Grayscale 'Unlockings' Poses Downside Risk to Bitcoin Price, JPMorgan Says

"Despite some improvement, our signals remain overall bearish," JPMorgan strategists led by Nikolaos Panigirtzoglou wrote in a note Wednesday. "Selling of GBTC shares exiting the six-month lockup period during June and July has emerged as an additional headwind for bitcoin."

Grayscale Bitcoin Trust, the world's largest digital-assets fund manager, allows institutional investors to gain exposure to bitcoin through shares in the trust, which currently holds 654,600 BTC. That's more than 3% of the cryptocurrency's supply. Grayscale is a unit of Digital Currency Group, which also owns CoinDesk.

Accredited investors can buy GBTC shares directly at the net asset value (NAV) in daily private placements by depositing bitcoin or U.S. dollars. The shares can be sold in the secondary market only after a six-month lock-in period.

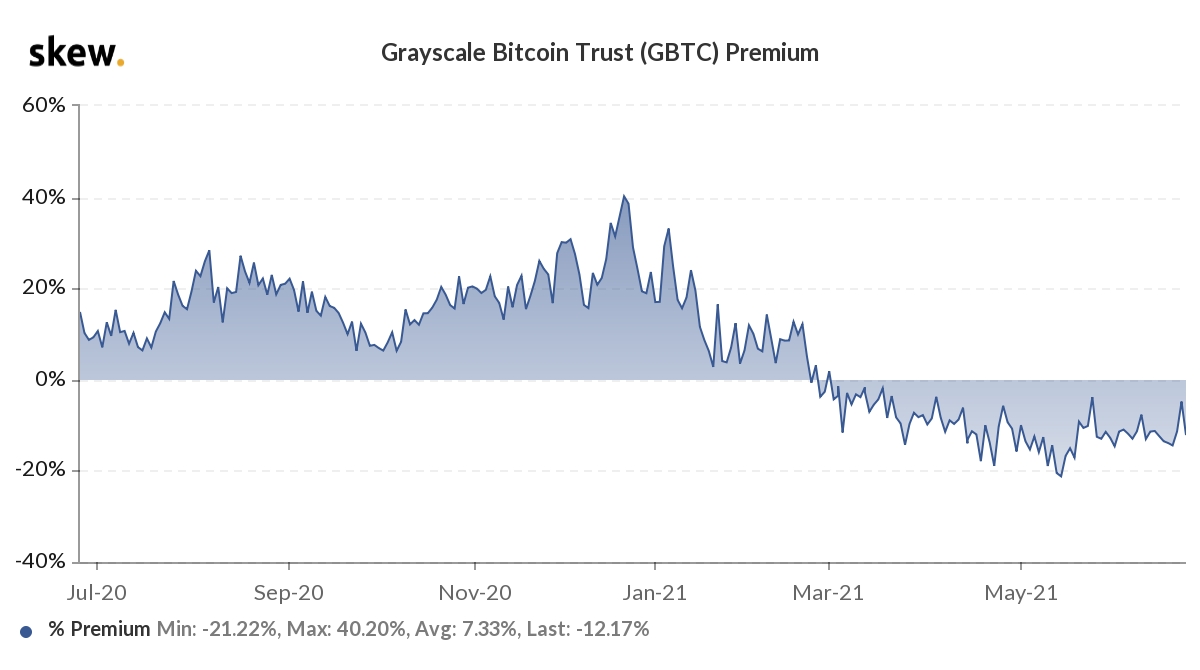

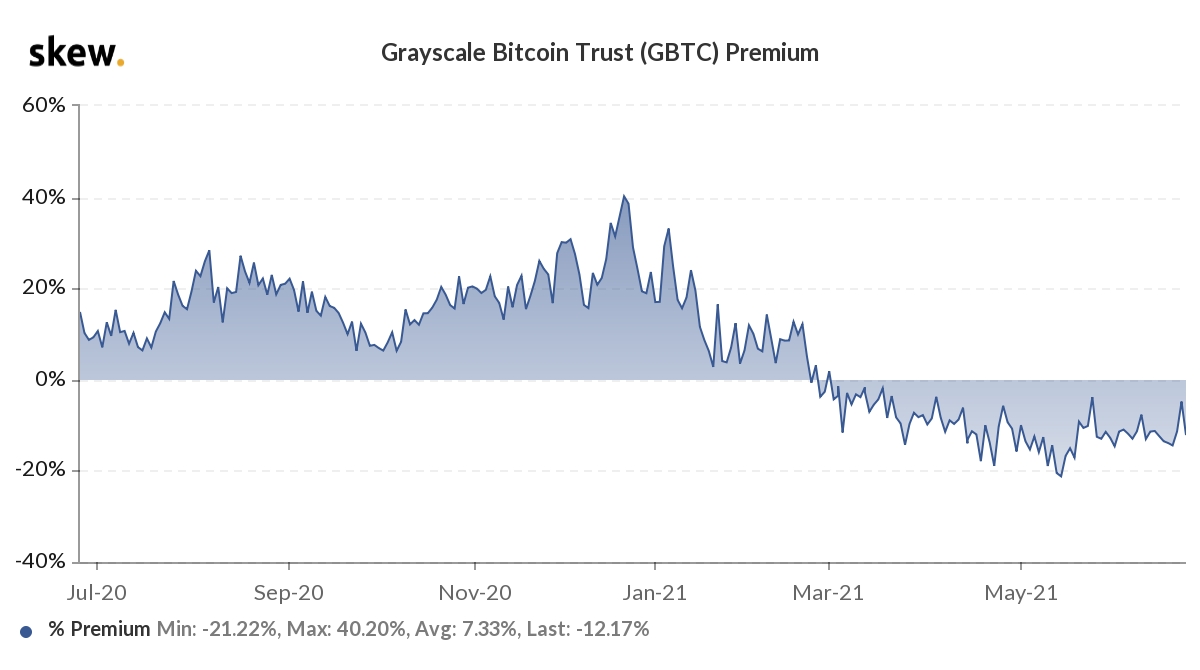

The trust's popularity exploded at the end of the last year when the premium on GBTC shares rose to a record-high 40% on Dec. 17. As such, investors rushed to carry trade or buy shares at NAV in a bid to sell them at a premium six months later. According to JPMorgan, the trust saw record inflows of $2 billion in December, followed by $1.7 billion in January.

The January tranche is scheduled for unlocking next month and is likely to release 140,000 bitcoin worth of shares, CoinShares' chief strategy officer, Meltem Demirors, pointed out on Twitter.

After unlocking, investors have the option of liquidating their shareholdings in the secondary market. Analysts at JPMorgan foresee investors selling at least some of their shares, leading to "downward pressure on GBTC prices and on bitcoin markets more generally."

What's not clear is whether investors will reinvest proceeds back into Grayscale by rebuying bitcoin and transferring it over to the trust. If that happens, bitcoin will likely pick up a strong bid.

Until February, the shares consistently traded at a premium. That kept overall demand strong, with investors rotating money back into the trust after unlockings. "Most of the capital was likely from investors doing a "rinse-in repeat," Ben Lilly, a crypto economist at Jarvis Labs, noted in a SubStack post dated April 22.

Now, however, the incentive to reinvest is relatively low. The so-called Grayscale carry trade has lost its shine ever since GBTC began trading at a discount in February. As of Wednesday, the shares traded at a discount of 12.17% to the net asset value, according to data source Skew.

Nevertheless, some analysts say the discount offers retail investors an opportunity to buy bitcoin on the cheap. "Investors looking for long-term passive bitcoin exposure are probably better off buying GBTC over spot bitcoin since you get paid to wait more via the discount than you pay in excess fees,” David Grider, a strategist at investment research firm FundStrat, wrote in an email in May.

Bitcoin is currently trading near $33,200, representing a 1.2% drop on the day. Prices dipped below $29,000 earlier this week only to make a quick recovery back to the multi-week trading range of $30,000 to $40,000.

DISCLOSURE

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.