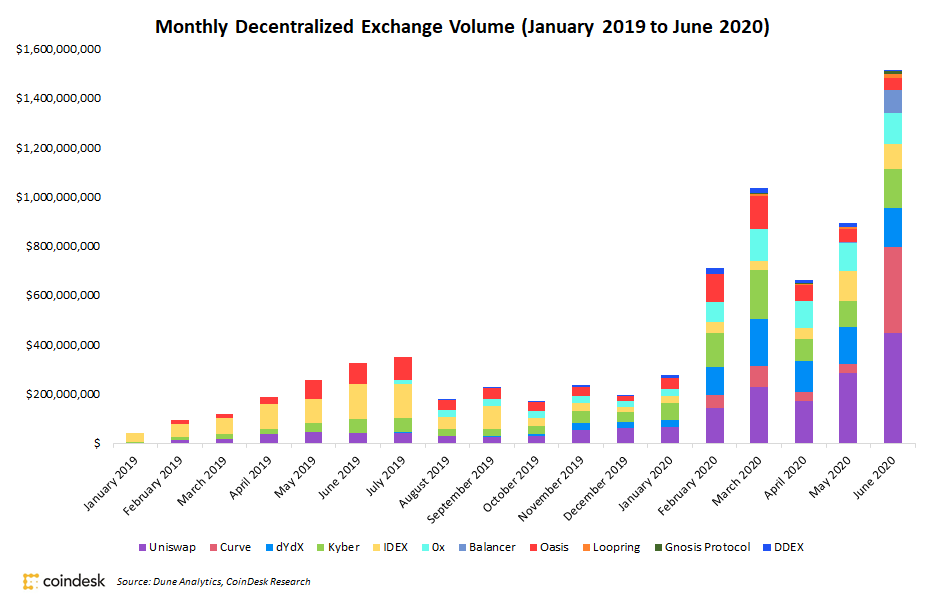

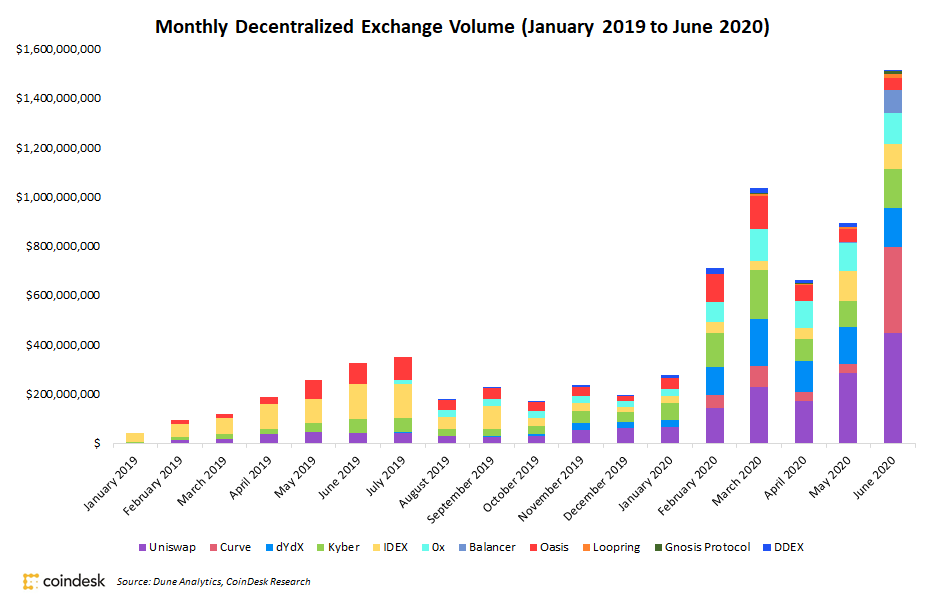

Decentralized Exchange Volumes Up 70% in June, Pass $1.5B

June trading volume on decentralized exchanges set a record high of $1.52 billion, up 70% from May, according to data from Dune Analytics. This double-digit percentage growth is simply “the continuation of a trend dating back to the end of [2019],” Jack Purdy, decentralized finance analyst at Messari, told CoinDesk.

Curve and Uniswap control the largest amount of traded volume, recording $350 million and $446 million, respectively, in June. Both protocols are automated market makers that can also function as decentralized exchanges. Balancer, a similar platform, recorded $93 million in traded volume, up 2,460% from $3.6 million in May.

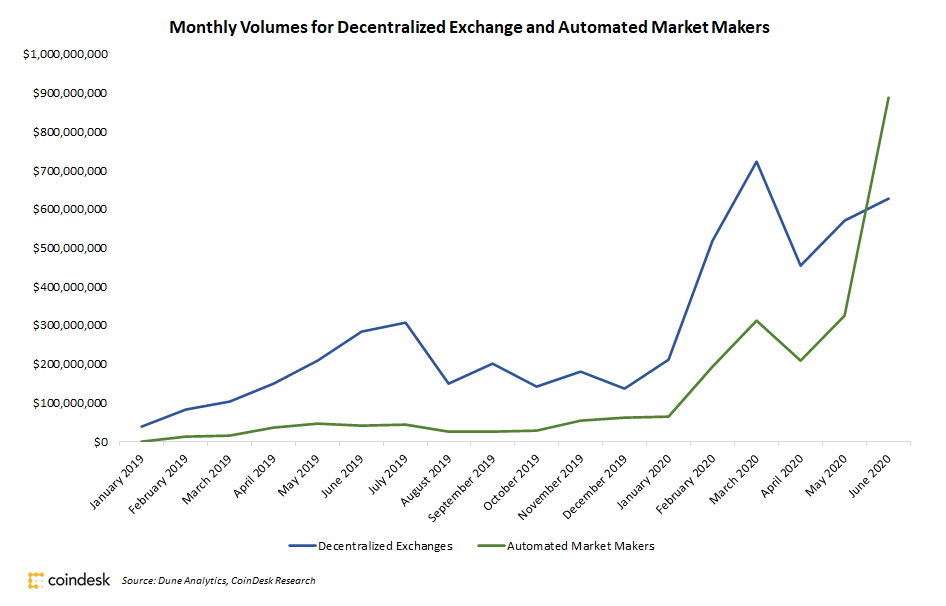

Significant growth can be partially attributed to the “proliferation of automated market makers,” according to Purdy. As a result, these markets offer greater liquidity for “the tail end of crypto assets” and even occasionally less order slippage than centralized exchanges, Purdy said.

In June, automated market makers grew by more than 170% while pure decentralized exchange platforms grew by only 10%.

Monthly aggregate volumes for decentralized exchanges and automated market makers

Too much growth too quickly could be cause for concern, however, as decentralized exchanges still need time for continued development and stress testing. Recent increases in trading volume are “starting to become a bit worrisome,” Purdy said, adding that an “unnatural rush to deposit assets” into these exchanges is fueled, in part, by the “liquidity mining phenomenon.”

Since January, aggregate decentralized exchange volumes, including automated market makers, have more than quadrupled from $276 million to $1.52 billion.

Even though popular decentralized finance protocols may be “highly audited and deemed safe,” plenty of potential attack vectors still exist, Purdy said. A decentralized liquidity provider, Balancer, lost $500,000 in a sophisticated attack Monday, for example.

The number and varieties of potential attacks only increase as decentralized finance protocols become more intertwined, Purdy said.

DISCLOSURE

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.