Investors Cashing Out of Grayscale Bitcoin Trust Might Bring Market Boost

The bitcoin market could get a boost this month from the expiration of investor restrictions on the sale of shares in the Grayscale Bitcoin Trust (GBTC), the world's largest cryptocurrency fund.

Some digital-asset analysts and investors say it's possible some of these investors might need to enter the market to buy bitcoin – to repay cryptocurrency loans they used to finance their original purchases of the GBTC shares.

"Lots of bearish chatter around GBTC unlocks whilst conveniently ignoring that in-kind subscriptions funded by debt will ultimately translate into spot buying," crypto services provider Amber Group tweeted.

The view contrasts with a forecast published last month by analysts at JPMorgan, the largest U.S. bank, who argued the end of the lockup period would weigh on the GBTC shares and bitcoin.

“Selling of GBTC shares exiting the six-month lockup period during June and July has emerged as an additional headwind for bitcoin,” the JPMorgan strategists, led by Nikolaos Panigirtzoglou, wrote on June 24. The dynamic would lead to “downward pressure on GBTC prices and on bitcoin markets more generally.”

But with the pace of unlockings now poised to increase, crypto-native analysts are pushing back against the narrative. While the selling of GBTC shares could lead to a deeper discount and drive away fresh capital, its negative impact is likely to be mitigated by the repurchases of bitcoin in the spot market. (Grayscale is a unit of Digital Currency Group, of which CoinDesk is an independent subsidiary.)

"The biggest unlocks are happening over the next two months, which could lead to heavy selling of GBTC on the open market," Jeff Dorman, chief investment officer at the cryptocurrency-focused asset manager Arca, wrote this week in a newsletter.

"As funds unwind this trade," he wrote, "it could actually put BUY pressure on bitcoin, not sell pressure, as those who sell GBTC will have to buy back bitcoin to cover the short leg of the trade."

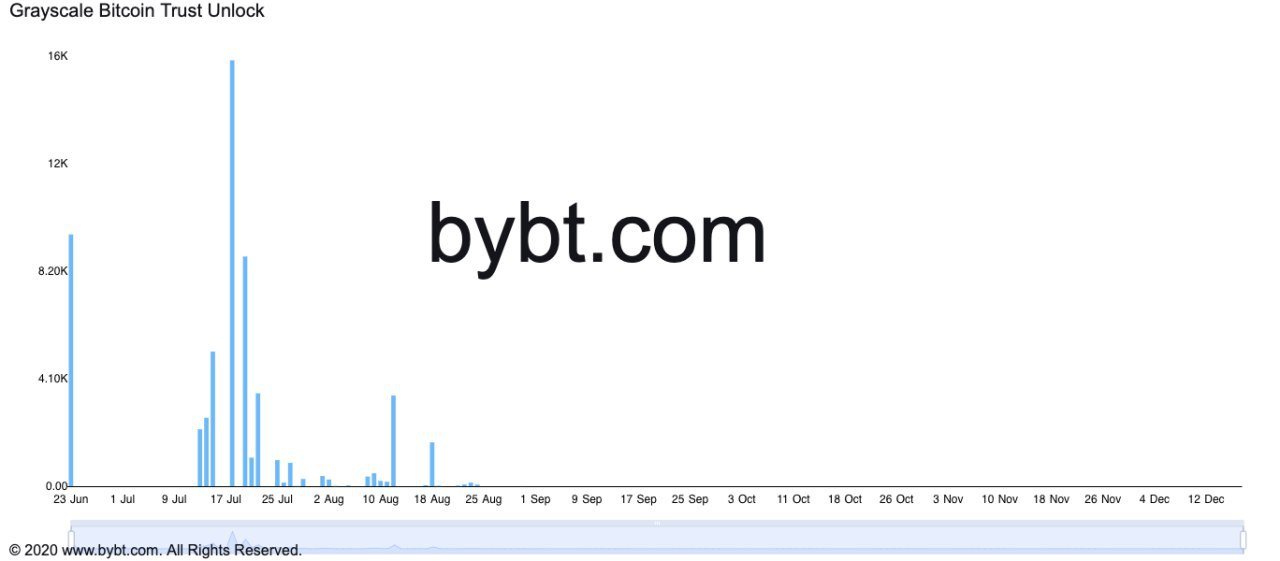

Grayscale Bitcoin Trust unlock

The unwind could be a significant event partly because the trade itself has been so popular in recent years and into early 2021. According to JPMorgan, the trust saw record inflows of $2 billion in December, followed by $1.7 billion in January.

Here's how it worked: Accredited investors (mostly institutions and wealthy traders) could subscribe to GBTC shares directly at the fund's net asset value (NAV), which is linked closely to the spot price of bitcoin. They did so in daily private placements by depositing owned or borrowed bitcoin or U.S. dollars. After a six-month lockup, those shares could be sold in the secondary market – including to retail investors.

For a long time, and due to a variety of reasons, the GBTC shares traded at a premium of 40% or more to the spot bitcoin price. So for the big investors, it looked like a surefire way to profit – especially with market sentiment quite bullish. There was little fear of the premium falling sharply or flipping to a discount, reducing the net yield on the carry trade.

But the bitcoin market has soured in recent months and in February the GBTC premium flipped to a discount, leaving scant motivation for new investors to attempt the once-popular trade. As of Thursday, GBTC shares traded at a discount of 10.5%, per data provided by Skew.

But it's now been almost six months since the trade stopped being popular, so the unlocks are coming into play.

Investors who entered the trade by locking in borrowed coins might now need to repurchase those to repay the loan. Similarly, those who deposit their bitcoin holdings need to buy back coins to return to their base portfolio.

So assuming supply-side factors remain constant, the repurchases associated with Grayscale unlockings could end up putting upward pressure on bitcoin prices.

The January tranche of GBTC share unlocks is scheduled for this month and is likely to release nearly 40,000 GBTC shares, according to data source bybt.com.

The biggest single-day unlock is slated to happen on July 18, with the release of shares worth 16,000 BTC. Upon unlockings, carry traders could snap up bitcoin from the spot market to repay loans or return to the original portfolio position, lifting bitcoin higher.

The cryptocurrency is currently trading near $33,000, down 4.5% for the week.

DISCLOSURE

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.