Mt. Gox Halts ALL Bitcoin Withdrawals, Price Drop Follows

UPDATE (7th February, 11:25 GMT): Users with bitcoin withdrawals in limbo have reported that the amounts are being returned to their Mt. Gox wallet balances.

Japan-based bitcoin exchange Mt. Gox, the third-largest for trading the US dollar for bitcoin by 30-day volume, has announced it is temporarily pausing bitcoin withdrawals.

The company has released a statement on its website that says the following:

Dear MtGox Customers,

During our efforts to resolve the issue being encountered by some bitcoin withdrawals it was determined that the increase in withdrawal traffic is hindering our efforts on a technical level. As to get a better look at the process the system needs to be in a static state.

In order for our team to resolve the withdrawal issue it is necessary to temporarily pause all withdrawal traffic to obtain a clear technical view of the current processes.

We apologize for the extremely short notice, but as of now all bitcoin withdrawals will be paused, and withdrawals in the queue will returned to your MtGox wallet and can be re-intiated once the issue is resolved. Customers can still use the trading platform as usual.

Our team will be working hard through the weekend and will provide an update on Monday, February 10, 2014 (JST).

Again, we apologize for the inconvenience, and ask for your continued patience and support while we work to resolve this issue.

Best regards,

The MtGox Team

Mt. Gox has been suffering from lengthy delays transferring bitcoin to USD and transferring to US bank accounts for some time now, but similar issues recently extended to those looking to withdraw fiat values in other major currencies like euro and Japanese yen.

Bitcoin-specific withdrawal problems

Most recently Mt. Gox's issues with getting money out of the exchange have extended even to withdrawals in actual bitcoin.

Reports of sporadic difficulties withdrawing BTC from Mt. Gox began to trickle in as early as late December, but increased in the 72 hours leading up to this announcement.

At first, users reported getting an erroneous "Invalid Bitcoin Address" error message when attempting to transfer - something that has happened several times in the past and is said to be due to the exchange's 'hot wallet' running dry in times of great demand.

Even supposedly successful transactions, which the Mt. Gox website will have claimed to have occurred, often do not register on bitcoin's public block chain. One user, who tried this morning to withdraw a substantial amount of bitcoin, told this story:

I had BTC sitting in my Gox account for a few weeks then decided to transfer to my home PC wallet. I had transferred BTC to and from Mt Gox several times since November last year without any problems. On Feb 4th at 2:15pm I made the transfer unaware that others were already experiencing problems with 'stuck' transactions. After I committed the transfer, the Gox website immediately issued a transaction hash and deducted the BTC plus a fee from my account. When I checked several hours later that transaction hash was not found on the blockchain. Needless to say, nothing has appeared in my wallet.

I raised three support tickets but none have yet been assigned to an agent. When I search google for "Mt. Gox BTC withdrawal problem" I find there are hundreds of people with the same or similar issues.

Even smaller withdrawals were affected, with other users reporting similar stories when attempting to withdraw amounts of less than 1 BTC.

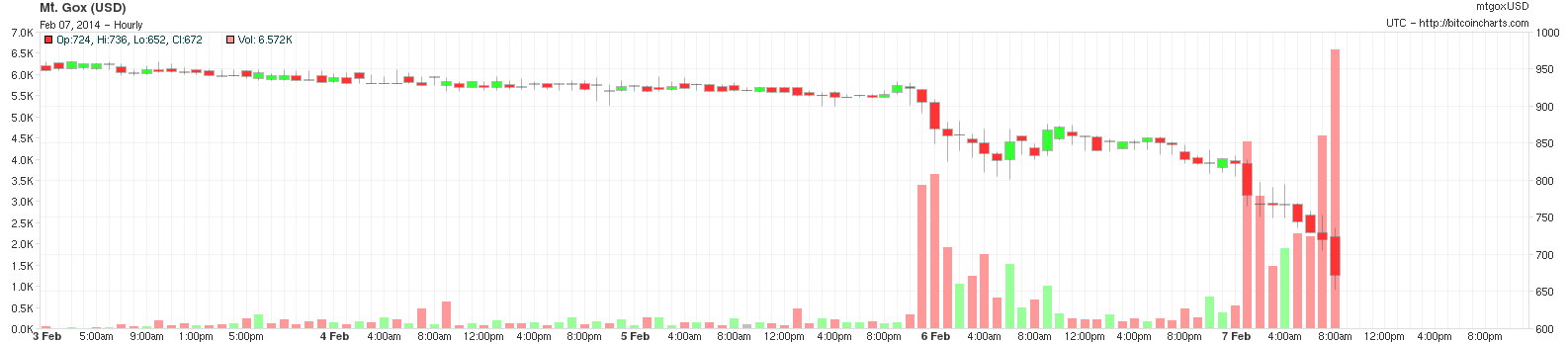

Graphs on Bitcoincharts.com showed bitcoin trading volume increasing markedly over the past 24 hours or so. At the time of writing, since midnight on the 6th February UTC, over 45,084 BTC has been traded on Mt. Gox - compared to only 11,348 in the entire 48 hour period before that.

source: bitcoincharts.com

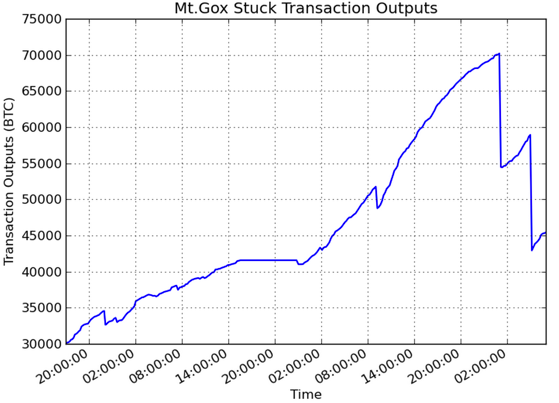

, which tracks data based on each exchange's public API, showed an hourly increase in Mt. Gox's BTC withdrawal volumes and 'stuck' withdrawals until 13:00 Japan time, when there was a vertical drop. Numbers began rising again almost immediately after.

Turbulent history

Many users had thought their bitcoin balances were relatively secure, at least compared to national currency amounts, and could be transferred to a local wallet at a moment's notice. Mt. Gox has not indicated there will be any difficulty doing that once its technical problems are ironed out.

This was the expectation, given bitcoin is considered 'sound money' by its fans and that Mt. Gox is not a fractional reserve bank subject to problems with a 'bank run' in digital currency. If a bitcoin is listed in a wallet, users presume it may be transferred or withdrawn without delay.

Were Mt. Gox to collapse, or even render itself unreliable as a platform, a large portion of bitcoin trade would either scramble for a new home or disappear altogether, which could have a dramatic effect on bitcoin's value.

Founded originally by serial tech innovator Jed McCaleb in 2009 as an exchange for Magic: The Gathering Online players, Mt. Gox was turned into a bitcoin-only exchange in 2010 before being sold to Mark Karpeles and his company Tibanne Ltd., the current owner.

was the largest and, for many, the only bitcoin-fiat currency exchange from bitcoin's introduction until last year.

It accounted for over 70% of global trading volume in April 2013 and its price has traditionally been the highest, apart from certain times in 2013 when BTC China held the record or when Bitstamp managed to overtake it.

A series of misfortunes since April have seen Mt. Gox's USD trading fall to an 18% market share, just behind Europe's Bitstamp and BTC-e with 30% and 25% respectively.

Criticism

Although criticisms have often been leveled at Mt. Gox throughout its history and reached a crescendo by the end of 2013, the company has also suffered from external forces.

Payment processor Dwolla experienced a suspension of transactions to and from Mt. Gox, initiated by the Department of Homeland Security (DHS) in May 2013.

Following that, in August a Mt. Gox subsidiary in the US, Mutum Sigillum LLC, lost $2.9m in a seizure of its Dwolla account by the DHS. That deparment of the federal government claimed that the company had concealed its business as a money transmitter and failed to register as such with FinCEN.

The DHS seized a further $2.1m from Mt. Gox's two Wells Fargo accounts in the US, one of them under Mutum Sigillum's name and one in CEO Karpeles' own name. Federal testimonies have since revealed the seizures had more to do with users' Silk Road related activities than FinCEN's rules.

With $5m in reserves gone, and with US banks and payment processors alike refusing to engage in further business with them, Mt. Gox has since struggled to transfer funds into the US and to its many American customers.

A dispute with another US partner, bitcoin incubator CoinLab, saw Mt. Gox sued for $75m in September 2013. Mt. Gox countersued for $5.5m, claiming CoinLab had also failed to register as a money transmitter and jeopardized the business. The case is still ongoing.

Users of the Bitcointalk forums have been complaining about Mt. Gox's withdrawal problems for the past few days. CoinDesk will continue to update this story as new information comes in.

This article was co-authored by Daniel Cawrey.

DISCLOSURE

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.