Silk Road alternatives emerge as public hammers FBI bitcoin wallet

The bitcoin community has been having some fun with the FBI, after it discovered the bitcoin address that the agency has been using to transfer Silk Road bitcoins to its own wallet. Pranksters have been sending tiny transactions to the address, giving them a chance to attach personal messages to the feds.

The FBI had already seized 26,000 bitcoins that had been held in escrow for Silk Road customers. It registered a bitcoin address using blockchain.info, which has a feature enabling people to attach notes if they send bitcoins using its wallet.

Among advertisements for bitcoin exchanges, pleas for charity, and sideways references to the X-Files, was one wag who seemed intent on Rickrolling the FBI. Repeatedly.

Others were more serious. “What we’re doing isn’t about scoring drugs or ‘sticking it to the man.’ It’s about standing up for our rights as human beings and refusing to submit when we’ve done no wrong,” said one commenter.

Others are already looking ahead, beyond Silk Road.

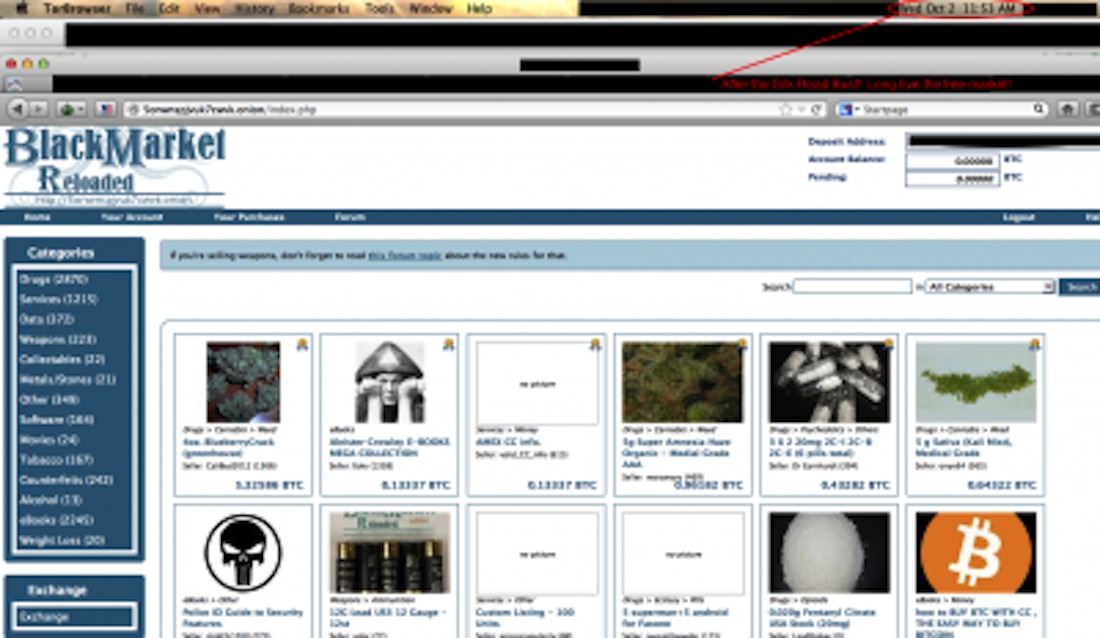

“They took down the site via conventional detective methods, but in the end, it doesn't really matter,” said Roger Ver, bitcoin advocate and founder of Memory Dealers, in an email to CoinDesk. “Here is an example of why.” He then posted a picture of the Black Market Reloaded site, which is a replacement for Silk Road.

Black Market Reloaded

Black Market was one of the sites listed in a note sent with a bitcoin transaction to the FBI’s blockchain.info address. That sender also posted the Tor link to another, called Sheep Marketplace.

Others are proposing alternatives that move entirely outside the Silk Road system, in which a central arbiter held bitcoins in escrow, releasing them when both parties to a transaction were satisfied.

Instead, Github user goshakkk used the open-source software development site to propose a system called Silk Road 2.0 in which no money passed through a black-market site, and in which no central server or small group of servers hosted the site.

Instead, the proposal suggested using bitcoin transaction scripts to find an ad hoc third-party who would mediate a transaction. Their vote would be needed to finalize a transaction and release coins from a buyer to a seller on the network.

“Everyone can be an arbitrator and they get chosen based on their reputation,” (s)he said, proposing a system like Namecoin to maintain identities and reputation information. That system could also use a community-run, decentralized social network such as Diaspora, in which multiple users could host their own nodes, all operating an instance of a black market marketplace.

Presumably, this would have to run over anonymous browsing networks such as Tor to avoid people running the networks being picked up by the authorities – although we're not entirely sure what such people would be charged with, if they were not handling funds.

But such a site would be a future problem for the Agency, which has bigger issues on its hands right how, as it tries to access a further 600,000 bitcoins. The 26,000 coins it already accessed were held by Silk Road, but the other funds were held separately by Ulbricht, and are worth around $80m at today’s prices. An FBI representative told Forbes that the private keys to these wallets are encrypted.

Featured image: Flickr

DISCLOSURE

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.