Tea Merchant Builds Coinbase Alternative for Litecoin Processing

When online farm-direct tea marketplace Tealet first contemplated accepting bitcoin, it did so because it perceived there would be an overlap between its customer base and the emerging virtual currency users.

As CEO Elyse Petersen told CoinDesk this October, both the company and bitcoin users are dedicated to "trying to cut out the middlemen".

However, Petersen had no idea just how enthusiastic the response would be. In the months since, Tealet has relocated from Hawaii to a new home in Las Vegas. There, it's found itself taking on a role as an ambassador for the cryptocurrency community, both to interested customers as well as other tech startups that want to replicate its success.

Since its 17th September launch, Tealet has seen 45% of its total revenue come from its bitcoin customers, who purchase from its extensive catalogue of loose leaf teas or subscribe to its bi-monthly tea delivery service.

Inspired by these strong sales figures, Petersen and Tealet web developer Cody Moniz began to consider the benefits of adding other virtual currencies, finally selecting litecoin as the payment option that could give its bottom line a boost.

But, after conducting some market research, Petersen came to an important realization, one that would lead her team to go above and beyond what many merchants would hope to achieve:

Selecting litecoin

Despite her success with bitcoin, Petersen may not have moved so quickly on litecoin if it hadn't been for her friend and fellow MBA student Warren Togami, a lead developer for litecoin who conducts interviews with Charlie Lee, and the passion of Tealet developer Moniz.

Petersen said that though Warren did suggest that she pursue litecoin, she was ultimately swayed by the virtual currency's unique approach to market adoption.

Market research

While enthusiastic about the possibility, Petersen was further dismayed by a lack of options that could provide the "smooth and low-risk transition" from litecoin to USD Tealet required.

Such a system, while useful to some merchants, simply wasn't practical for Tealet, which can process upwards of 100 orders a day.

Developing a solution

The completed project was the result of two weeks of effort by Moniz, who Petersen described as a "cryptocurrency fanatic" who was happy to put his skills to the test with a big challenge. Warren, in turn, conducted quality control to ensure the project was ready for its launch.

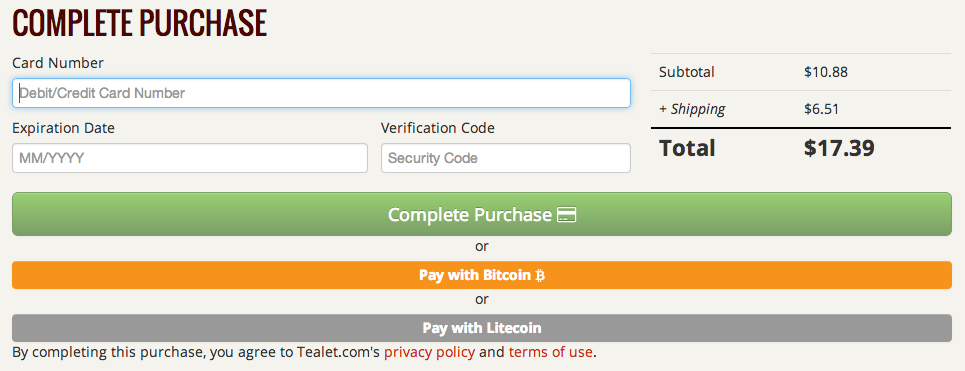

As of 5th February, Tealet shoppers can now add teas to checkout, and before completing the purchase, choose whether to pay with a debit or credit card, bitcoin or litecoin.

litecoin, tealet

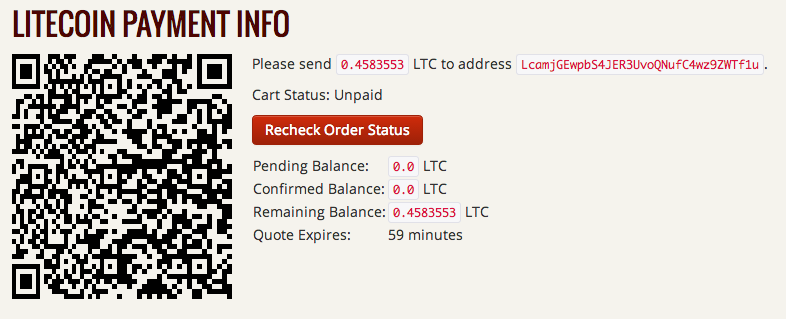

Next, a window will appear displaying a QR code along with the amount the customer owes in LTC. Prices will be valid for a 30-minute window. Once customers complete their purchase, Tealet's new system processes the order.

litecoin, tealet

To mark the launch, Tealet buyers will also be able to purchase special litecoin tea boxes, which also come with free litecoin keychains.

A white-label solution

For now, the processor is a work in progress. Petersen said that Tealet still needs to manually move its litecoin earnings from a BTC to USD state. But, she's optimistic such kinks will be ironed out.

Petersen hopes Tealet will soon be able to offer its processor as a white-label solution, though she acknowledges more advanced solutions from competitors could make it obsolete with time. This version of the processor would utilize watch-only wallets to help other merchants accept LTC without worrying about money service business or money transmitter requirements.

The CEO mentioned that she has since learned about market alternatives like GoCoin, which now offer litecoin processing, and is considering making the switch to this service.

Still, her story is proof that despite the rise in popularity of bitcoin and litecoin, market solutions are still limited, and that opportunity abounds for enterprising firms.

Image credit: Cup of tea | chumsdock

DISCLOSURE

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.