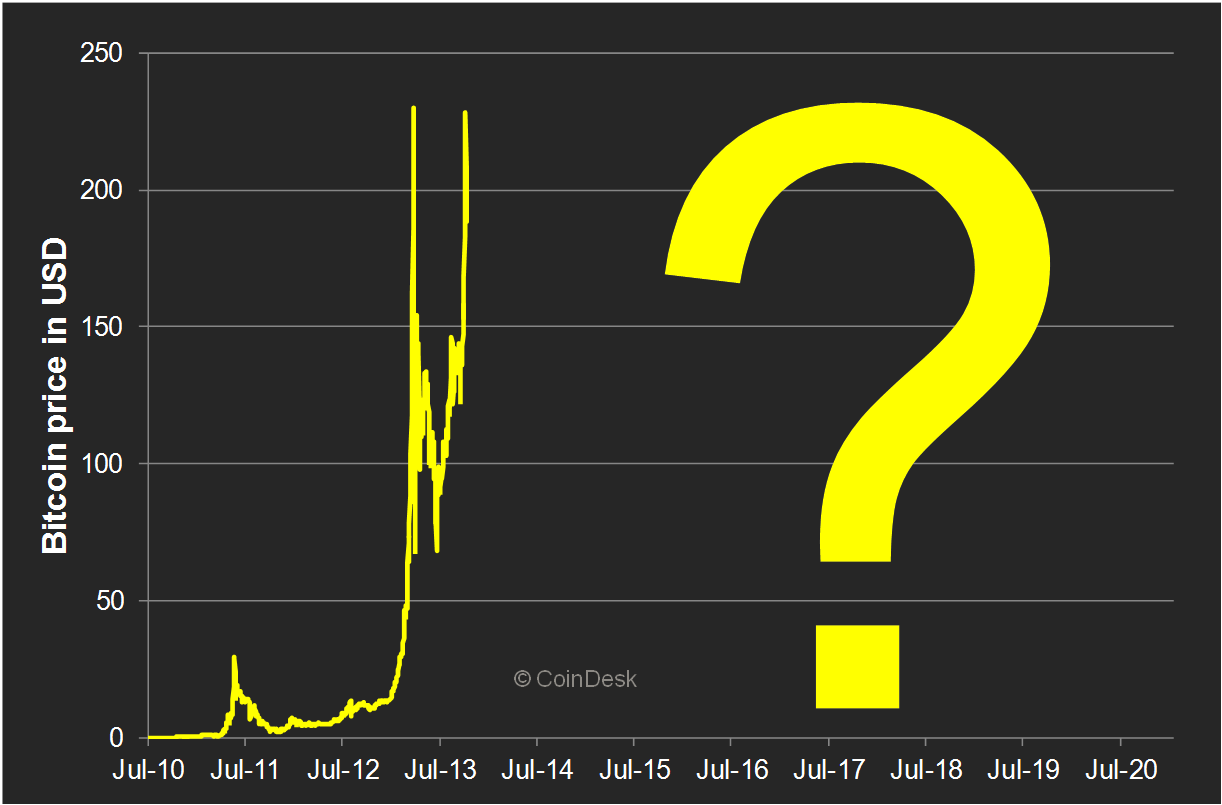

Op-Ed: The bitcoin price has the potential to reach $1,820 by 2020

Editor’s note: This guest post was written by Radoslav Albrecht, co-founder of peer-to-peer bitcoin lending platform Bitbond.net. He has a background in economics, worked at an investment bank in London, and runs the German bitcoin blog bitcoins21.

The bitcoin price is probably the most discussed aspect about bitcoin. But only few discussions try to derive a quantified long-term price potential.

Do not mistake potential for prediction. As Yogi Berra said: “It is tough to make predictions, especially about the future.” Nobody is capable of accurate prediction. The price potential rather tells us where the price could go, given that certain assumptions will prove correct.

So if we’re not good at predicting something, why bother with an analysis about the bitcoin price potential?

Because it gives us a better understanding as to what drives the bitcoin price. It allows us to watch the identified drivers closely and refine our estimate of the potential.

What determines the bitcoin price?

The bitcoin price is the result of supply and demand for bitcoin. The more demand there is, the higher the price goes. The more supply there is, the lower the price (all else being equal).

The supply side of bitcoin is fairly well known, even if we look into the future. Bitcoin supply growth will drop below 15% annually very soon.

In the year 2020 the number of mined bitcoins will have surpassed 18 million. That means, when we omit bitcoins created through lending, the bitcoin supply will grow at a predictable rate that is on a decline.

The second factor that impacts supply is the so-called velocity of money. This figure tells us how often one unit of currency exchanges hands within a given time.

We calculate it by dividing the bitcoin transaction volume by the number of bitcoins in circulation. Currently this figure is at approximately 9 on an annual basis.

That means, one bitcoin is on average spent 9 times in one year. The velocity has remained stable for about six months now and since it’s already pretty high compared to fiat currencies we can assume that it will not get much higher.

Let’s look at demand next. Bitcoin is used in various types of transactions. The transaction volume drives demand for bitcoin which ultimately affects its price.

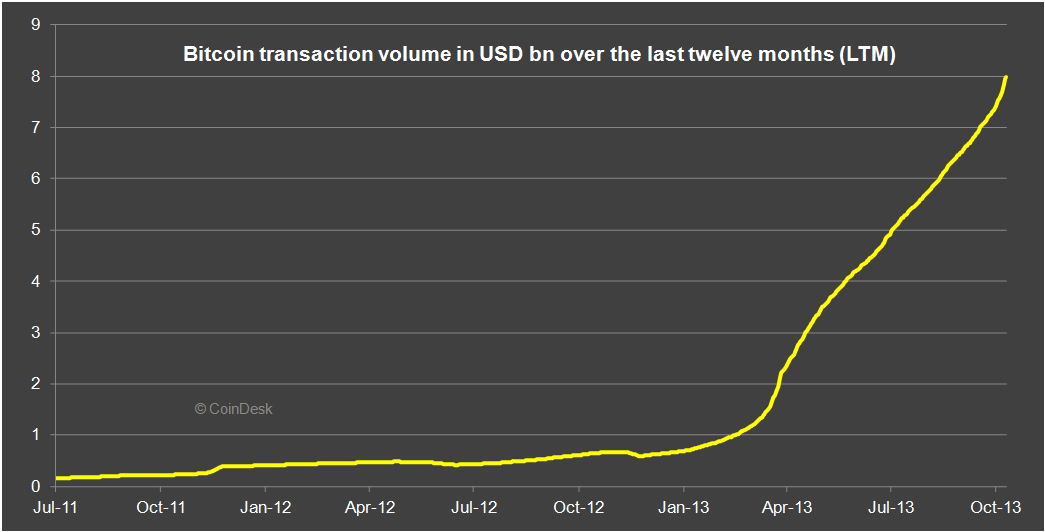

The following chart shows us the bitcoin transaction volume in billions of US dollars. Each point of the curve is the sum of all bitcoin transactions of the last twelve months (LTM) converted at the corresponding daily exchange rate. As we can see, the transaction volume has skyrocketed since April 2013.

; own calculations.

The 4 bitcoin use cases

We can categorize bitcoin transactions into four use cases. For each use case, bitcoin competes with other existing solutions.

I will compare bitcoin with a major player in each category and try to estimate a potential future transaction volume for bitcoin until the year 2020. From that we can derive the bitcoin price potential.

1. Online payments

The largest bitcoin competitor in online payments is PayPal which reports to have 137 million active registered accounts. In the year 2012 the total value of transactions through PayPal was at $145 billion which is 18x the LTM bitcoin volume. Will bitcoin ever reach today’s volume of PayPal?

One thing that strongly impacts the adoption of bitcoin as a payment system is its exchange rate volatility.

All other aspects of bitcoin as a payment system are superior in my opinion. If bitcoin volatility keeps declining (which it currently is despite recent events), adoption and use in online payments will grow. And besides PayPal, there are other solutions where bitcoin has large potential to take away market share.

Also, it’s not just about taking away market share from other solutions. The PayPal 2012 transaction volume grew by 22% compared to 2011.

A growing world economy conducts an increasing number of payment transactions, so the market as a whole is growing rapidly. That’s why we can indeed assume that in 2020, bitcoin will reach today’s volume of PayPal transactions.

Additionally, there could be new applications for micropayments. I believe we will see entirely new revenue models here that can emerge through the availability of an instant and cost effective payment system like bitcoin. That way, additional transaction volume could be created.

2. Point of sale payments

There are many countries where most shops and restaurants don’t accept credit or debit cards. Costs and payment cycles are probably the main obstacles.

Bitcoin allows these shops to offer a cashless payment method that is convenient and cost effective for the merchant. Therefore it’s likely that adoption in point of sale payments will grow as well.

However, quantifying this is almost impossible. To keep our overall calculation conservative, we will assume the transaction value of this use case to be zero.

3. Remittances

This is a use case where bitcoin has a big advantage in my opinion. Even if we take exchange fees on both sides of one transaction into account, bitcoin is still much cheaper than the competition. It might take some time until the infrastructure is available to all people who send and receive money internationally, but it’s getting there.

[post-quote]

From its annual report we can see that Western Union transmitted $81 billion in 2012 in consumer-to-consumer transactions. This is a figure that bitcoin should be able to achieve in future years. And this again omits market growth and other competing solutions like bank wire transfers. These are lengthy and expensive in many cases, providing additional potential for bitcoin.

4. Investments

With emerging investment vehicles, bitcoin is now an asset class that is accessible to institutional investors.

This opens a whole new world. There are many reasons why bitcoin benefits a portfolio of financial assets. However, there is currently one limit to substantial investments in bitcoin.

The bitcoin market capitalization is roughly at $2.3 billion which is very small for an asset class. If you want to enter positions that are in the millions of dollars, your market impact is just too big. Or worse, the market for bitcoins doesn't provide sufficient liquidity for very large trades.

But speaking of the future, investments in bitcoin as an asset class will play a major role. With growing demand from the other three use cases market cap should go up. Consequently, larger institutional investments will follow.

Estimating bitcoin transaction volume from investing is about as tough as with the point of sale payments. But this one definitely can’t be neglected.

So here is one approach we can take. Even though bitcoin is an asset class on its own, it has characteristics of other asset classes.

These are mainly commodities and other currencies. Both of these asset classes don’t pay any dividends, just like bitcoin. And among other things they are used for similar purposes like bitcoin. Namely as a store of value and a medium of exchange.

Foreign exchange markets are the most liquid markets in the world in terms of transaction volume. Even if bitcoin is successful as a currency, it will probably take many years before it plays the role of a currency from an investment point of view.

That’s why we should just stick to a comparison with commodities for now. The most obvious thing to do is to compare bitcoin to gold. Other precious metals like silver would do as well, but let’s keep it simple.

The total amount of gold ever mined until 2012 was 174,100 tons. At a current spot price of $1,350 per troy ounce the total value of gold is $6.9 trillion.

The majority of gold wholesale trading is conducted through the London bullion market. From the historical market clearing turnover we can see that over the last years the average annual trading volume equals roughly the total amount of gold ever mined.

That makes an annual trading volume of $6.9 trillion at the current price. If we assume that bitcoin reaches 1% of this volume, we get a bitcoin transaction volume from investments of $69 billion.

Potential bitcoin transaction volume

When we sum up the estimates of each use case we get a potential annual bitcoin transaction volume of $295 billion. This is a 38x increase compared to today. In the last six months the bitcoin LTM transaction volume has increased sevenfold, so another 38x increase until the year 2020 does not seem out of range.

Potential bitcoin price

Now comes the juicy part. What does this all mean for the potential bitcoin price?

From the quantity theory of money we know that money supply (M) times the velocity of money (V) must equal the amount of goods in an economy (Y) times the price level (P).

This relationship always has to hold. If we know three components of this equation, we can calculate the fourth component. So let’s put it all together and derive an implied potential bitcoin price for the year 2020.

We know that in the year 2020 M will be approximately 18 million bitcoins.

We assume V to remain constant compared to today, so it’s got a value of 9.

We take the transaction volume, which we estimated to be at $295 billion, as a proxy for Y.

Solving for the price level P and showing the result by the more common inverse notation we get a potential price of USD 1,820 per bitcoin.

That’s quite a lot.

Again, please bear in mind that this is not a prediction!

Also, this is by no means advice to enter positions in bitcoin. There are many risks, some of which we might not even be aware of today. The price we calculated here is one that we might see in the future if bitcoin continues its extraordinary growth path for all use cases.

Concluding remarks

This article outlined how we can derive a potential bitcoin price. The stated figure is hypothetical. The interesting part is how bitcoin will be adopted in the various use cases.

If we want to discuss the bitcoin price of the future, it makes sense to dig deeper into possible adoption scenarios for each use case.

The highest degree of uncertainty in this calculation comes from the investment use case.

If the bitcoin price really reaches something like $1,820 until the year 2020, the market cap will be at $33 billion. That’s still small compared to the money supply of most countries and compared to the total value of gold.

But when we compare bitcoins with stocks, a $33 billion market cap would mean a lift from the small cap to the large cap segment.

In such a scenario we have a positive feedback loop. The more investors there are, the more that are likely to join in. That could accelerate the investment use case significantly. A higher market cap will also lead to decreased volatility. This benefits the payment and remittance use cases.

Therefore it is also important which path bitcoin adoption takes at what time scale. Bitcoin is a network good which means that each user benefits the more users there are. That's important to keep in mind when we analyze bitcoin adoption further.

DISCLOSURE

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.