The Corporate Argument for Bitcoin

Earlier in the week, MicroStrategy announced it purchased $25 million in bitcoin (BTC) in January. CEO Michael Saylor joined crypto podcast “UpOnly” to reveal the back story of his company’s move to accumulate 125,051 bitcoin in 2020 and 2021.

Founded in the late 1980s by Saylor, MicroStrategy (MSTR) is a publicly traded business intelligence and software provider, but it is now better known for the $4.7 billion in bitcoin it holds on its balance sheet.

You’re reading Crypto Long & Short, our weekly newsletter featuring insights, news and analysis for the professional investor. Sign up here to get it in your inbox every Sunday.

Before buying all that bitcoin, it was already one of the largest independent, publicly traded companies in its industry. In 2020, its revenue was nearly $480 million and it had an enviable 8.29% EBITDA (earnings before interest, taxes, depreciation and amortization) margin in the trailing 12 months before its first BTC purchase. When discussing the company's position during the “UpOnly” podcast, Saylor said, “It's profitable, that's what we are. We love it, we’ll keep doing it. But you can't really scale it.”

He then claimed that while the company was profitable, it wasn’t viable to reinvest profits into hiring sprees or increasing marketing spending. That makes MicroStrategy a cash cow that keeps collecting cash on its balance sheet.

That sounds like a good problem to have, except it becomes a problem if those accumulated dollars start diminishing in value because of inflation.

The Federal Reserve’s response in 2020 to COVID-19 with massive quantitative easing helped push the equities market to new highs, with investors favoring speculative growth stocks such as Tesla (TSLA) and tech monopolies such as Apple (AAPL) and Amazon (AMZN). Soaring stock prices allows those companies to make larger acquisitions and use their valuations to expand their operations with historically cheap capital, sending their stocks higher again, rinse and repeat.

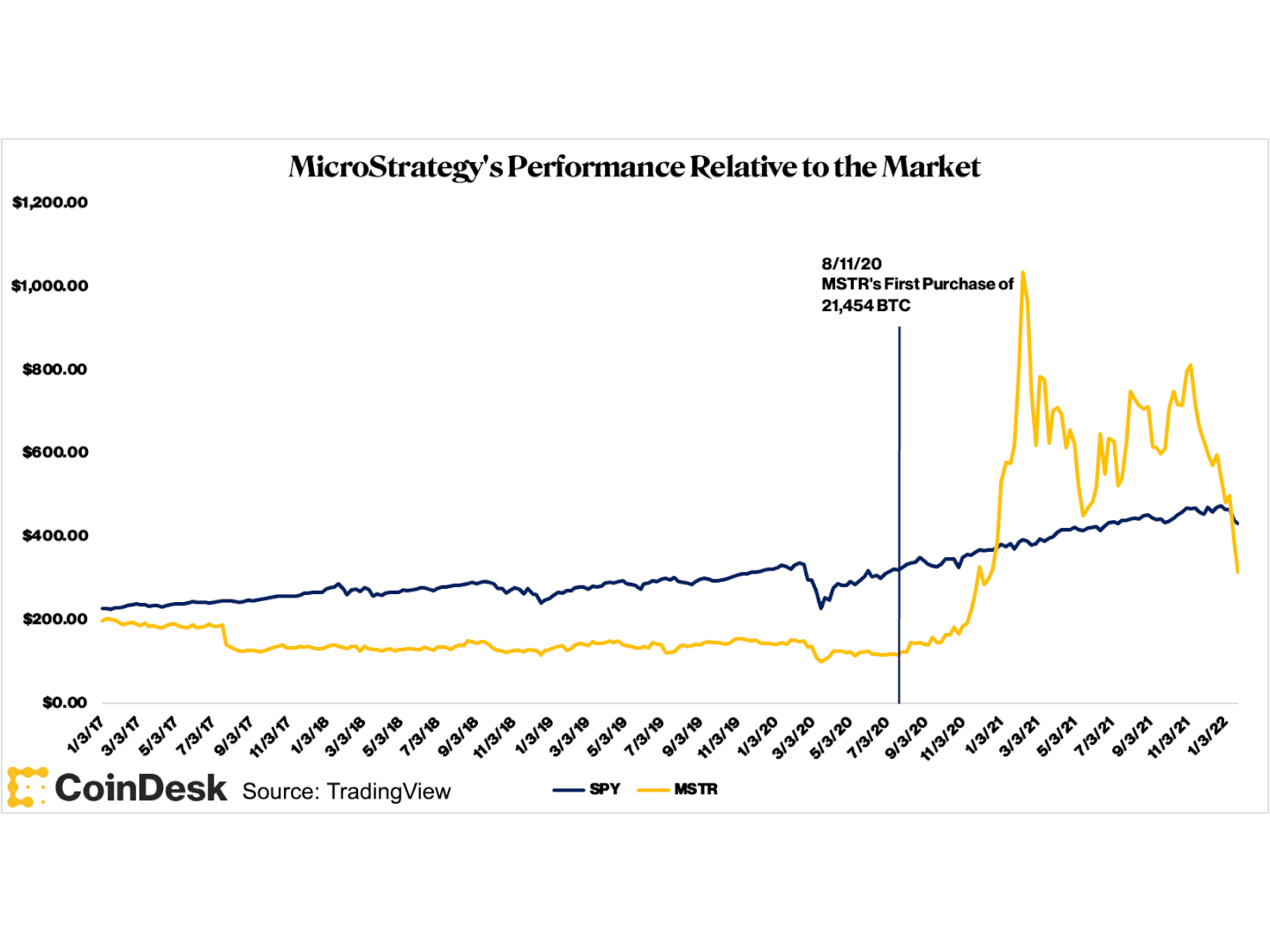

One stock that wasn’t rallying was MicroStrategy’s. In fact, it was a laggard for several years even before the pandemic hit. From the start of 2017 to the beginning of March 2020, the S&P 500 was up nearly 31% while MicroStrategy shares fell 31%. The Federal Reserve’s pandemic QE response didn’t change things for MicroStrategy. As the S&P 500 and many growth stocks approached the highs again just three months after March 2020’s crash, MicroStrategy’s stock continued to fall.

In one of his many sailing analogies, Saylor likened his company’s performance to rowing a boat against wind blowing harder than one can row. Even worse, inflation began to pick up and the purchasing power of cash cows was falling hard against the stock market and against any assets they might buy. Thus, buying bitcoin was like turning the rowboat around and sailing with the wind.

On Aug. 11, 2020, MicroStrategy announced the purchase of 21,454 bitcoins for $250 million. While Saylor considered the purchase defensive, between Aug. 10, 2020 and the first week of 2021, the price of MSTR stock rose 263%, from $146.63 to $531.64.

Those who didn’t want a stake in a company buying bitcoin were offered a way to cash out through a $250 million cash tender offer via a modified Dutch auction, which saw around $60 million in redemptions.

(TradingView.com)

Since its first bitcoin purchase, MicroStrategy hasn't slowed down. The company has now purchased 0.66% of the entire supply of bitcoin at an average price of about $30,000. The accumulation included purchases at $57,000, which now appears to be near the top for this cycle.

Saylor acknowledged that MicroStrategy has developed a reputation for buying at local tops. If the company’s bitcoin thesis is correct, buying tops will be a part of a strategy that could prove to be very profitable in the long run, even if the company takes a short-term hit on earnings. Under the generally accepted accounting principles, a company is required to take an impairment charge on a digital asset if the asset’s market price falls below the company’s purchase price, while no gain can be realized until the asset is sold. So while the numbers are deceiving, MicroStrategy took a $147 million impairment charge during last year’s fourth quarter.

More importantly, if all of its hopes pan out, MicroStrategy may maintain its purchasing power, hedging against inflation and potentially even outperforming the broader stock market. In the past week, Saylor and MicroStrategy’s chief financial officer have both assured the public that they will continue to buy bitcoin and use it in a productive way that adds more value for shareholders.

While many criticize bitcoin’s volatility and tendency to drop by 50% seemingly on a whim, Saylor appears to be unconcerned. His response to the criticism is that either you can die a slow death, facing the blows of a devaluing dollar and a soaring stock market, or you can fight. If bitcoin’s price can outpace inflation, it is a good investment as opposed to holding cash. While it may be a long shot, if bitcoin’s adoption becomes widespread in the near term, MicroStrategy will have put itself in a better position than the vast majority of public companies.

DISCLOSURE

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.