Vault of Satoshi expands Canadian bitcoin exchange market

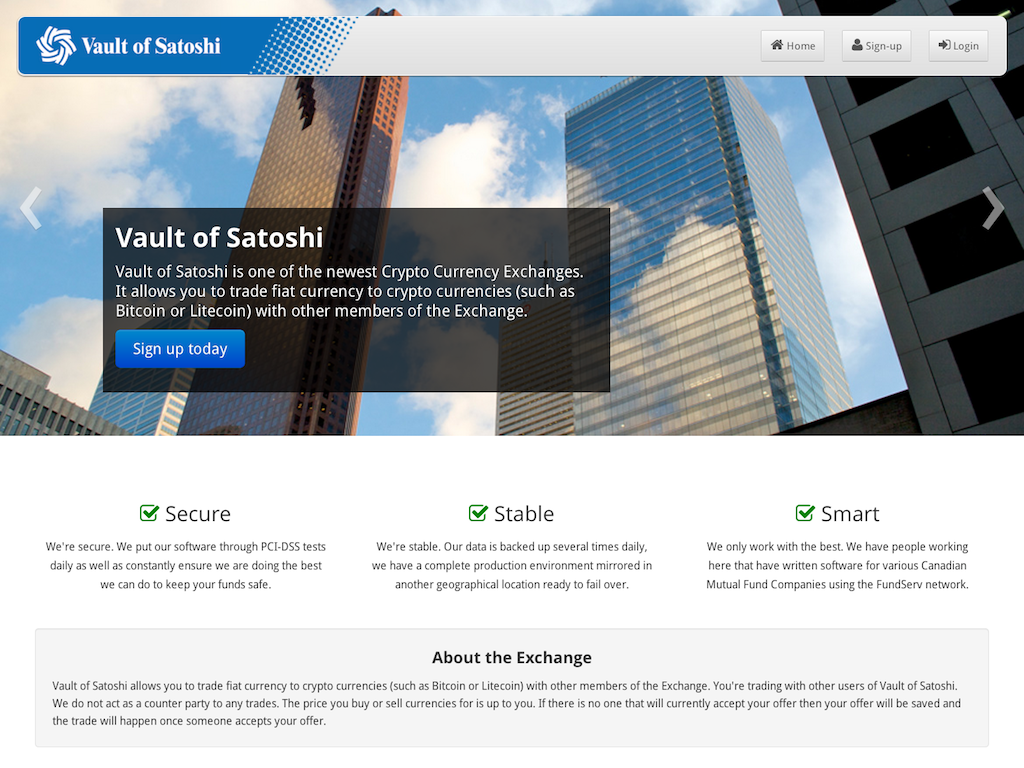

A new Canadian exchange launched this week, offering cheaper rates than the incumbent, and touting an advanced API. Toronto-based Vault of Satoshi is offering trades between fiat currency and either bitcoin or litecoin.

The exchange, which is offering all of its services at 0.5% or below, is entering a relatively uncrowded market in Canada. The incumbent is Virtex, a Canadian exchange with fees of 1.5% for transactions less than 400 bitcoins over 120 days. To get the 0.5% rate from Virtex, you’d need to trade more than 2,000 bitcoins over three months.

“I would say that we have one of the most comprehensive APIs in the world aside from Mt. Gox and these other exchanges, and the most comprehensive API in Canada,” said Michael Curry, CEO of the company.

He has a track record in startups, having started website monitoring firm Verelo and sold it to Dyn this January. After that, he started working on his exchange, which he originally began testing on the Testnet in May.

Curry consulted for a mutual fund company and wrote a buy/sell system for one of the companies there. This, and his experience developing website monitoring software, positioned him well to create his own software system in C, he said. “We’ve taken a lot of knowledge from ramping up Verelo,” he added.

Vault-of-satoshi

All of this happened under the moniker BTCTO.com, before he changed it to Bank Of Satoshi. However, that name incurred unwanted interest from the Office of the Superintended of Financial Institutions (OSFI) in Canada, so he changed it again to its current name.

The firm sent in two requests to FINTRAC, the financial services regulator in Canada, asking for a money services business (MSB) license, but the regulator’s current position is that no such license is currently needed for bitcoin. The company was refused, says Curry.

However, this puts exchanges in a precarious position, because while the regulator may not have concerns, some banks do. Royal Bank of Canada closed Virtex’s account early this year because it didn’t have a license, and Curry had the same problem.

“We got the boot from there about two months in, and we’ve switched over to three banks: Scotia, BMO [both Canadian], and Wells Fargo in the US,” he says.

, a gaming lawyer in Toronto with several bitcoin-related clients, says that the regulatory landscape is likely to change. He said:

Curry has a long-term strategy to deal with the regulatory challenge: he wants to become an exchange dealing between fiat currencies, to force the issue. The regulatory hurdles for this will take around 48 months, he predicts.

In the meantime, he is adopting strict KYC rules, requiring photo IDs and proof of residence from customers that sign up. Once they are in, however, they can pay with cheques, money orders, Interac e-transfers, cash deposits, and bank wires.

The firm is also planning to offer a merchant checkout feature, so that online vendors can transact in bitcoin. This is something that Virtex went live with in mid-August.

canadian-flag

As of now, Vault of Satoshi has launched with support for both bitcoin and litecoin, although it has designed its site to easily support other coins.

“We designed the system from the ground up to be vanilla. Bitcoin is no different from litecoin. The only difference is in the backend and how it processes that fund, and we have a vanilla API for that.”

In the coming months, the Vault of Satoshi will consider adding other coins, such as PPC and Namecoin, Curry added. In the meantime, it is busy mining them.

“We have quite the farm. We thought ‘we’ll build an exchange – but how are we going to back it?’” Curry said. At the time, the firm didn’t have any seed funding. It purchased 40 GPU cards, and recently took delivery of a 60Gh/sec Butterfly Labs ASIC miner.

Now, however, it has seed funding. It scored $250,000 in May from Ryan Van Barneveld, the co-founder of Fusenet, which owns SimplyAudiobooks and audiobooks.com.

Got any other stories about bitcoin in Canada? Get in touch via [email protected].

Image credit: Flickr

DISCLOSURE

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.