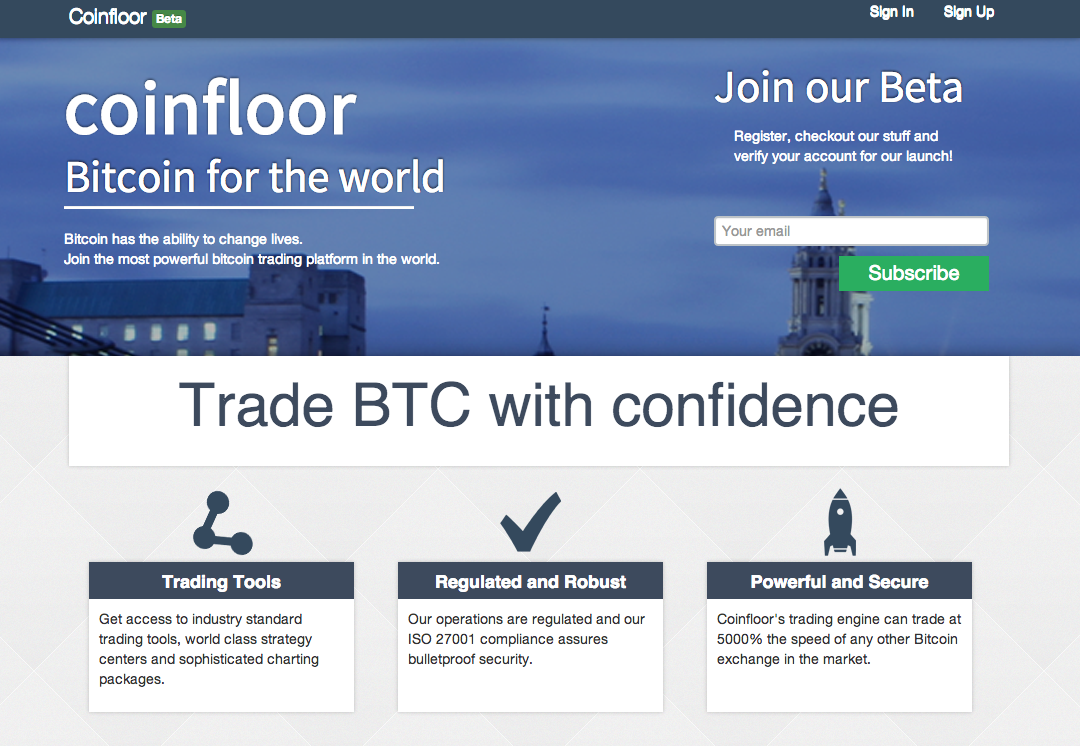

UK bitcoin exchange Coinfloor opens for business

A UK-based bitcoin exchange has beat competitors to the post as it opens for business today. London-based Coinfloor begins registering customers at 9am this morning.

The site, launched by Mark Lamb and Amadeo Pellicce, hopes to get in on the market early by offering GBP/BTC trading services before regulators have passed judgement on the cryptocurrency. It beats BitPrice to market. The latter has been lobbying regulators in the UK about bitcoin’s status, but hasn’t opened its doors yet.

Coinfloor, which is backed for an undisclosed sum by VC firm Passion Capital, is the first firm to trade bitcoins for GBP on an order book for at least a year. There are scant other exchanges in the UK trading bitcoins for GBP. Bittylicious offers the chance to buy bitcoins for sterling, for example, although this appears to be a more rudimentary site, and doesn’t have the charting facilities offered by Coinfloor. London-based Intersango ran an order book and allowed GBP trades, although that site inherited hacked and now-defunct virtual currency exchange Bitcoinica. It was sued by customers, and is no longer taking registrations.

“Historically the biggest hurdle for setting up a bitcoin exchange (whether in the UK or elsewhere, but even more so in the US) has been securing a banking partner,” said Stefan Glaenzer, a partner at Passion Capital. In 2012 Mt. Gox had to suspend GBP trading after its Barclays account was discontinued. It is possible to trade GBP for bitcoins on some other exchanges, but getting money out in GBP can involve a premium.

Coinfloor has secured multiple banking accounts from several different partners, he said. At least one of those is a Santander-owned bank, but neither the exchange nor the VC is saying who.

The other barrier to UK exchanges has been regulation. The UK Financial Conduct Authority (formerly the Financial Services Authority) and HMRC are so far not regulating bitcoin, but this creates uncertainty, and talks are ongoing.

“It's not for us to predict if they may change their view, but if they do, we will be prepared and ready to be compliant given our self-imposed procedures for KYC/AML,” said Glaenzer.

[post-quote]

The firm has also taken the precaution of excluding US users, to comply with KYC/AML rules that it says exceed compliance requirements for a regulated exchange. However, it hopes to open up trading to US users soon.

Coinfloor will offer straightforward trading services via an order book. There will be no margin trading available, but the firm is capitalizing on what it calls a sophisticated algorithmic rounding engine for fee calculation. Instead of simply rounding up its fees, it uses a form of stochastic rounding, which uses an algorithm to determine how a fee is rounded. This makes it suitable for high-frequency professional traders, it says.

Catering for pros will be one reason why the firm is offering maker-taker pricing for traders. To this end, the firm will also be offering ‘maker-taker’ pricing, which favours market makers.

In exchange trading, a market maker brings liquidity to an exchange by always being prepared to trade an asset. This stands in contrast to ‘takers’, who only come to an exchange with request to buy or sell when they are ready. Market makers are important because they make it easier for people to buy and sell an asset on an exchange without hoping that a suitable counterparty will turn up.

Market makers generally make their money via a ‘spread’, where they buy and sell at different prices to make a profit. But maker-taker pricing encourages market makers by giving them lower fees. If a trader places an order on Coinfloor that enables another party to make a trade, the trader is considered a maker, and will get lower fees. The other party, who takes advantage of that order, is taking liquidity out of the exchange. They are considered takers, and will be charged the taker rate.

Maker rates are up to 0.3% for those averaging £500 or less in trades over a 30-day period. Taker rates are 0.5%. These fall lower for higher-volume traders. For example, maker rates for 30-day averages between £55,000 and £88,000 are 0.03%, and taker rates are 0.28% at that level.

Coinfloor claims to the first bitcoin exchange to offer maker-taker pricing, but it won’t be the last. US-based exchange Coinsetter, which will focus on the USD/BTC currency pair, plans to offer maker-taker rates when it launches soon.

The maker-taker model encourages liquidity in a financial market, which is something that bitcoin sorely needs at present, and it is an example of how a new class of exchanges is becoming more sophisticated.

This model is attracting some sophisticated attention. Taavet Hinrikus, co-founder of low-cost currency exchange firm TransferWise and one of the first employees at Skype, also backed the firm.

Coinfloor begins taking account registrations today, but will begin trading on 5 November.

DISCLOSURE

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.