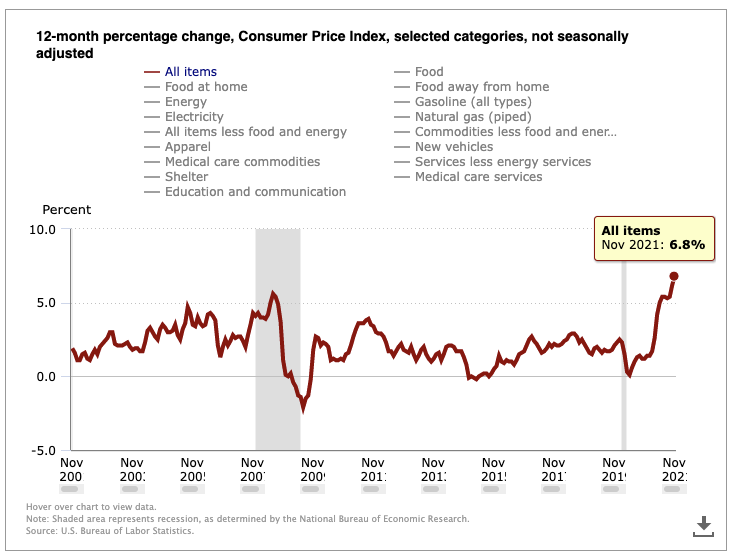

US Inflation Jumps to 39-Year High of 6.8% in November; Bitcoin Falls

The U.S. Labor Department’s Consumer Price Index (CPI), closely tracked by bitcoin traders due to the cryptocurrency’s use by some investors as a hedge against inflation, has risen to its highest since the early 1980s.

The CPI for all items rose 6.8% in the 12 months through November, the highest since May 1982, when it was 6.9%. The cost-of-living increase was in line with the average forecast of economists in a Reuters survey, but it marked a sharp increase from October’s 6.2% print.

Stripping away the volatile food and energy component, the CPI core reading for November was 4.9%, more than double the Federal Reserve’s stated target of 2%.

Bitcoin rose 2% in the minutes after the CPI data was released, trading around $50,000. But within the a few hours, the price had dropped to below the $48,000 level.

Crypto traders may see the high inflation rate as additional motivation for the Federal Reserve to accelerate its withdrawal of monetary stimulus. At a meeting last month, the U.S. central bank announced plans to start tapering its $120 billion-a-month of bond purchases – a form of stimulus, funded by money printing, designed to help markets and the economy heal from the impact of the coronavirus.

Next week, the Fed is expected to double the pace of the tapering to wind down the bond purchases by March, sooner than the current trajectory of mid-2022. Less monetary stimulus might be bad for bitcoin, since the cryptocurrency’s price has been buoyed in the past couple years by bets that trillions of dollars of money printing by the Fed would stoke inflation.

“We are expecting more sideways trading as eyes shift towards central bank meeting next week,” said Lennard Neo, analyst at Stack Funds.

CPI Report

After the release of the October CPI data, bitcoin shot up by almost $3,000 to quickly hit a new all-time high of $68,950. But within a few hours, the move reversed completely, and prices fell as more traders shifted to focus on the logical consequence of faster inflation: monetary-policy tightening by the Federal Reserve that might crimp demand for riskier assets from stocks to cryptocurrencies.

The world’s largest cryptocurrency by market capitalization is currently trading around $47,400, down 31% from the all-time high reached in early November, when the last inflation report was released. Bitcoin is still up 64% on the year.

“Today’s inflation figures were marginally less than many were fearing, but the reality is that if you’re being paid less than 7% more than you were this time last year, your purchasing power is diminishing,” said Jason Deane, crypto analyst at Quantum Economics.

He said that “The Fed has no real tools left to try and fight it and is effectively strapped into the ride with the rest of us.”

Looking ahead, Deane expects to see a rapid upward movement in gold, major indices and bitcoin.

DISCLOSURE

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.