Terra Becomes Second-Largest DeFi Protocol, Surpassing Binance Smart Chain

Decentralized payments network Terra is now the second-largest blockchain for decentralized finance (DeFi) protocols in terms of total value locked (TVL). Terra, which is behind Ethereum, crossed Binance Smart Chain (BSC) this week.

On Terra, 13 projects lock over $18.2 billion in value, data from analytics tool DeFi Llama shows. That’s over $1.4 billion per protocol on average compared with an average of $73 million per protocol on BSC, which has $16.5 billion locked on 225 protocols.

The figures are a nearly 42,000% increase compared to December 2020, when DeFi projects on Terra held $42 million in value.

Ethereum retains the DeFi crown with $152 billion in value locked on 361 protocols. DeFi projects rely on smart contracts instead of middlemen for financial services such as lending, trading and borrowing.

DeFi heats up on Terra

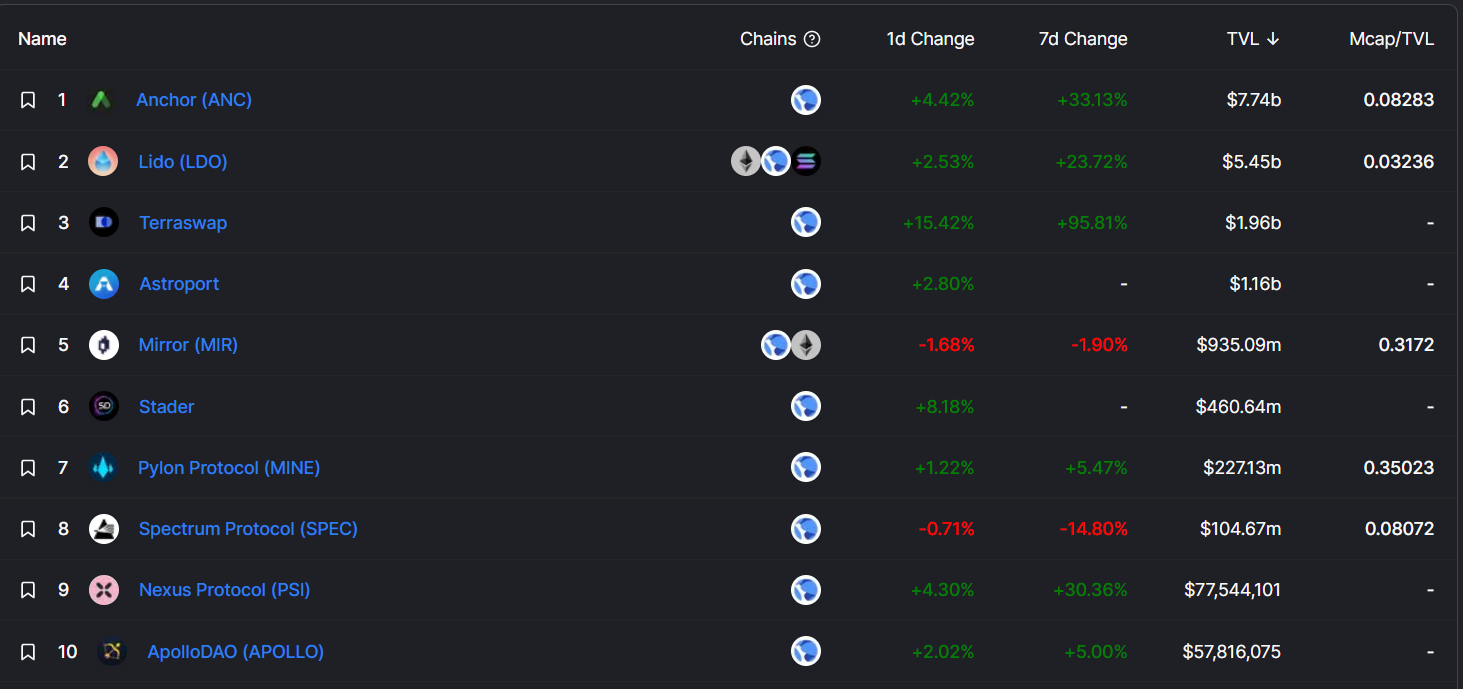

Leading the TVL charts on Terra is Anchor, a savings protocol offering low-volatile yields on Terra stablecoin deposits. Anchor locks over $7.7 billion in value and accounts for 42% of Terra’s TVL. Anchor users accrue rewards through a diversified stream of staked rewards from major proof-of-stake blockchains.

Staked assets liquidity provider Lido is next on the list with over $5.4 billion in TVL. In third place is decentralized exchange (DEX) Terraswap, which has seen its TVL increase over 95% in the past week. Terraswap matches peer-to-peer trades between users using Terra’s smart contracts. All liquidity, as on other DEXs, is contributed by the users themselves, in return for token rewards based on the amount of liquidity they provide for each trading pair.

Terra TVL chart (DeFiLlama)

The increase in TVL on Terra coincided with the rising price of its LUNA token. The price is up 54% compared to the past week, trading at all-time highs of $83 on Tuesday morning, as per data from CoinGecko.

LUNA price chart (TradingView)

Some attribute LUNA’s success to both its token mechanisms and use in DeFi applications. “Terra has recently been very successful both in terms of its LUNA coin price and the TVL on its DeFi protocols. The demand for the LUNA token mostly stems from the demand for UST, the algorithmic stablecoin on Terra which is minted using (burning) LUNA,” said Adrian Krion, CEO of Web 3 gaming company Spielworks.

“Unlike other layer 1 blockchains, Terra’s TVL isn’t mainly driven by swap protocols but by savings protocols utilizing so-called bonded tokens, native LUNA tokens which participate in the stabilization of the protocol and thereby generate yield,” he said in a message to CoinDesk.

LUNA was one of the strongest-performing cryptocurrencies in the past month even as the broader market tumbled. Bitcoin and ether have traded in a tight range since November 2021, but tokens of Ethereum rivals Solana and Avalanche have seen gains as traders placed bets on them outperforming Ethereum.

Some in crypto circles refer to investing in SOL, LUNA and AVAX as the SoLunAvax trio, and the trade has netted nearly 400% since May 2021 compared to an equally weighted basket of bitcoin and ether in the same time period.

UPDATE (Dec. 21, 08:57 UTC): Adds Spielworks CEO’s comment in ninth and tenth paragraph.

DISCLOSURE

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.