Ethereum Transaction Fees Set a Record Once Again as DeFi Becomes Even Pricier

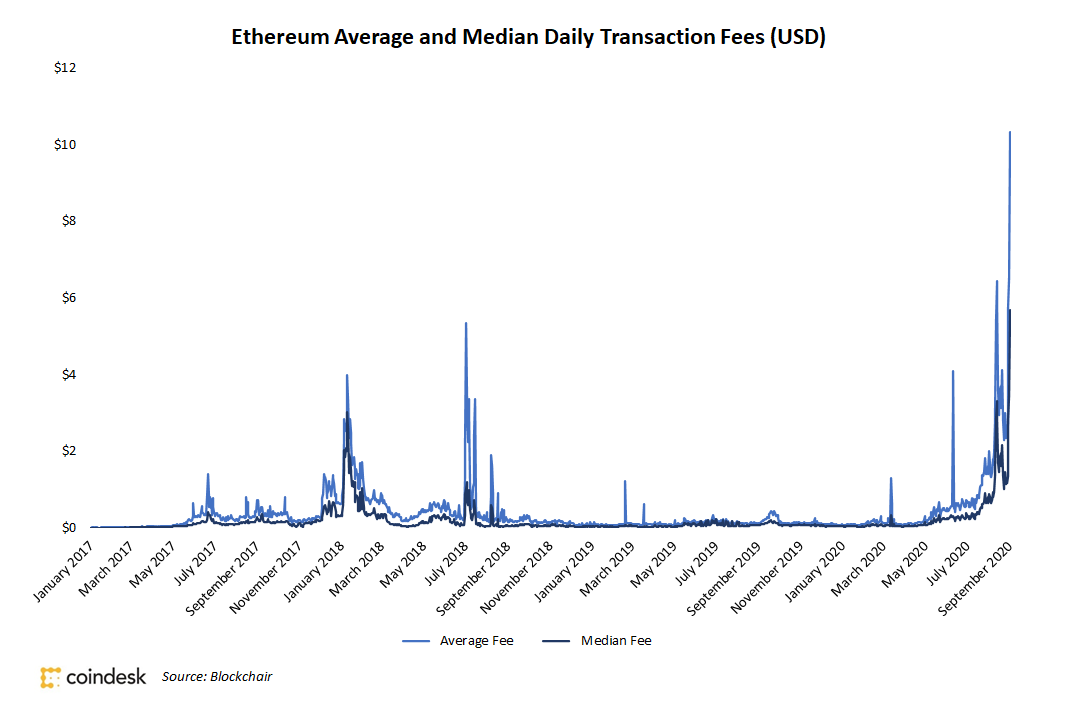

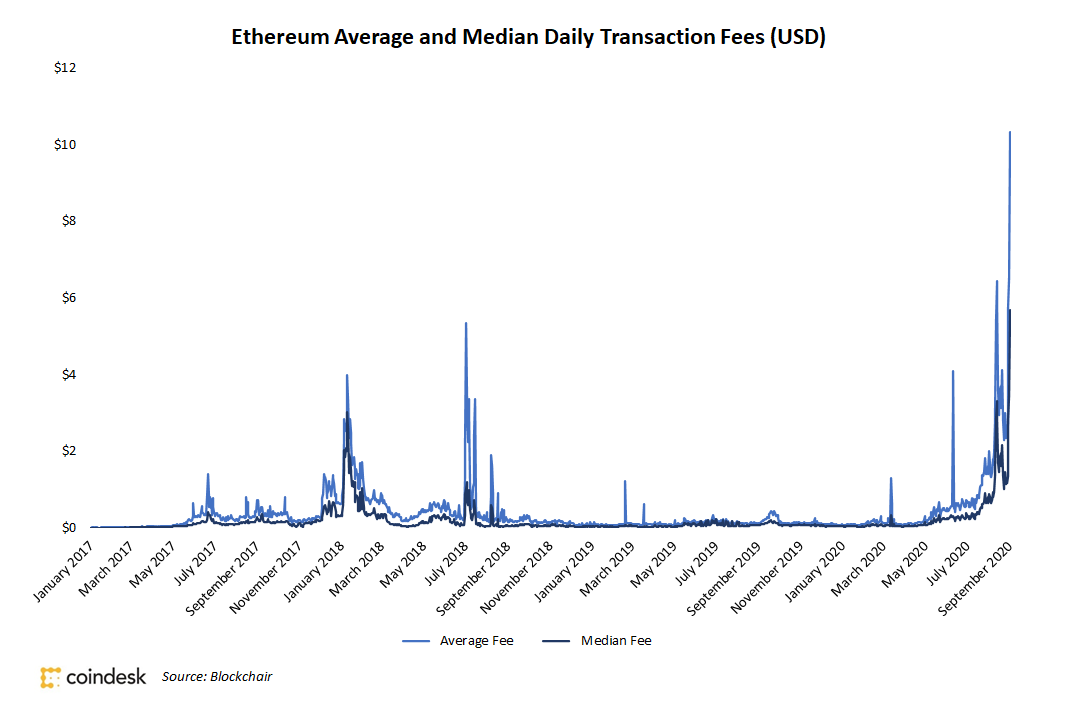

Ethereum transaction fees have soared to new all-time highs for the second time in three weeks, according to on-chain data analyzed by CoinDesk.

- As of Tuesday, average and median transaction fees have skyrocketed to record highs of $10.33 and $5.68, respectively.

- Average fees reached record highs of $6.04 on Aug. 13, as CoinDesk previously reported, while median fees stayed just below their all-time highs of $3.03.

Ethereum average and median network fees since 2017.

- Steep network fees are a “double-edged sword” for Ethereum, said Wilson Withiam, Ethereum analyst at Messari, in a private message with CoinDesk. “They can ward off potential users,” he noted. But rising fees also signify “an increase in network utilization and demand for block space.”

- As fees increase, entities responsible for large on-chain transaction volume are searching for techniques to reduce pressure on the network.

- For example, leading stablecoin tether (USDT), the second-largest consumer of Ethereum gas fees, will “investigate” the addition of an Ethereum-scaling technique called zk-rollups that allows transactions to be batched off-chain and reduce transaction pressure on the network.

- “The idea behind zk-rollups is aggregating multiple operations (transfers, smart contract calls, ...) into one single L1 transaction that ‘compress’ all the underlying transactions,” Tether CTO Paolo Ardoino said in an email to CoinDesk. “Zk-rollups are at the moment the most comprehensive L2 solution for the Ethereum scalability problem.”

- As transaction fees continue to increase, largely caused by the continued explosion of decentralized finance (DeFi), this is causing DeFi to “slowly become a game reserved for the wealthy,” Withiam said.

DISCLOSURE

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.