First Mover Asia: Cryptos Hold Their Ground but Investors Remain Wary of Russia Invasion Plans, Inflation

Good morning. Here’s what’s happening:

Market moves: Major altcoins largely gained ground; bitcoin dipped and then recovered later in the U.S trading day.

Technician's take: Indicators are neutral as BTC maintains gains; resistance at $46K.

Catch the latest episodes of CoinDesk TV for insightful interviews with crypto industry leaders and analysis.

Prices

Bitcoin (BTC): $44,191 -0.4%

Ether (ETH): $3,154 0.4%

Top Gainers

Top Losers

| Asset | Ticker | Returns | Sector |

|---|---|---|---|

| Ethereum Classic | ETC | −2.2% | Smart Contract Platform |

| Litecoin | LTC | −1.4% | Currency |

| Cardano | ADA | −1.0% | Smart Contract Platform |

Markets

S&P 500: 4,475 +.09

DJ

IA: 44,934 -0.1%

Nasdaq: 14,124 -0.1%

Gold: $1,869 +0.8%

Market moves

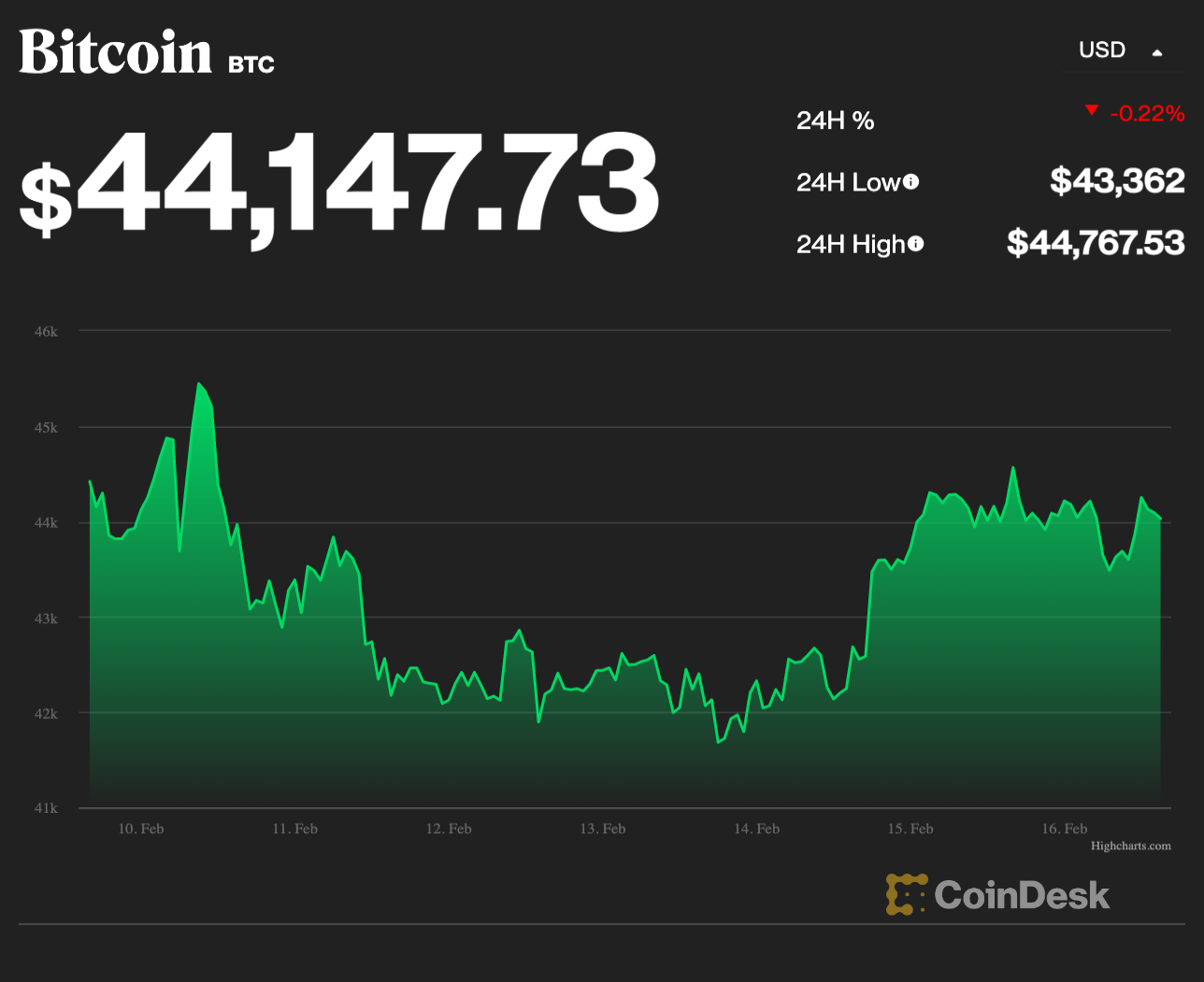

Bitcoin dipped during the first half of Tuesday but regained most of its lost ground later in the day to reestablish its foothold above $44,000, about where it stood a day ago. A number of major altcoins rose over the same period, although ether dropped slightly.

The crypto markets' tenacity suggest there will not be another January-like dip soon.

"Bitcoin continues to look very healthy after weathering the geopolitical storm well before benefiting from the improvement in risk appetite on Tuesday," wrote Craig Erlam, senior market analyst, U.K. & EMEA for Oanda.

At the time of publication, bitcoin, the largest cryptocurrency by market capitalization, was trading at $44,147, down slightly. Ether, the second-largest cryptocurrency by market capitalization, was trading at $3,149 and was also down slight over the past 24 hours.

Still, investors continued to look warily at Russia's next military moves along the Ukraine border and at the latest inflationary news. The U.S. Federal Reserve is continuing to track rising inflation, according to minutes from its January meeting, and is widely expected to raise interest rates several times this year. The trickle-down from rising prices is likely to affect consumer spending in the months ahead.

The tech-heavy Nasdaq and Dow Jones Industrial Average were roughly flat for the trading day, while the S&P 500 rose slightly.

"Risk appetite remains important, especially that linked to inflation and interest rates, which could continue to be a drag if anxiety remains in the broader markets," Erlam wrote.

Technician's take

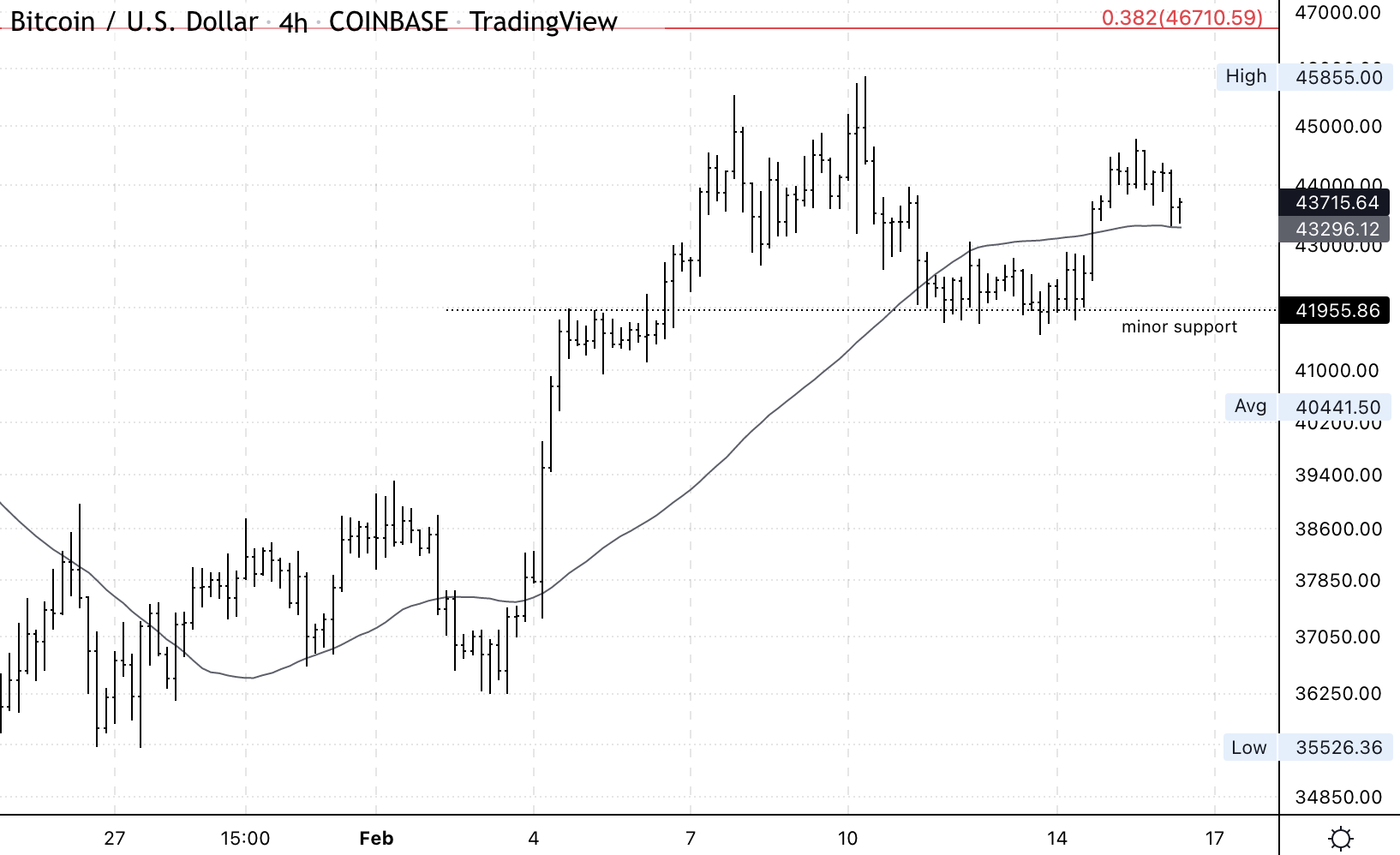

Bitcoin Rangebound; Initial Support at $40K, Resistance at $46K

Bitcoin four-hour chart shows support/resistance levels (Damanick Dantes/CoinDesk, TradingView)

Bitcoin (BTC) was trading in a tight range between $43,000 and $44,000 over the past 24 hours. Support is nearby, which could limit pullbacks over the short term.

Buyers will need to maintain a price floor above $40,000 to sustain the uptrend from $36,000 that occurred on Feb. 3. Intraday charts appear overbought, however, which could stall the upside, similar to what occurred last week.

For now, the 50-day moving average on the four-hour chart has flattened, indicating a pause in upside momentum. Resistance remains at $46,000, and if buyers fail to maintain current levels, a dip toward $35,000 seems likely.

Important events

8:30 a.m. HKT/SGT (12:30 a.m. UTC): Australia part-time/full-time employment (Jan.)

3 p.m. HKT/SGT (7 a.m. UTC): Speech by European Central Bank's executive board member Isabel Schnabel

3 p.m. HKT/SGT (7 a.m. UTC): Swiss imports/exports (Jan. MoM)

5 p.m. HKT/SGT (9 a.m. UTC): Economic bulletin

9:30 p.m. HKT/SGT (1:30 a.m. UTC): U.S. housing starts (Jan.)

CoinDesk TV

In case you missed it, here is the most recent episode of "First Mover" on CoinDesk TV:

Could Ukraine Be the Crypto Capital of the World? Colorado to Accept Tax Payments in Crypto by End of Summer

"First Mover" hosts spoke with Alex Bornyakov, Ukraine Ministry of Digital Transformation deputy minister and head of Diia City Project, as geopolitical tensions weigh on global markets. Colorado Gov. Jared Polis (D) took the hosts behind the scenes at 2022 ETHDenver and shared the state's plan to accept tax payments in crypto by end of the summer. Plus, Lennix Lai of OKX offered crypto market analysis.

Headlines

Canada Sanctions 34 Crypto Wallets Tied to Trucker 'Freedom Convoy': Bitcoin, Ethereum, Litecoin, Monero and Cardano addresses are all on the list.

Twitter Adds Ethereum Wallet Support to Tipping Feature: The social media giant added the ability to send bitcoin tips in September but Ethereum addresses are new.

Nic Carter’s Castle Island Ventures Raises $250M for Third Crypto Fund: The early-stage firm is targeting monetary networks, financial services and internet infrastructure with its latest fund.

Gold-Backed Tokens Grow Despite Mixed Reviews From Analysts: With high inflation and geopolitical turmoil in the headlines, these tokens appear to be benefiting from the current investment climate.

Berkshire Hathaway Invests $1B in Brazilian Digital Bank Nubank, Reduces Mastercard, Visa Positions: The share purchase was made in the last quarter of 2021, according to an SEC filing.

Longer reads

ETHDenver Agenda: 3 Big Themes in 2022: What you need to know about Ethereum’s big event this winter.

Today's crypto explainer: How to Pick the Right Play-to-Earn Game for You

Other voices: Some lawmakers and their families are betting thousands of dollars on crypto (CNBC)

Said and heard

"The Bitcoin network does what it’s supposed to do – this much is made clear by the recent fundraising effort to support a convoy of truckers in Canada, who are protesting coronavirus-related restrictions. Whatever Satoshi’s concerns were for the nascent monetary network at the time, they are now certainly resolved." (CoinDesk columnist Daniel Kuhn) ... "An invasion remains distinctly possible." (U.S. President Joe Biden) ... "The need for the about-face is partly of the Fed’s own making. Mr. Powell responded to the [coronavirus] pandemic by doubling down on strategies developed by his predecessors to combat prolonged high unemployment and very low inflation. When the labor market healed rapidly and high inflation emerged as the bigger threat, he and his colleagues were caught by surprise." (The Wall Street Journal) ...“Unfortunately there’s a difference between what Russia says and what it does. And what we’re seeing is no meaningful pullback. On the contrary, we continue to see forces — especially forces that would be in the vanguard of any renewed aggression against Ukraine — continuing to be at the border, to mass at the border.” (U.S. Secretary of State Antony Blinken)

DISCLOSURE

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.