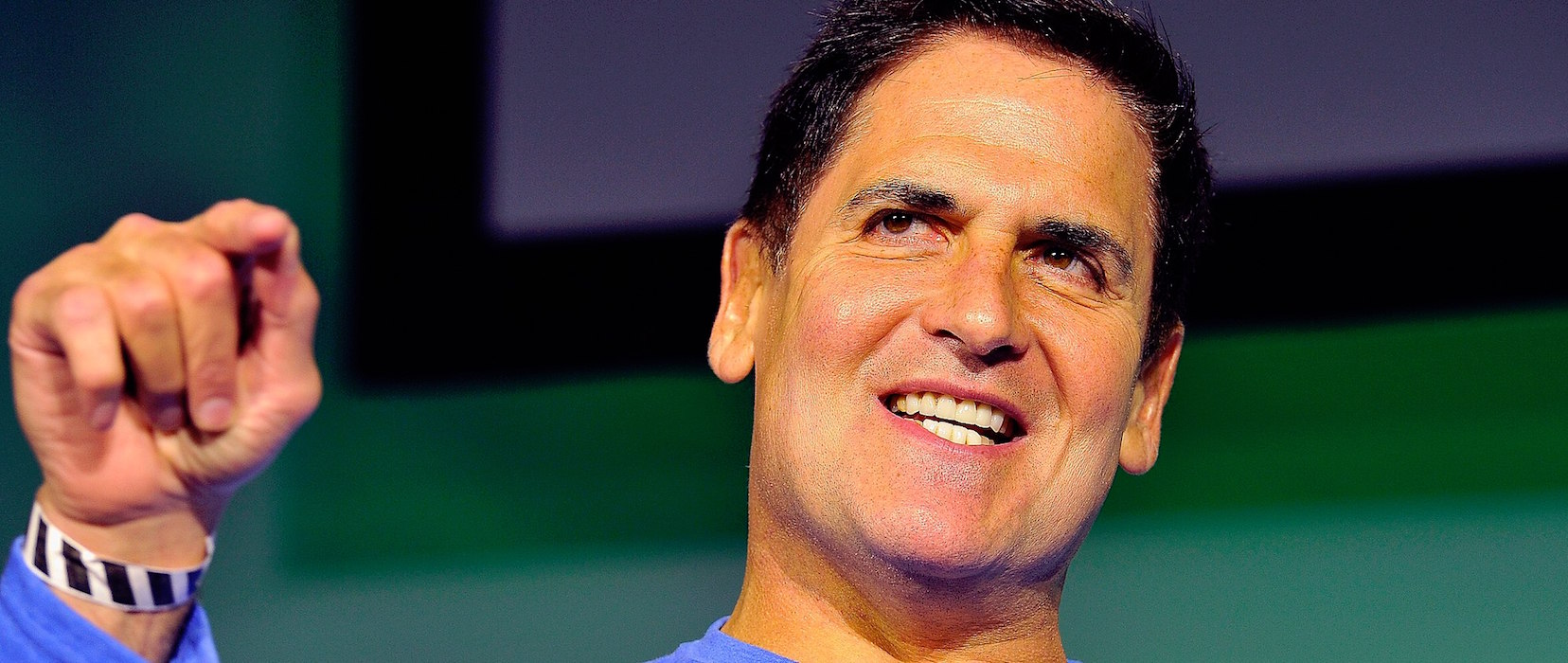

Mark Cuban Touts Dogecoin on ‘Ellen’: ‘A Whole Lot Better Than a Lottery Ticket’

Billionaire investor, “Shark Tank” personality and Dallas Mavericks owner Mark Cuban explained the dogecoin phenomenon to millions of viewers of Ellen DeGeneres’ daytime talk show on Tuesday, describing the much-hyped cryptocurrency as “a whole lot better” of an investment “than a lottery ticket.”

Besides "doja-coin," Cuban and DeGeneres discussed non-fungible tokens on the episode, which Cuban described as “just a digital collectible that you can buy, hold, sell like any other collectible.” DeGeneres tweeted Monday that she is auctioning an NFT to benefit World Central Kitchen.

That Cuban was discussing dogecoin on "Ellen," a daily talk show with an average of 1.5 million viewers, many of whom are women below the age of 54, could bring the Shiba Inu-themed crypto into the mainstream.

“Cryptocurrency is just an asset to invest in. Bitcoin is kind of like a digital version of gold. Ethereum is a digital version of a currency,” Cuban told DeGeneres. “And then you got dogecoin, which is just fun. But the weird part about it [is] it went from being a cryptocurrency joke to now becoming something that’s becoming a digital currency.”

All in the family

Cuban explained that his 11-year-old son, Jake, is involved in dogecoin, with the two Cubans buying “$30 worth.”

“So the question everyone wants to know, is dogecoin a good investment? And here’s the reason I got Jake into it. It’s not necessarily the best investment you can make, but you can buy it on Robinhood, and signing up and trading on Robinhood is free. So that’s one thing,” Cuban said.

“The second thing is it’s about 26 cents per dogecoin. So if you go and spend five, 10, 15 dollars, that’s a better investment than buying a lottery ticket. And you know what? It could go up,” he continued. “It’s also becoming a digital currency, which is crazy if you think back to its origins.”

Cuban noted his Mavericks basketball team's store accepts dogecoin for merchandise, and suggested DeGeneres do the same for her Ellen Shop. (He did not mention that spending even trivial amounts of crypto on goods and services can incur a tax liability in the U.S.)

“But, overall, when someone brings up dogecoin to you and asks you if it’s a good investment, I wouldn’t say it’s the world’s best investment, but it’s a whole lot better than a lottery ticket and it’s a great way to learn and start understanding cryptocurrencies,” Cuban said.

“The Ellen DeGeneres Show” had an average of 1.5 million viewers over the past six months, down from 2.6 million viewers for the same period in 2020, according to a recent report in the New York Times quoting data from research firm Nielsen.

The core audience for “Ellen” is adult women below the age of 54, according to Nielsen. In September, DeGeneres publicly apologized on the show for allegations of workplace misconduct.

KYC TV

Cuban did not mention risk factors such as dogecoin's unlimited supply and sparse technical development.

He did, however, explain one of the realities of trading crypto on regulated platforms: they collect sensitive personal information from users.

After DeGeneres said she felt uncomfortable because Robinhood asks for a Social Security number, Cuban gave the audience a primer in anti-money-laundering requirements.

"There's something called know-your-customer," he said. "They have to make sure you're not a money launderer or a fraudster, and so they have to confirm your identity."

As if to reassure viewers, he said Robinhood is "pretty good at keeping [data] secure. ... I didn't have a problem putting in my information."

DeGeneres replied: "well, I trust you."

UPDATE (April 28, 01:33 UTC): Added details about dogecoin's risk factors and discussion of KYC.

UPDATE (April 28, 13:40 UTC): Added line about tax consequences of spending crypto on goods and services in U.S.

DISCLOSURE

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.