First Mover Asia: Bitcoin Below $40K Before Regaining Ground; Altcoins Fall

Good morning. Here’s what’s happening:

Market moves: Bitcoin fell below $40,000 briefly as U.S. stocks continued to drop thanks to a newly hawkish Federal Reserve.

Technician’s take: BTC buyers could respond to short-term oversold signals, although upside appears limited.

Catch the latest episodes of CoinDesk TV for insightful interviews with crypto industry leaders and analysis.

Prices

Bitcoin (BTC): $41,797 -0.2%

Ether (ETH): $3,077 -2.6%

Markets

S&P 500: $4,670 -0.1%

DJ

IA: $36,068 -0.4%

Nasdaq: $14,942 +0.05%

Gold: $1,801 +0.3%

Market moves

Bitcoin fell again on Monday during U.S. trading hours after a small recovery over the weekend. The bearish price move came after U.S. stock market losses deepened as investors brace for actions from a more hawkish Federal Reserve.

The most valued cryptocurrency fell below $40,000 briefly in early hours before it moved back above $41,000. At press time, bitcoin was changing hands at over $41,500, down about 1% in the past 24 hours, according to CoinDesk data.

Last week, prices of the oldest cryptocurrency fell for six straight days after Fed minutes revealed policymakers had discussed aggressive interest rate hikes alongside a faster pace to normalize its balance sheet.

“The tightening of financial conditions is expected to negatively impact risk assets such as equities and crypto as they become less attractive than safe-haven bonds,” crypto trading data firm Kaiko wrote in its weekly newsletter on Monday.

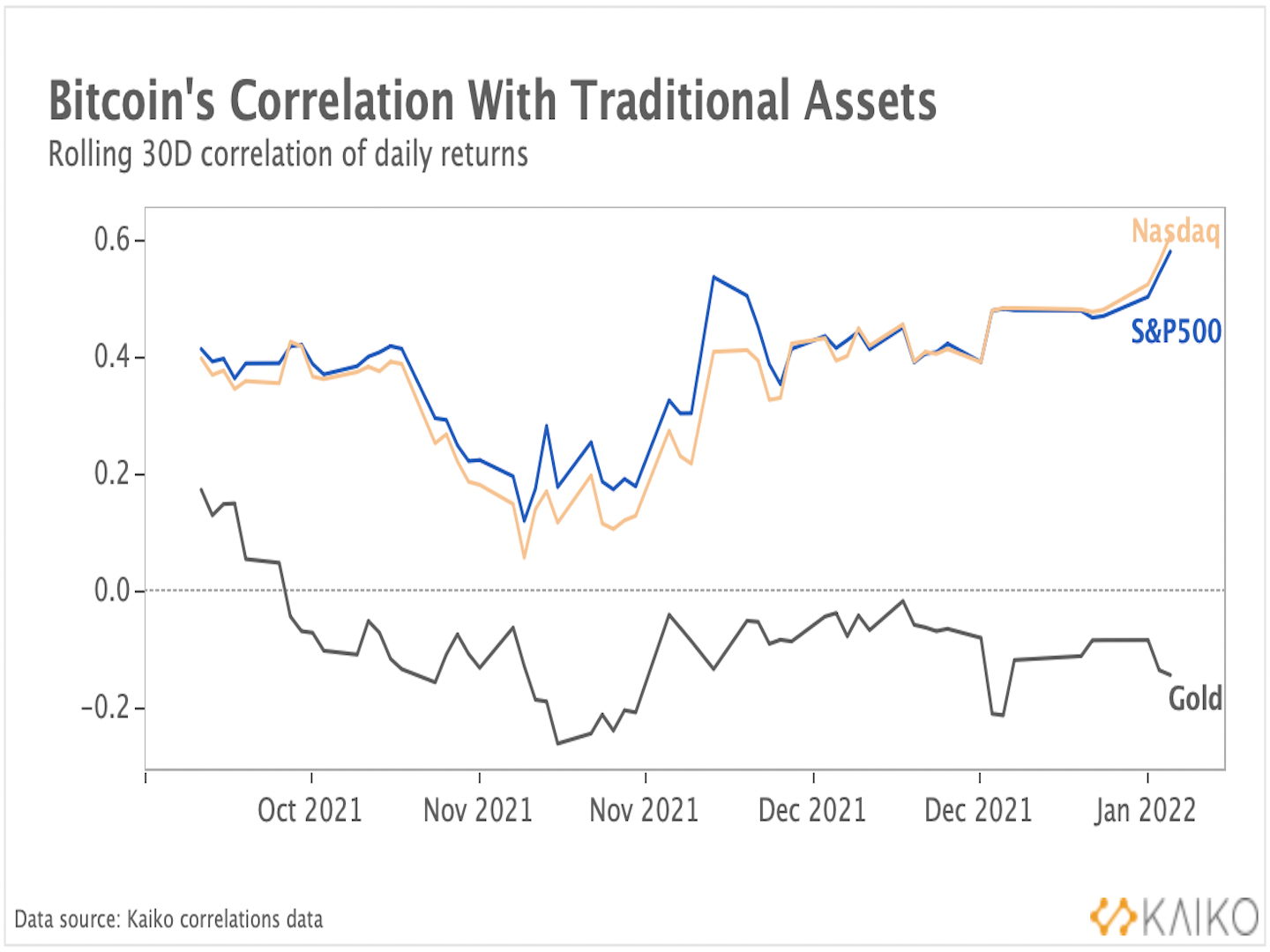

According to Kaiko, the impact of the Fed’s December meeting has sent the correlation between bitcoin and traditional assets to the highest in more than a year.

(Kaiko)

“The Federal Reserve’s December meeting had a strong impact on global financial markets, with traders reacting swiftly to the prospect of monetary tightening,” Kaiko wrote. “During the volatility, bitcoin behaved strongly like a risk asset.”

Following bitcoin, most of the major cryptocurrencies were also in the red on Monday. Ether, the second-biggest cryptocurrency by market capitalization, plummeted below $3,000 at one point before it returned above $3,000.

Technician’s take

Bitcoin four-hour price chart shows support/resistance with RSI on bottom (Damanick Dantes/CoinDesk, TradingView)

BTC was down about 2% over the past 24 hours, although the price action has been fairly muted over the past few days.

The relative strength index (RSI) on the four-hour chart is rising from oversold levels, which typically precedes a brief price bounce. On the daily chart, the RSI is the most oversold since Dec. 10.

Upside momentum has weakened given BTC’s two-month long downtrend. This means sellers could remain active around resistance levels.

Important events

8:30 a.m. HKT/SGT (12:30 a.m. UTC): Australia imports and exports (Nov. MoM)

8:30 a.m. HKT/SGT (12:30 a.m. UTC): Australia retail sales (Nov. MoM)

8:30 a.m. HKT/SGT (12:30 a.m. UTC): Australia trade balance (Nov. MoM)

1 p.m. HKT/SGT (5 a.m. UTC): Japan leading economic index (Nov. MoM)

11 p.m. HKT/SGT (3 p.m. UTC): U.S. Federal Reserve Chair Jerome Powell testifies before Congress

CoinDesk TV

In case you missed it, here are the most recent episodes of “First Mover” on CoinDesk TV:

“First Mover” hosts discussed the metaverse with The Sandbox Co-founder and Chief Operating Officer Sebastien Borget. In addition, DFINITY founder and Chief Scientist Dominic Williams shared insights behind the company’s internet computer opening an Ethereum bridge. Finally, TheoTrade co-founder Don Kaufman offered market analysis.

Latest headlines

Digital Asset Funds Hit by Record Weekly Outflows of $207M: Bitcoin-focused investment funds saw $107 million in outflows over the seven-day period.

Pakistan’s Investigation Agency Contacts Binance About $100M Scam: At least 11 allegedly fraudulent applications linked to Binance, and several thousand investors were hit.

Major Mining Pools’ Bitcoin Hashrate Nears Recovery as Kazakhstan’s Internet Is Partially Restored: The world’s second-biggest mining country has been engulfed in civil unrest over the past week.

Billionaire Investor Bill Miller Now Has 50% of His Personal Wealth in Bitcoin: The famed fund manager had invested heavily in bitcoin in his funds before.

Bitcoin’s Slump Is Good for Crypto Miners Long-Term, Jefferies Analyst Says: A lower bitcoin price will deter new entrants and help incumbents gain market share.

Longer reads

The Metaverse Needs a Constitution: If we want our virtual worlds to be free and open, they need rules. Or companies like Meta (Facebook) will make them for us.

Today’s crypto explainer: CME Ethereum Futures, Explained

Other voices: Crypto crazy: my attempt to become a bitcoin billionaire

Said and heard

“And if you do it right and for long enough, like Ethereum or Binance, you might become too deep-rooted to dispose of. In the current regulatory environment, it is the best chance for blockchain companies to succeed. We did it differently. We tried to do it “right.” And therefore, now, we have to close.” (Entrepreneur Zoe Adamovicz writing for CoinDesk on closing her most recent venture, Neufund)...

“There is a white-knuckle fear on the Street around tech stocks. Tech stocks have been on a bull run, and now Fed worries and the spiking 10-year yield are crashing the tech party with investors hitting the sell button and heading for the elevators in unison.” (Wedbush Securities Managing Director of Equity Research Dan Ives in the The New York Times)...

”In reality, DAOs are likely to suffer from some of the same principal-agent problems that exist in the traditional world. In theory, customers can buy stock in a company and participate in the benefits that come from making use of their data as well. They can also vote out the management team. In practice, this rarely happens.” (EY Global Blockchain Leader and CoinDesk columnist Paul Brody)

DISCLOSURE

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.