Overstock.com Becomes First Major Retailer to Accept Bitcoins

UPDATED on 10th January at 18:25 (GMT)

Overstock.com CEO Patrick Byrne sent a tweet on 10th January, indicating that the company had sold $124,000 in goods via bitcoin in the 21 hours since it began accepting the cryptocurrency.

After 21 hours on @overstock.com, we've had 780 #Bitcoin orders that accounted for $124,000 in sales. Wow!— Patrick M. Byrne (@OverstockCEO) January 10, 2014

That figure amounts to around 4% of daily revenues, based on the firm's 2012 figures.

He also added in an interview with CNN that he believed Amazon would be forced to take bitcoin at some point, as the market is growing by 30% per month.

---------------------------------------------------------

Online retail giant Overstock.com has moved forward its plan to take bitcoin payments. The company began taking the digital currency on its site this morning. About $10,000 worth of bitcoins has reportedly already been spent since Overstock made the announcement just a couple of hours ago. The first item purchased in bitcoin, according to Overstock CEO Patrick Byrne, was a $2,700 patio set. Around 150 bitcoin-based orders were received in the first 90 minutes, he added. The firm has chosen California-based online wallet and payment processing firm Coinbase to handle its transactions, in what must surely be a major coup for the company, which posted the following on its blog:

"This marks the largest retail Bitcoin implementation to date. For the first time ever, customers can purchase a wide selection of goods with bitcoins — from electronics to home accessories — from a trusted, branded vendor. We’re excited to serve as Overstock.com’s official digital wallet to facilitate all related transactions on their site."

Less than three weeks ago, Byrne told CoinDesk that the firm would begin taking bitcoin payments in June or July, and at the time had not signed a payment processor. However, things accelerated after Byrne broke the news, he said. “I felt I had tipped my hand. I didn’t want someone else to beat us,” Byrne told tech publication Wired.

Pretty impressive #bitcoin volume from @Overstock: over 150 orders in the first hour. — Coinbase (@coinbase) January 9, 2014Coinbase allegedly swung the deal by offering to fly people out to Utah to help with the integration. 40 people worked intensively around the clock from 1st January. Byrne told Forbes:

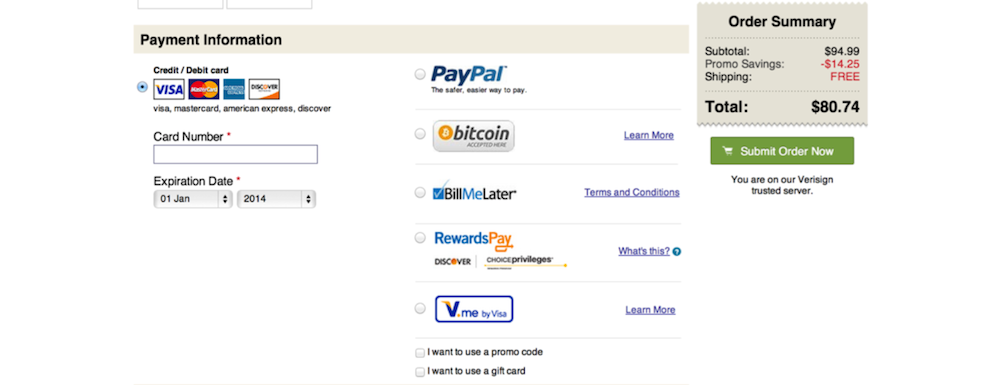

Now that the deal has been signed, more details are available on issues such as refund handling. Bitcoin customers returning items will initially get in-store credit, reports suggest.

The deal with Coinbase also provides some clarity on how Overstock will manage its exposure when dealing with a notoriously volatile financial instrument, which acts more like a commodity than a currency at present.

In

December, Byrne said that some hedging might be necessary if the firm decided to hold a position in bitcoin. However, Coinbase immediately converts bitcoins that it processes into dollars, meaning that Overstock will never hold any of the digital currency. In conversation with Bloomberg, Coinbase CEO Brian Armstrong admitted that the firm would be taking all the risk for Overstock.

"There's a marketplace for these things. With liquidity and scale, all of these things become easier," he said, adding that the value of having a large mainstream retailer of physical goods is good for the bitcoin economy. Coinbase also resorts to over-the-counter trades with two or three institutional players, at least one of which is a miner, along with exchanges, when it needs to trade bitcoin.

Byrne had not developed a clear projection for the amount of business that it would conduct in bitcoin, but when pressed, he said that 1% was a reasonable figure.

Coinbase currently serves around 17,000 merchants with its payment processing business. Aside from using algorithmic trading to manage its own bitcoin exposure and shield retailers from volatility, one of its other unique selling propositions is ease-of-use.

The company has created a system which interacts with the block chain, but which also provides additional benefits to those operating exclusively within its own network. It enables holders of bitcoins in Coinbase-based wallets to send bitcoins to each other using email addresses, for example. It also enables US-based users to purchase bitcoins directly from it. This is something that pure payment processing companies like BitPay do not offer.

Coinbase is also considerably more advanced in its funding than other bitcoin companies, having completed a $25m B round last month from Andreessen Horowitz. This bought the total amount raised by the company to $31.9m. This cash may help the company to deal with any state-level regulatory challenges that it faces in the future with its bitcoin sales service.

Overstock's growth story

Launched in 1999 from the ruins of bankrupt D2: Discount Direct, Utah-based Overstock began by selling purely surplus and returned merchandise via its e-commerce marketplace. Ironically given its beginnings, Byrne built the firm initially on liquidating inventory from dying dot com firms, during the technology industry recession.

The firm, which went public in 2002, has since moved into new merchandise. It offers a mixture of direct retail sales and online auctions, and also operates an affiliate program. Although it looks like a single supplier, its products come from dropship suppliers all over the country. Its 2012 revenues were $1.09bn and it lists almost a million products on its site.

Overstock's low pricing model, which includes cheap shipping for customers, relies on thin margins, making payment processing fees a particular burden. Bitcoin-based sales will not be entirely free, as Coinbase charges a transaction fee, but it will be cheaper than the credit card payment process which will still dominate the firm's business.

Byrne said last month that cost reduction was only one of the drivers for accepting bitcoin. The other was grounded in ideology, as he felt that bitcoin was a "pro-freedom" currency, with the potential to become immune to political influence. Yesterday, he added in a conversation with Forbes that access to the bitcoin community was also a driver in the decision.

Overstock’s share price rebounded slightly on the news of bitcoin acceptance, but was still off from early trading this morning, following news that it would be fined $6.8m by a California judge for allegedly misleading price comparisons on its website. That case was brought by the state of California in 2010.

Overstock.com now features a bitcoin payment option

DISCLOSURE

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.