Lido Dominates Booming Market for Ethereum 2.0 Staking Derivatives

One of the hottest new ways to invest in ethereum is to lock money into a future, upgraded version of the Ethereum blockchain that’s already running in parallel, known as the Beacon Chain. The process is called “staking.” Investors put ether (ETH) into the Beacon Chain and can reap annualized yields in excess of 5%.

While that’s significantly higher than returns offered by most traditional bank accounts and U.S. Treasury bonds, the problem is that in some cases investors may not be able to “unstake” their tokens – get them back – for a year or more. For instance, the Beacon Chain won’t allow withdrawals until after Ethereum’s transition to a proof-of-stake blockchain from the more energy-intensive proof-of-work is complete.

To address the issue, cryptocurrency entrepreneurs have created a new market known as “Ethereum 2.0 staking derivatives,” essentially special derivative tokens representing staked ETH. These tokens can be used in decentralized finance (DeFi) applications as collateral to earn additional yield. The whole point is to provide ether stakers with liquidity even while their tokens are tied up in the Beacon Chain, waiting for the upgrade that’s expected to go live next year. Have your cake and eat it too, as it were.

And one decentralized autonomous organization (DAO), in particular, Lido, has leaped to a dominant 80% market share in this fast-growing realm. Recently, the number of ether – the native token of Ethereum’s blockchain – staked via Lido crossed the 1 million milestone (worth $3.7 billion), marking a 45-fold year-to-date increase and accounting for 15% of all ETH staked on Ethereum’s Beacon Chain, according to Dune Analytics.

“With the progress being made toward Eth 2.0, there has been increased interest in staking ETH, and Lido is one of the best decentralized venues to do this through,” Jeff Dorman, chief investment officer at Arca Funds, told CoinDesk in a Telegram chat.

“Eth 2.0” is shorthand for Ethereum 2.0, which refers to Ethereum’s ongoing transition from a proof-of-work blockchain (similar to Bitcoin’s) to proof-of-stake, which is supposed to be faster and far less energy-intensive. Ethereum staking began last December with the launch of the Beacon Chain, though the proof-of-work version still serves as the primary network until the upgrade takes effect.

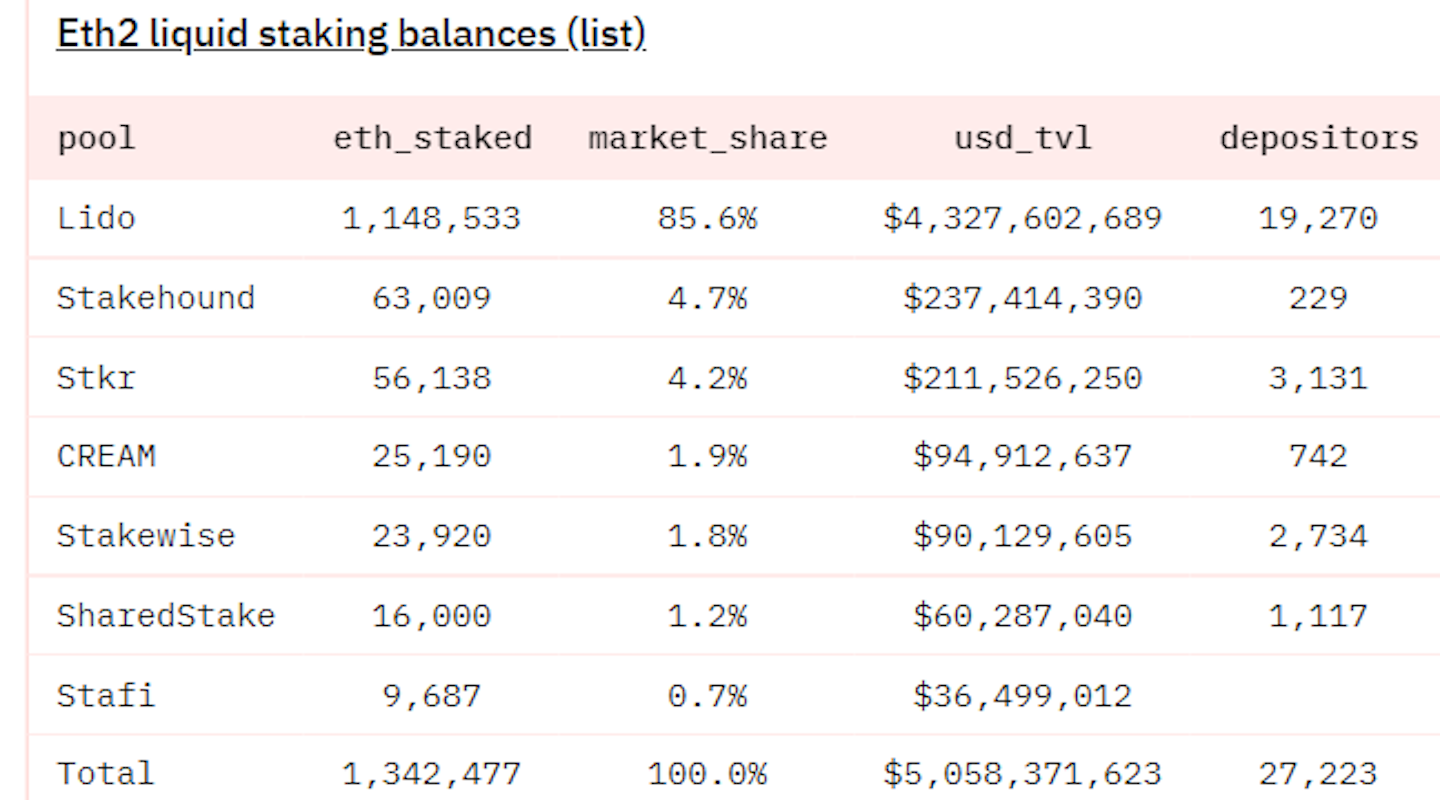

Lido dominates balances in the fast-growing market for Ethereum 2.0 liquid staking. (Dune Analytics)

Most staking pools, except SharedStake and Stakewise, have been growing, but Lido dominates the sector, according to Delphi Digital. Spartan Capital’s general partner and head of research, Jason Choi, said the protocol has received more than half of the recent new inflow.

Proof-of-stake consensus mechanisms secure blockchains by selecting transaction validators depending on the number of coins they hold. An entity needs to hold at least 32 ETH, worth about $120,960 at ether’s current price of $3,780, to become a validator on the Beacon Chain. (Ethereum’s transition from proof-of-work to proof-of-stake mechanism is expected to happen early next year.)

Like Lido, centralized exchanges such as Kraken and Binance also pool user funds, allowing investors holding fewer than 32 ETH to contribute to Eth 2.0 and earn rewards. Those exchanges account for a significant portion of the coins held in the deposit contract of Ethereum 2.0 Beacon Chain, according to a report from blockchain analytics firm Nansen emailed to CoinDesk on Aug. 17. The deposit contract currently holds more than 7 million coins, according to blockchain analytics firm Glassnode.

However, Kraken and Binance are losing share to decentralized staking protocols like Lido, according to Nansen.

Why Lido?

While centralized staking facilitates quick access and high liquidity, it comes with the risk of severe “slashing penalties” and reduced overall rewards. An Ethereum validator who engages in malicious behavior receives a slashing penalty and loses a significant amount of ether staked. Violators can also be forcibly removed from the network.

That risk is mitigated with Lido, which has several validators. “Nine active node operators [validators] are currently staking ETH on behalf of Lido, and five more have been on-boarded just recently,” the protocol’s tech lead, Vasiliy Shapovalov, told CoinDesk last week. So, even if one validator is identified as malicious, the resulting loss due to the slashing penalty is far less than what would be with a centralized exchange.

The protocol provides users liquidity on the underlying ether via a “staking derivative” token called stETH. When users deposit 1 ETH into the Lido protocol, they get 1 stETH in return.

“The rewards for stETH are accrued automatically. Each day your balance of stETH increases in your wallet,” Lido Finance said.

As Ben Giove, a contributor at crypto newsletter Bankless, noted, Lido users can earn staking yields, maintain their network share through the derivative token and use the same as collateral in other DeFi protocols.

Kraken offers a staking derivative. However, according to Lido DAO member Konstantin Lomashuk, it cannot be used outside of the exchange. Many of these centralized staking services require users to lock up their tokens. “Keep in mind that staked ETH cannot be unstaked,” Kraken warned in January on its website.

With Lido, technical risks associated with becoming a validator are transferred to industry experts. “Lido is non-custodial, but validation is handled by some of the best professional services, which gives even large funds confidence in entrusting their services,” Spartan Capital’s Choi said.

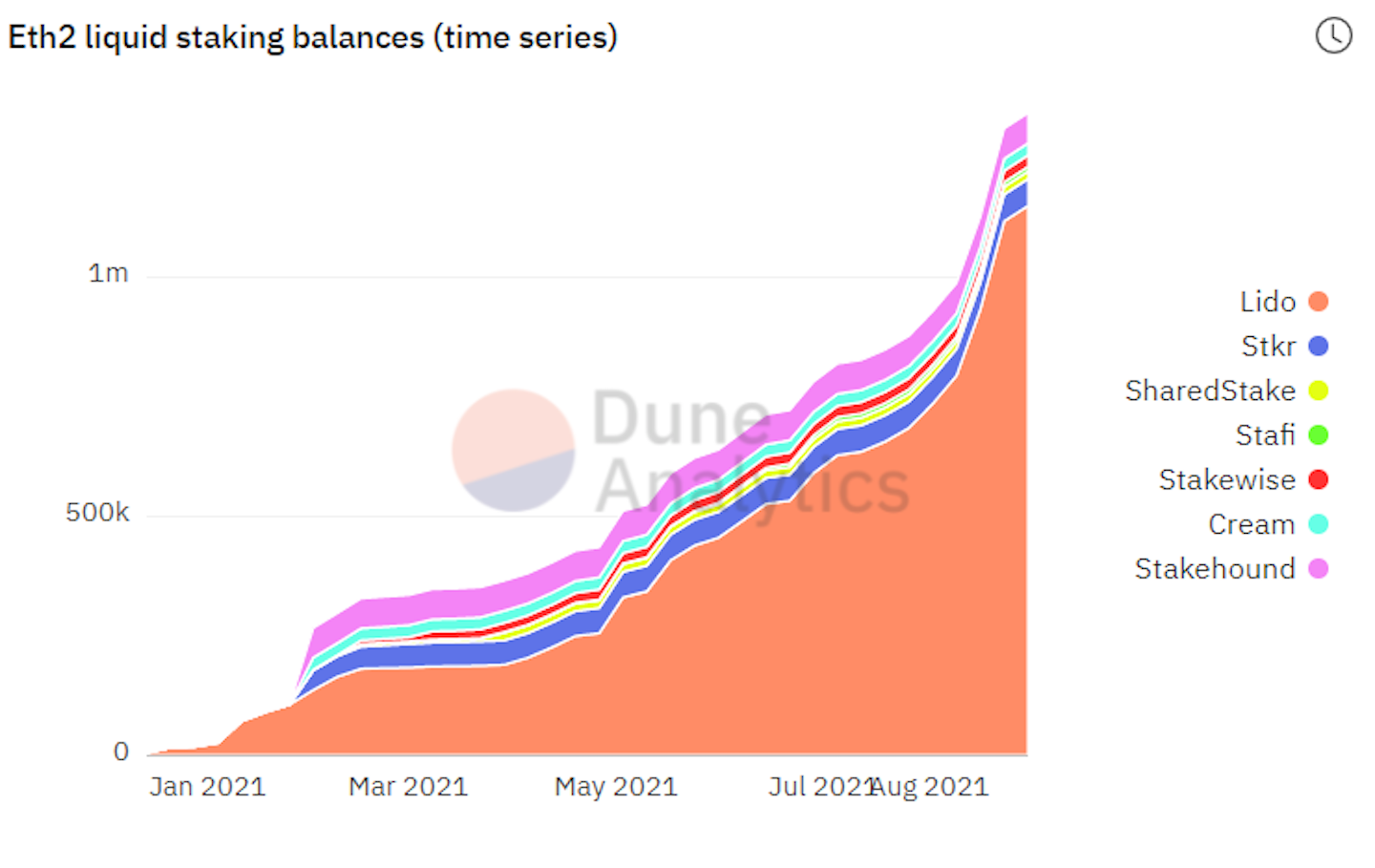

Ethereum 2.0 liquid staking balances have surged. (Dune Analytics)

While Lido’s unique depositors and cumulative deposits have been trending up since the beginning of the year, the growth curve has been particularly steep in recent weeks.

Shapovalov, Lido’s tech lead, attributed the recent pickup in growth to several factors, including Lido’s staking referral program, its recent debut on the Terra blockchain-based Anchor protocol and a partnership with the decentralized finance protocol Curve Finance.

Referral program

Launched July 19, Lido’s referral program lets existing users earn lido token (LDO) rewards by encouraging other people to stake ether on the platform. LDOs are the Lido protocol’s governance tokens, offering potential value for holders through protocol fees.

According to the official website, the referring user receives 15 LDO tokens worth $87 for every ether staked due to a referral. So if a new user stakes 10 ETH (worth about $34,000 at current prices), the referring user receives a reward of 150 LDO or $870. The minimum stake to generate a reward is one ETH.

Users can claim referral rewards on the Ethereum-based decentralized exchange DiversiFi without having to pay gas fees.

The referral program has brought in about 300,000 ETH, Shapovalov told CoinDesk; that’s worth more than $1 billion at current ether prices. That accounts for most, but not all, of the 360,00 ETH increase on the platform since the referral program was launched, according to Dune Analytics.

“It’s important to also note the powerful Lindy effects at play,” Spartan Capital’s Choi said. The Lindy effect is the idea that the older something is, the longer it’s likely to be around in the future.

stETH’s DeFi foray

Some analysts said the recent move by Anchor protocol to adopt bETH – a version of the stETH tokens retrofitted to work on the Terra blockchain – as collateral has bolstered Lido’s growth.

“As it stands, Eth 2.0 staking is one-directional, i.e. you can deposit and stake your ETH, but you can’t withdraw it yet,” Denis Vinokourov, head of research at Synergia Capital, said. In contrast, “bETH lets you lend and borrow your staked ETH on the Terra network, a dynamic which in turn has literally opened up flood gates.”

According to Messari research analyst Jack Anderson, bETH has opened up a cross-chain opportunity for stETH holders to earn a yield on their staked ETH.

“Before, they could take their stETH and deposit in the Curve pool to earn additional yield (on top of the ETH 2 staking rewards), and now they can use bETH to borrow Terra USD or UST by converting their stETH into bETH,” Anderson said. UST is the algorithmic stablecoin of the Terra blockchain. Anderson added that Lido’s efforts to decentralize and maintain transparency have given people a lot of confidence.

According to Bankless, the stETH-ETH pool on Curve Finance launched earlier this year is the most prominent stETH integration to date. The pool allows the stETH token holders to swap between the staking derivative and “regular” ETH. Anyone can provide liquidity to the stETH pool in return for staking rewards paid out in LDO and trading fees. At press time, the pool holds $4.8 billion in deposits and more than 700,000 stETH. That’s more than 50% of the derivative token’s total circulating supply.

Therefore, holders of stETH can simply stop staking by selling the derivative token for ether through Curve Finance. However, in that case the stETH seller loses staking rewards to the buyer.

While Lido and decentralized staking, in general, holds an edge over centralized exchanges, it is not devoid of risk, at least in theory. As Terra Money noted last year, liquid staking appears analogous to asset-backed securities in a sense that “both create a new layer of abstraction that tends to make people care less about the health of the underlying assets, something that we’ve also seen before during the transition from physical delivery to paper delivery in the futures market.”

Further, a validator can short the staking derivative token when found malicious, thereby profiting from the decline in the price of the token. “Theoretically that’s possible,” Lido said, adding that its validator set includes only validators who have good reputations.

DISCLOSURE

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.