Ether Could Hit $10K, FundStrat Says, Touting Network Value Versus Bitcoin's

Ether (ETH), the second-largest cryptocurrency by market cap, could see further gains towards $10,000 this year after reaching a new all-time high around $2,780 on Thursday – a roughly threefold increase forecasted by FundStrat, a market research firm.

ETH is up about 40% for the month to date versus a 5% decline for bitcoin (BTC). “We’re maintaining our overweight ethereum vs. bitcoin recommendation from April 2020,” wrote FundStrat in a research note published on Thursday.

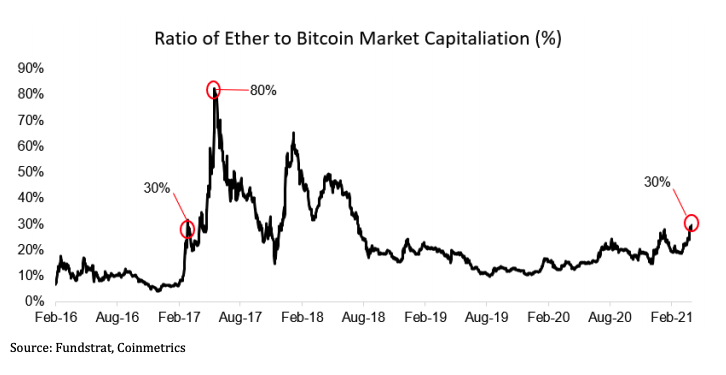

- “Ethereum’s market cap has risen to ~30% of bitcoin’s over recent weeks. During the last market cycle, ethereum broke this level and [had] as high as 80% of bitcoin’s value.”

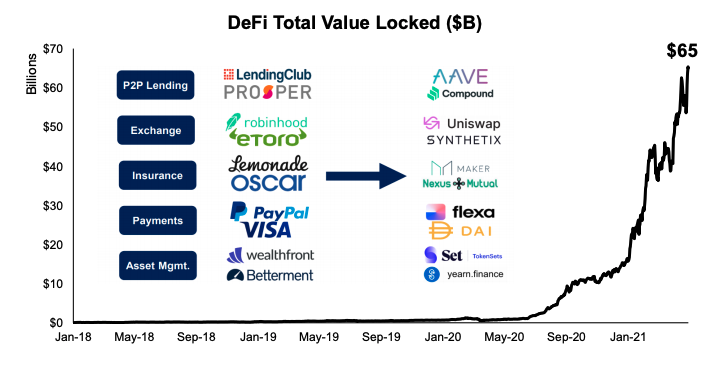

- “The crypto narrative is shifting from bitcoin to ethereum and other segments like DeFi (decentralized finance) and Web 3.0 apps.”

- FundStrat is bullish on ETH as new financial applications are being developed on the Ethereum network, which has grown significantly in scale over the last year.

- “These applications are generating ~3x fees for the Ethereum network vs. Bitcoin, which trades at ~3x the market cap.”

- “In crypto accounting terms, this is the same as a company using revenue, less operating costs and earning profit that is used to buy back stock. This means the network would become profitable like a company once ETH supply reduction from burned fees outpaces inflation,” wrote FundStrat.

- FundStrat also expects bitcoin to reach $100,000 this year and the total cryptocurrency market cap to reach $5 trillion.

Chart shows ether's market cap relative to bitcoin.

Chart shows total value locked in DeFi smart contracts and a general comparison to traditional FinTech firms.

DISCLOSURE

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.