How One Fund Used the Carry Trade to Beat Bitcoin

While the crypto market picture has turned decidedly bleak in the second quarter, a $130 million crypto hedge fund headed by a Wall Street veteran claims it has continued to fare well, thanks to price discrepancies in the spot and derivatives markets.

"Our quant fund is now up 78%, having begun the second quarter at 62%," LedgerPrime's chief investment officer, Shilliang Tang, told CoinDesk in a Telegram chat. "Cash and carry strategies have worked well during this quarter's sell-off."

This is in contrast to bitcoin, which lost most of its triple-digit year-to-date gains as it dropped to lows below $30,000 on June 22.

How the carry trade works

Carry trading, or cash and carry arbitrage, is a market-neutral strategy that exploits inefficiencies in the spot and the futures market. It combines a long position in the spot market and a short position in futures when the market is in contango – a condition where the future prices of an underlying asset are higher than the current spot price. As expiration nears, the premium evaporates; on the day of the settlement the futures price converges with the spot market price, generating relatively riskless returns.

Carry traders make money irrespective of the market trend, although the return depends on how steep is the contango. Bitcoin futures usually offer a substantially higher carry yield than their fiat currency counterparts, most of which yield less than 5%, according to a JPMorgan report published on April 7.

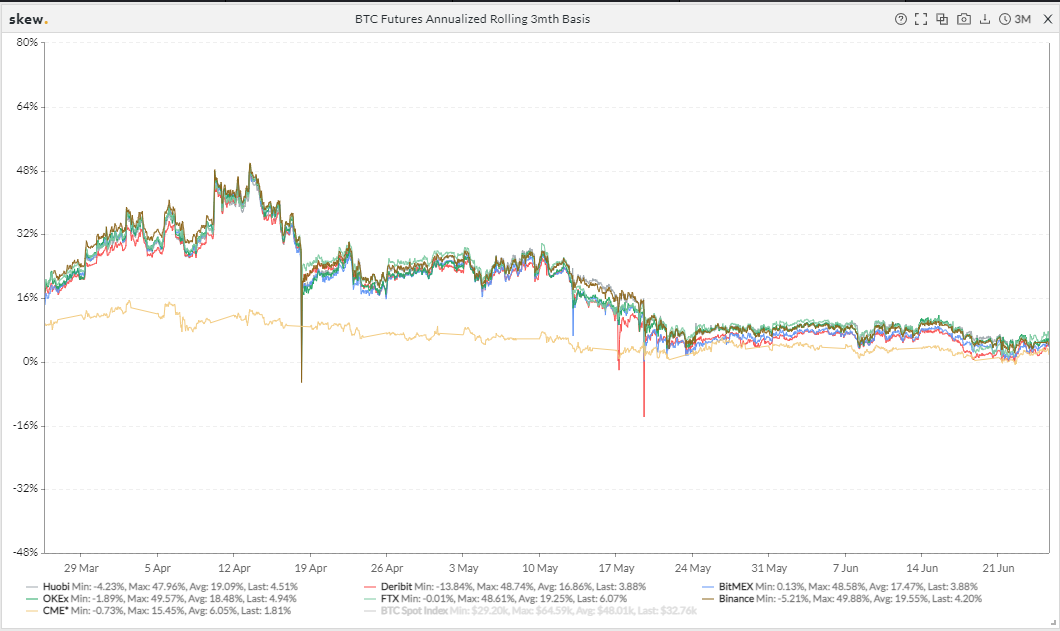

The situation was more pronounced during the height of the bull run in mid-April when bitcoin hit a record high above $64,800, lifting the premium on June futures to 25% on the Chicago Mercantile Exchange (CME). The quarterly futures traded a much higher premium of around 40% on other non-regulated exchanges such as Binance or Huobi, per data source Skew.

So, traders could have locked in an annualized profit of 40% in mid-April by buying bitcoin in the spot market and selling the quarterly futures contract, which expired Friday.

Several trading firms employed carry strategies back then, as reported by CoinDesk, and may have squared off positions early after the mid-May crash. That, in turn, may have been the catalyst which pushed down June futures premium to less than 10% on significant exchanges.

Bitcoin futures premium

Carry trades are closed by selling the bitcoin holding and buying back the short futures position or allowing it to expire.

Often traders borrow stablecoins such as tether (USDT) to finance the long leg of the strategy. That tends to have a bearing on the net yield generated by the carry trade.

In the second half of April, the annualized cost of borrowing tether on the decentralized finance protocol Compound was around 8%. Assuming traders borrowed USDT to purchase bitcoin in the spot market, holding the carry strategy until the June 25 expiry would have generated a net yield of about 32% in annualized terms (return of 40% from cash and carry minus tether's borrowing cost of 8%).

Going long convexity

"You can buy the spot with borrowed funds or just buy it outright, but short futures in both cases," said LedgerPrime’s Tang, a former volatility trader at Bank of America and UBS.

While cash and carry arbitrage was Tang's favored strategy in the second quarter, the fund focused on trading relatively cheap out-of-the-money (OTM) options during the first quarter.

"Long convexity trades worked the best during the first quarter bull run," Tang said.

In finance, convexity refers to non-linearity, meaning that if the price of the underlying asset changes, the resulting change in the cost of the derivative is non-linear. In other words, instead of a linear relationship between the long position and its return, the trader receives a multiple of the linear return.

For example, assume a certain stock is currently trading at $100, and a trader owns a $120 call expiring in September. The option will start gaining value as the market moves higher. However, often with a big move, the overall demand for options picks up, boosting volatility. That, in turn, adds to options value, resulting in outsized gains.

"Those tail [call] options were cheap, in our opinion, when bitcoin first broke through $20,000," said Tang. In plain English, the fund took long positions in call options at strikes well above $20,000 after bitcoin established a foothold above that level at the turn of the year.

Bitcoin rallied by over 100% to $58,000 in the first quarter and peaked above $64,000 on April 14. On that day, the U.S.-based crypto exchange Coinbase debuted on Nasdaq.

While LedgerPrime switched the strategy in the second quarter, some traders continued to pile into cheap call options at $80,000 in hopes for a continued bull run. Those options are now well out-of-the-money.

Overall, the derivative market has cooled in the wake of the price crash, as excess bullish leverage has exited the market. Further, carry trades are no longer attractive.

Instead, some may look to take on another bet: selling options, which can be quite risky as the maximum return is limited to the extent of premium paid, while losses can be significant.

"The carry trade has no premium anymore," Tang noted. "Option implied volatilities are still high, so there’s still yield to be harvested there by selling calls and puts, or strangles, if we think the market is going to consolidate around these levels."

DISCLOSURE

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.