Overstock.com to Become First Major US Retailer to Accept Bitcoin

Major online retailer Overstock.com plans to accept bitcoin as payment from the second half of 2014, according to various reports.

Website newsBTC first broke the news, with reports in MarketWatch and FT.com later confirming with Overstock.com’s CEO, Patrick Byrne. The company had hinted at accepting bitcoin in a New York Times interview in October, but Byrne said he was waiting for more legal clarification before going ahead. It now seems to be moving towards a more definite schedule.

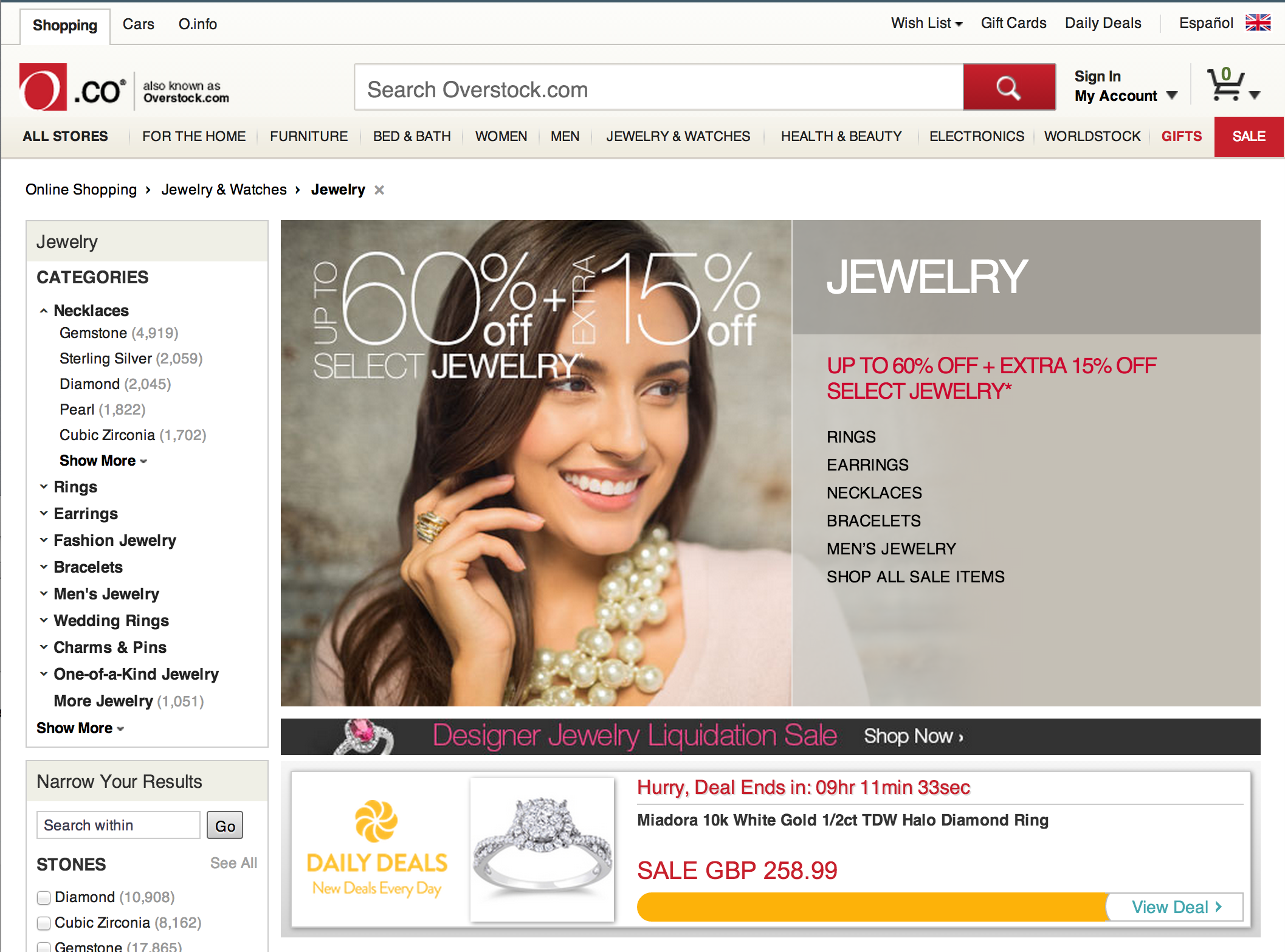

With over a billion dollars in annual revenue, Overstock.com (increasingly branded as O.co) would be by far the largest retailer to accept bitcoin as a general payment method for all products thus far. It would also serve as an important test case for bitcoin at large scale, with other large retailers (and probably the authorities) looking on in interest.

No word was given on what, if any, bitcoin payment processing company Overstock.com would use and it could decide to create its own. Byrne indicated the plan was a kind of trial for bitcoin, that his company wasn’t going to spend a fortune implementing it and would monitor its use to judge whether to continue accepting it in future.

He also said he would be looking for a system to hedge against bitcoin’s price volatility, promising to convert it straight into dollars otherwise. He was “not in the least” deterred by this week’s downturn, he said.

Underlying principles

Byrne is known for his libertarian views and has been open to bitcoin for a while. In newsBTC’s audio interview he describes himself as “an Austrian economist by background… I endorse bitcoin for many of the reasons I would endorse the gold standard.”

“I believe in money that is not fiat currency, that a government mandarin can’t just create by fiat with the stroke of a pen. Gold has that property and so does bitcoin.”

He said the US Federal Reserve’s “watering down” of currency would eventually see bitcoin gain acceptance. “Bitcoin is good money,” he added. He also told FT.com he didn’t own any bitcoins of his own just yet.

Business support for bitcoin

[post-quote]

While many small and independent retailers have accepted bitcoin for a few years and more have joined in throughout its 2013 days of glory, to date no major retailer with an international profile has chosen to accept bitcoin, as governments dithered over its legality.

Some large companies, like Baidu in China and Richard Branson’s Virgin Galactic, have accepted bitcoin for a particular (and usually quite exclusive) product. While the news was accepted gladly by the bitcoin world, it remained mostly promotional in nature and the community still waits with anticipation for a ‘big name’ supporter.

Overstock.com began its life after the 2000 dotcom bubble collapse, selling office supplies from failed companies. It has grown since then to sell new products and all manner of housewares, travel goods, and accessories. Several of its products are handmade especially for the company by workers in developing nations.

The US’ National Retail Federation ranked Overstock.com second in the country for best customer service in 2010, and a survey that same year also named it one of the top 10 places to work in America.

The company has also been vocal in calling for a more open door immigration policy for skilled workers in the US, saying it was difficult to find the developers it needed to expand the business.

DISCLOSURE

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.