'Weird DeFi' Gets Weirder

Decentralized finance (DeFi) has always been strange, but it's becoming mind-bending.

It's following the course the internet took as a publishing platform. First, it recreated things from the analog world. Then it invented new things. Then new things were built on top of the new things. Finally, the internet colonized the analog world. We're at phase 3 in DeFi: new things built on new things.

"It's a snake-eating-its-own-tail element to DeFi right now," Tom Schmidt, a general partner at Dragonfly Capital, said in a phone call.

The pre-blockchain internet did this in a lot of ways, but drop-shippers are a great example. First there were shops online that worked much like shops on the street. Then there were shops like Etsy that combined shops like a mall. Finally, there were drop-shippers: websites that never touched inventory, instead instructing wholesalers, such as Asian e-commerce megasite Alibaba, where to ship sales the drop-shipping website made.

DeFi is starting to get similarly reflexive. Entrepreneurs are creating products that could only exist in DeFi, products that take advantage of its strange qualities such as on-chain transparency and distribution of useful new tokens to drive loyalty.

This builds on a theme we've touched on before.

Last year, as the debut of Compound's COMP token kicked off a craze for earning extra tokens atop of fees for lending assets to different protocols (what's come to be known as liquidity mining and yield farming, respectively), the excitement got somewhat demented as food memes made bizarre crypto projects all the rage.

We called that era “Weird DeFi.” Some of it proved to be ephemeral, such as Tendies and Wifey, which aren't really in the conversation any longer; others, like SushiSwap, proved to be super important.

But DeFi didn't stop with food memes. It kept growing and evolving, and it seems we've entered a new era of Weird DeFi, one that's more finance, less meme. It's weird because it's new, because it could only exist on blockchains where it's possible to mix and match the work of multiple teams without any gatekeeper’s permission.

It's also weird because some of it is pretty hard to wrap your head around.

"You need to have something really special in the market in order to get users and attract investors," Schmidt said. "The need has sort of been filled for some of these basic things."

In other words, Dragonfly isn't really interested in models that improve slightly on existing projects that already have a user base and can iterate on their own. Dragonfly is looking for things that make its partners go, "Hmm!"

What follows is a look at four projects that exemplify this new, self-referential but nevertheless innovative phase of DeFi.

Alchemix – for loans that pay off themselves

Let's start with maybe the hardest of these projects to understand.

Alchemix allows users to stake collateral (at first, only the dollar-pegged stablecoin DAI) and then take out a loan as a synthetic version of that collateral (alUSD). This is much like MakerDAO, which allows users to borrow a portion of a deposit in ETH, WBTC, USDC or other assets and then borrow a portion of its value in DAI.

"Alchemix is like one layer above a lot of the protocols," said Eva Beylin, a member of the knowingly named investment firm eGirl Capital, which invested in Alchemix. "They are this layer above but a layer below the wallet and the end user."

Where Alchemix differs from its predecessors, though, is it manages the loan for borrowers. They don't need to make payments. They don't need to watch the market. Alchemix will take their full deposit and invest it (most likely on Yearn Finance) and use the yield earned there to pay off the loan (while pocketing a small portion of the yield).

Basically, it offers an advance on future yield. "With Alchemix, you have a fixed yield but you don't know when you'll be able to pull your assets out," Schmidt said. If the user just deposited it into Yearn themselves, that person would have a variable yield.

In other words, Alchemix users are trading certainty about returns for liquidity.

"Alchemix seems very polarizing. I don't personally really understand the appeal," Schmidt said.

Starting with DAI makes sense because it's easy and has very little volatility, but Beylin says yield-generating vaults that will accept other kinds of collateral are coming soon.

In fact, the approach starts to make more sense as a way for people who are long a specific asset to remain long while still making trades. To that end, Alchemix just released an ETH vault.

It had a rocky launch, however.

Nevertheless, the design scratches much the same itch as MakerDAO but without the slashing risk. (If the value of a borrower's collateral drops too far MakerDAO sells it and the borrower gets a painful liquidation penalty, which forces them to keep an eye on their positions.) So one of MakerDAO's chief use cases is allowing users to make other bets without selling assets they are long.

Similarly on Alchemix, because many users are long ETH, they are very likely to like the idea of borrowing synthetic ETH to make other trades while hoping the value of their ETH continues growing.

Why someone would want to borrow against a stablecoin to get more stablecoin is a little harder to understand, to Schmidt's point, but one reason might be just to make a bet on the future of Alchemix itself.

The protocol offers a number of liquidity mining opportunities for alUSD holders that earn the ALCX governance token, one the creators promise will start earning fees from Alchemix users.

Convex – better liquidity mining for CRV

Convex enables its users to earn more CRV tokens on Curve.

That's it.

Beyond earning more CRV, users can also earn the Convex token, CVX, but the main point is goosing CRV rewards for liquidity providers.

"Curve is so confusing. It's one of the most useful products out there but then it's somewhat confusing, all the rewards you can earn," said Defi Dad, community lead at Zapper.fi, an online dashboard for DeFi investing. Schmidt agreed, saying Convex probably represents a feature that Curve should have built itself.

This is what might be called meta-liquidity mining. It's an application to improve liquidity mining. Basically, Convex is able to boost rewards by having lots of people use it. When someone earns CRV and then stakes it to Curve, that boosts the CRV rewards. Convex is able to do this en masse. It generates lots of CRV fast because lots of people are using it.

Curve's CRV is a favorite token for liquidity miners, probably because it's up almost 400% since 2021 began.

Sorting out how to optimize providing liquidity on Curve is very hard. Convex makes it easy. Users can pool resources on Convex and the protocol will figure out the best way to allocate it all so everyone gets the best CRV rewards

Yearn Finance, the robo-advisor for yield, has always been long Curve. It has always been the biggest liquidity provider to Curve, which is an automated market maker for stablecoins.

There's a narrative of rivalry between Yearn and Convex, but the truth is Yearn is using Convex a lot.

And Convex may have been inspired to some degree by Yearn. Yearn has a vault it calls the Backscratcher, in which users can deposit CRV that will never be returned. Users will receive a token for their deposit that will earn income, however. Yearn then uses its Backscratcher holdings to boost returns across the system, making it a moat that gives Yearn a competitive advantage above and beyond its strategies.

For DeFi Dad, Convex finding a way to make earning CRV work better reflects a larger truth about DeFi. "When you join a community and you approach it in a collaborative manner and you demonstrate respect for what already exists, there's a lot of support in this community," he said.

ARCx – credit scores for degens

Liquidity mining has caught on with DeFi project founders in part because they want to create communities around their projects.

All of these things have network effects. The more people use something, the better it works for everyone.

Even a good design can take a long time to amass enough users, though, so an incentive is helpful. However, once this idea of giving tokens to early users caught on, some of the biggest whales, or large holders, started taking advantage.

They would dump liquidity, harvest tokens as long as they were worth it and leave.

"They're mercenaries," Schmidt said. "They'll dump it and move on."

This severely undermined users' experience and the ability to create a sticky, or loyal, community.

ARCx is the beginning of an idea that could counter that problem.

What if platforms had a way to give better rewards to actual users of protocols? What if there were a simple way to verify a wallet had made some trades, made some deposits and maybe held an airdropped token for a while (or even staked it)?

All of this is public information viewable on-chain, but obviously it would take a lot of extra coding for each new yield farm to do the needed engineering to verify that for each new user.

ARCx is building that infrastructure now. It's doing it for its own yield farms, but Schmidt, an investor in the project, says ARCx has a vision to make it a platform.

"ARCx is using your past on-chain activity to determine the rates you should get on their system," Schmidt explained.

Think of it like a credit score. In traditional lending if a bank knows your track record of paying debts, it may be able to offer you a lower rate than if the sole criterion was the collateral pledged.

DeFi is pseudonymous so it has been largely collateral-based to date, with no consideration of the borrower’s history. But in ARCx, if a specific wallet has exhibited the kinds of positive behaviors that a protocol is looking for, it can give its owner better rates on loans or a boosted token reward for liquidity providers.

"It's a pseudo-Sybil system," Schmidt said, because whales could game it but it would require a lot of work and expense to do so.

Reflexer – a unit of account for DeFi

Stefan Ionescu, the creator of Reflexer, quickly admits the Ethereum world may not have been ready for his idea.

"I think we launched something extremely complex, hard to grasp by the community and way ahead of its time," Ionescu said. "I still wanted to build it because I thought it was the right way to do a stable asset."

The core idea of Reflexer is that the unit of account in DeFi (the way we understand how much something is worth) should be native to DeFi. It should reflect, on some level, the price of ETH rather than, for example, the United States’ relative geopolitical position in the world.

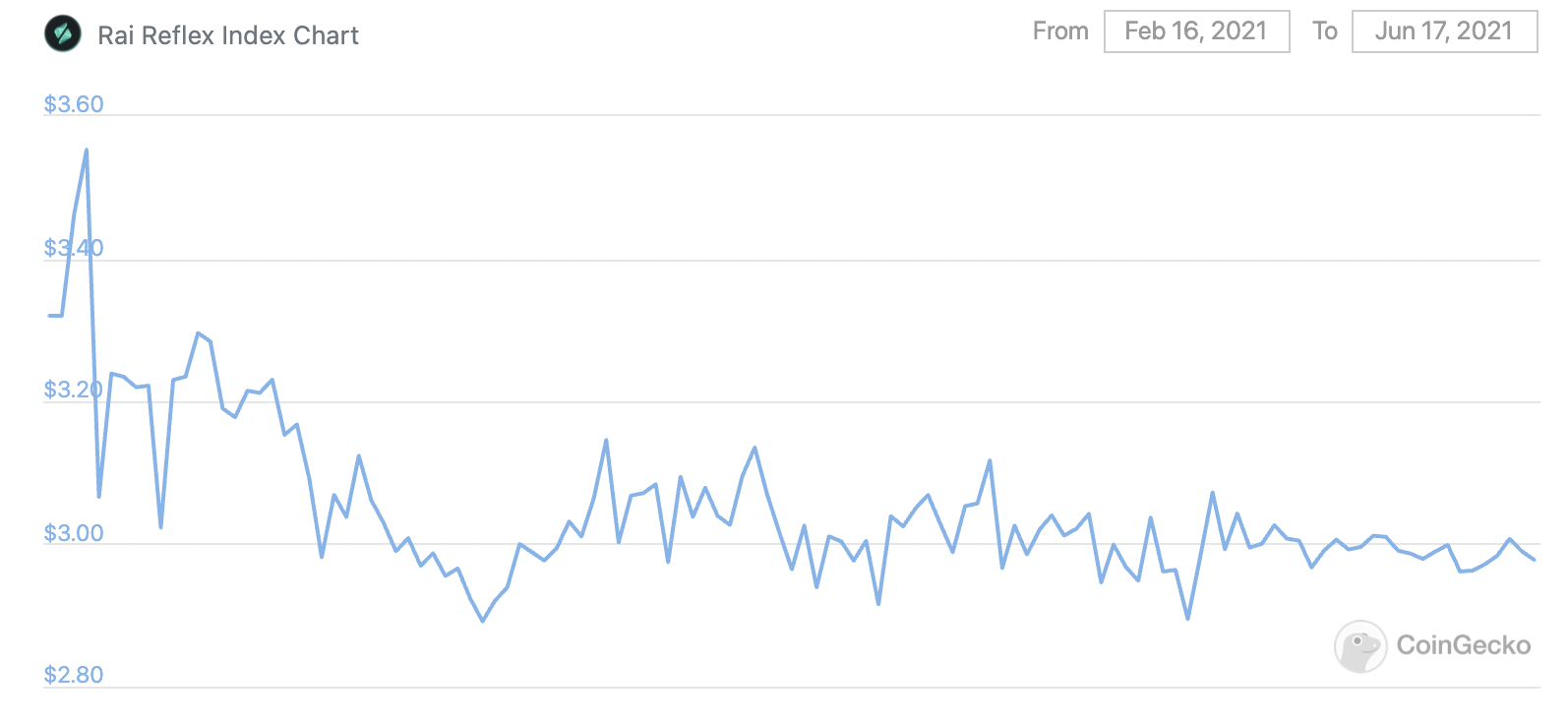

Reflexer is a lender much like MakerDAO is. It makes a synthetic asset from ETH, but instead of tracking the price of the U.S. dollar RAI attempts to track the price of ETH, but slowly.Think of it like this: Bitcoiners love to show a long graph of the BTC price overlaid with a smooth line that follows the average price of bitcoin over a long period of time. That line is pretty steadily rising, even if every few hours BTC can swing all over the place.

ETH does the same thing. So what if there were an ETH derivative that followed that broad line?

"Of all the projects, this is one where I was, like, ‘This is new thinking,’" DeFi Dad said.

Such praise is flattering but it's been tough to make Reflexer sticky. Ionescu admits the community for his project is small and made up largely of people who are deeply into economic theory.

"Right now I would say only weirdos or people who really understand economic theory are into the community," Ionescu said. "The vast majority of people are still focused on dollar stablecoins."

He's working to form partnerships with projects that could use RAI, its ETH derivative, as a collateral type or as an asset that's like ETH but without so much of a price swing.

The team may also shift the model of Reflexer's governance token to make a fairer backstop insurance system on the protocol. Ionescu said they have made a lot of progress recently on getting RAI's price to be less volatile, too.

RAI's 90-day price chart.

Beyond giving people a crypto-native unit of account, the other aim of Reflexer is to make a statement about the excess of governance in DeFi projects. "We are still dedicated to removing governance from RAI by August of next year," Ionescu said.

Getting traction has been hard, though. DeFi's degens are all for earning ETH but they still think in dollars. Ionescu said getting people to wrap their heads around the Reflexer worldview has stymied his team’s ability to build community as well as some other projects.

The team is now looking to make some serious shifts in how the Reflexer protocol works that Ionescu thinks might turn things around. Right now, for example, all holders of its governance token are effectively the backstop insurer of Reflexer. Ionescu plans to propose a model where only those who opt in to staking provide insurance, and they would earn inflationary income for doing so.

This speaks to a broader psychological appeal of Weird DeFi. There's something satisfying about finally getting the hang of using these platforms effectively and coming up with clever tricks. To a certain degree, teams can create more stickiness by giving users ways to actively manage positions, even if requiring the extra step isn't strictly necessary as a practical matter.

"There's probably a little bit of a retail mentality to this whole thing. People like to do stuff with their tokens," Schmidt said.

DISCLOSURE

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.