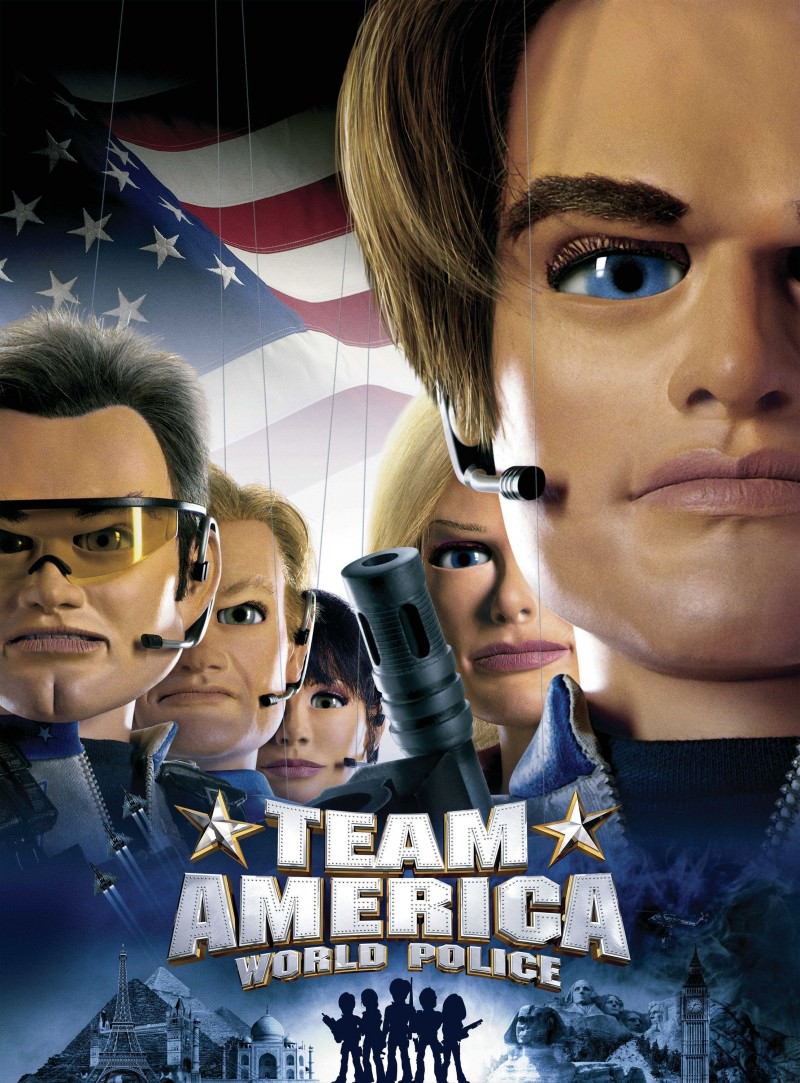

Team America's Dwolla bashing is just the start

The idea that the US government cannot regulate businesses which only operate on the internet will come as news to the online poker and gambling companies shut down by the US in recent years. Or indeed Kim Dotcom recently arrested in New Zealand because his Megaupload site upset the US.

So it should come as no surprise to see US authorities taking action against US-based Dwolla. Nor that the action sends ripples through the market - Mt. Gox politely declined to talk to CoinDesk today citing advice from its lawyers. Exchanges are likely to be the first front line in this war - Bitcoin can survive for ever but will struggle for value if it cannot be converted into fiat currency.

A little history

The US government does not like its citizens betting on sports events. So it went after a London-listed company called Betonsports. In 2010 it went after individual staff members and arrested the company's chief executive David Carruthers while he changed planes at Dallas airport. Carruthers eventually copped a plea and got three years in prison.

Two years ago the US decided it didn't like online poker either and arrested 11 people working for sites offering the service. It also got fulltiltpoker.com closed down by authorities in Alderney - the Channel Island where the company was based.

Follow the money

The US has free access to the world's financial transactions in the name of fighting terrorism. It is likely that the US will claim terrorism and money laundering as the reason for its attack on Dwolla.

The "Terrorist Finance Tracking Program" operates via the SWIFT transaction network which is based in Belgium. It gives US spooks full access to all your banking transactions.

But like so much similar legislation it quickly crept far beyond fighting terrorism.

Last year US spies noticed a Danish gent called Torben Nødskouv had sent $20,000 to a German company in order to buy Cuban cigars - entirely legal under EU law. US authorities seized the money citing the US trade embargo with Cuba - an embargo which has no legal basis in Denmark, or Germany.

Despite appeals and complaints from Danish politicians Nødskouv did not get his money back, nor did he get any cigars. He had broken no laws but he lost his money.

Bitcoin companies might think they're smarter than the online gamblers and have better connected investors but US authorities have rules of their own.

Maybe we should take solace from Black Swan author Nassim Taleb who said on Twitter:

DISCLOSURE

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.