The CoinDesk Mining Roundup: Alydian, Dogecoin and Cloud Mining

Cryptocurrency mining for fun and profit is always better with the latest and greatest information. With that in mind, CoinDesk's regular round-up details some of the most interesting events going on in the mining world in recent days – including an intriguing dogecoin announcement.

So, let’s explore some of the happenings since the last round-up.

Mining heads to the cloud

As bitcoin mining difficulty continues to rise, big-time miners are looking for a leg-up on the competition. If that’s you, you might want to check out this article by Data Center Knowledge (DCK), an online industry news site.

According to the article, those who can’t afford to (or just don’t want to) invest in major mining infrastructure and its issues now have another option – cloud-based mining. This is a business strategy whereby customers can pay a monthly fee to outsource their mining and reap the benefits that way.

The mere fact that DCK is covering mining at all is a sign that bitcoin infrastructure is now a serious business for IT professionals.

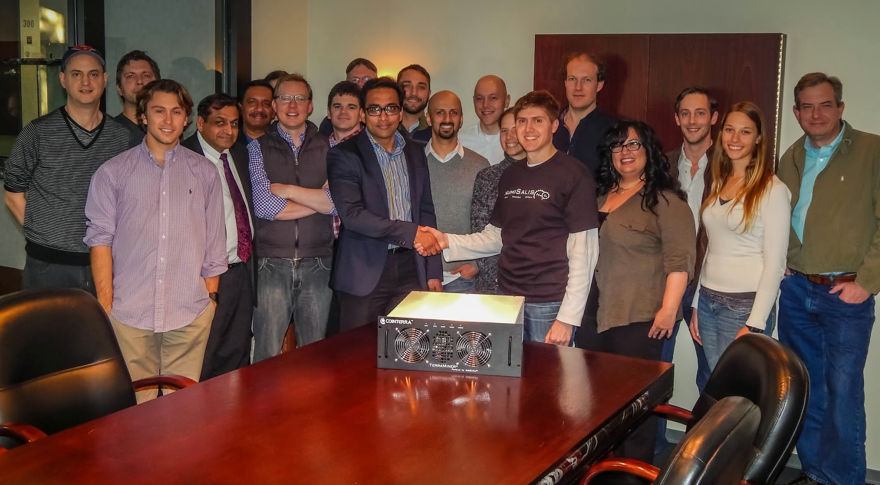

CoinTerra miner misses the 2TH/s mark ... for now

Texas-based CoinTerra has begun shipping its new line of bitcoin miners. The company’s much-anticipated $5,999 TerraMiner IV tests out between 1.63 TH/sec and 1.72 TH/sec, which is below the anticipated 2 TH/sec performance.

Because of this disappointment, the plan for its next production run, dubbed ‘batch 3’, is for a redesign aimed to break that 2 TH/sec barrier.

“We are getting closer and closer to the spec with improvements that we are doing on the board,” Ravi Iyengar, CEO of CoinTerra, recently told The Register.

Bankruptcy judge blocks Alydian from assets sale

The Alydian story seems to only worsen as time marches on. The CoinLab-incubated company filed for bankruptcy late last year, revealing that it had piled up debts of $3.6m. Now, a judge is calling into question the propriety of the company itself.

Seattle’s US Bankruptcy Court Judge Karen Overstreet has blocked Alydian from auctioning off its assets, since it has not been able to prove that it actually owns any of its bitcoin mining technology. “What I see is a debtor that has absolutely zero existence,” Overstreet said.

Corporate mines will profit from transaction fees

In the second part of Data Center Knowledge’s bitcoin mining series, it outlines the potential corporatization of bitcoin mines.

Data centres usually have long-term lease agreements, so system administrators will be confronted with planning their future mining hardware in an uncertain world where the difficulty level of the currency quickly increases and profitability exponentially decreases. That could see a shift towards transaction fees as a way to stay profitable.

Large-scale mining projects owned by large corporations will be built in the data center in order to reap financial rewards from payments. Eventually, if bitcoin becomes more of a transactional asset rather than a speculative investment, even the major payment players, for example, could also end up owning bitcoin mining set-ups.

Dogecoin to allow inflation

The surprising rise of dogecoin has been hampered by a few concerns, one of which has been the number of coins that can be mined. The scrypt-based coin was initially pegged at 100 billion units, yet there have been indications that that number is not set in stone.

In an announcement that could create an interesting mining experiment, doge’s creator Jackson Palmer has decided that the altcoin will allow for inflation, creating 10,000 new coins per block after the initial 100 billion are mined, or 5 billion per year.

So, what will that mean for the incentives to mine dogecoin? There will be more coins to mine, for sure, but it's a bit early to say if it’s a positive step overall.

KnCMiner claims ‘massive progress’ on 20nm chip

Swedish miner manufacturer KnCMiner has been making headway on its 20nm chips, it says. The company is striving to be the first to market with that particular node, and the company has announced they have made “massive progress”.

KnCMiner indicates on its website that the second generation Neptune – with that 20nm chip – will ship in the second quarter of 2014. The unit will have 3 TH/sec of mining oomph and is priced at $9,995. There will be a limited batch of 1,200 miners in total.

KnCMiner is also boasting that the units will be more efficient, with a 30% reduction in watts per GH over the previous model.

Centerus joins the cloud mining crowd

CEO Carlos Tapang was a speaker at the North American Bitcoin Conference in Miami recently. He talked about the aggressive marketplace that exists in bitcoin mining today, saying “the competition is really tough in bitcoin mining right now”.

Tapang believes he has a solution to that problem for those interested in profiting from mining bitcoin. His company's “condo mining” concept allows its customers to choose a pool and mine with the company’s equipment – with payouts submitted “by the minute”, according to its website.

Butterfly Labs selling gear on TigerDirect

Maker of ASICs miners Butterfly Labs is now selling its products on Tiger Direct. BFL is going the retail route to better get its mining devices into the hands of potential customers.

The company has had some problems with its clientele and a disgruntled customer is now suing the company. One of the accusations alleges that the company holds onto equipment for itself in order to profit from mining.

BFL has responded that the claim is "irresponsible and false".

The value of mining

Early bitcoin investor and advocate Roger Ver recently told a conference of cryptocurrency fans that bitcoin mining is a “billion-dollar market”.

Even with bitcoin’s current market cap at over $11bn, that’s still a significant industry component of the cryptocurrency.

After all, bitcoin mining is a very important function of the protocol itself. The fact that it continues to create new coins and provides essential confirmation of transactions means that the industry surrounding it will only continue to grow. As bitcoin goes, so does mining.

It is, ultimately, an integral part of this revolutionary system.

Mining cart image via Shutterstock

DISCLOSURE

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.