Withdrawals from Mt. Gox: growing pains or banking bottleneck?

On July 4th, bitcoin investors let out a collective sigh of relief when Mt. Gox finally resumed USD withdrawals. The reason for the hiatus on withdrawals was so Mt. Gox could test out its new transaction system in the face of increased volume. Yet there was a level of exasperation for those looking to cash out of BTC because of the fact that bitcoin at the time was experiencing a low not seen since April.

Despite resuming withdrawals, a number of people have expressed discomfort at the fact that they cannot get their money from Mt. Gox, despite issuing withdrawal requests. I’m also dealing with this issue as well. I sold some bitcoins via Mt. Gox on July 22 and requested a withdrawal, and as of press time I still have not received money in my bank account.

Others, with more substantial sums of money tied up with Mt. Gox, have been expressing their displeasure on Reddit, the Bitcointalk forum and in the comments section of CoinDesk.

Can Mt. Gox handle processing so much USD?

Kinnard Hockenhull, founder of the US-based exchange BitBox, believes that Gox’s issues stem from its geographical location and the fact that it must cooperate with a banking system that’s suspicious of bitcoin. “They are international, that increases the number of intermediates. And Mt. Gox wasn’t built to be a financial exchange. The banking industry has not been accepting of bitcoin businesses.”

It’s no surprise then, that when Mt. Gox’s bank saw how much money was flowing into and out of its accounts, they contacted regulators. As it turned out, Mt. Gox had failed to register as a money transmission business when it was clear that the company was handling financial transactions made in bitcoins (they have registered since).

This combined with performance issues that the company says it is fixing have created a controversial situation. The question is whether or not Mt. Gox can start to put the drama behind them, as most financial businesses don’t normally have this many issues.

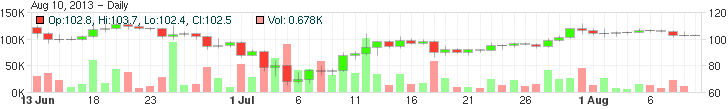

Transaction volume

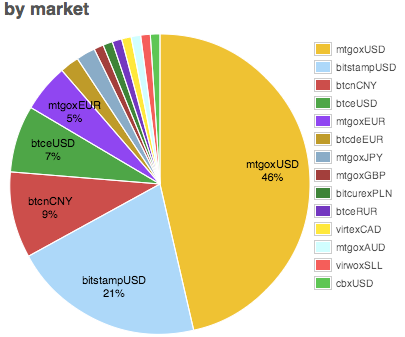

Mt. Gox still proclaims on its website that “As of July 2011, Mt. Gox handles over 80% of all bitcoin trade”. That may have been true back then, but no one can deny how much has changed in the bitcoin universe since 2011. Yet it could just be that the sudden spike in bitcoin interest and the associated increase in transaction volume have contributed to the problems Mt. Gox is dealing with today.

Alistair Cotton, a corporate dealer for Currencies Direct, believes that the problems that have plagued Mt. Gox are battles it is fighting all on its own in uncharted territory. "The real problem the exchange suffers from is fighting these battles by itself, without the safe harbor of a regulator or even laws protecting it. If everyone plays fair, there are real benefits to a lack of regulation and involvement by authorities. But nobody plays fair when there is little chance of getting caught.”

Opportunities for other exchanges

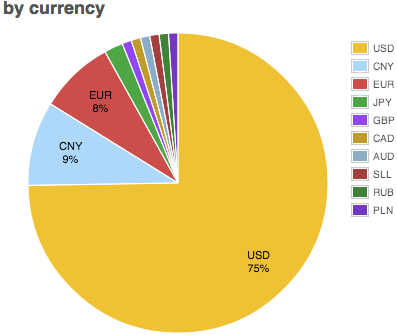

The US dollar is the primary currency exchanged for bitcoin. That means exchanges that are focused on servicing USD customers have an opportunity to garner new business.

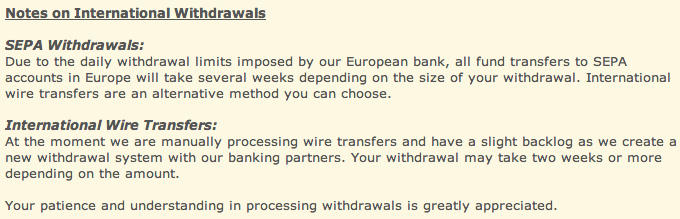

“I can only surmise that Mt. Gox may be having issues with its bankers who may be placing daily limits on the amounts of transfers - causing queues to build up. There is no reason to delay withdrawals. Imagine if your bank did this”, says Michael Parsons, a bitcoin advisor who writes his own personal blog called BitcoinBytes.

This apparent blockage by banks is not deterring any other exchanges, especially those based in the United States. Coinbase is one of the best known because of its $6.11 million series A funding. BitBox’s Hockenhull, whose exchange is FinCEN compliant, believes that bitcoin’s game-changing nature is just too disruptive for traditional financial institutions to dismiss. “Bitcoin isn't just money or a way to make money, it's a movement to change the meaning of money.”

The future of Mt. Gox

Just by a measure of their market share, and being one of the earliest exchanges for bitcoin, Mt. Gox has a tremendous competitive advantage. But those looking to withdraw USD from Mt. Gox can easily transfer their BTC to another exchange and get their cash that way, if they so choose.

When Mt. Gox and Dwolla were working together, the system of withdrawals worked fairly well. Now that has changed, it has made withdrawals much harder for Mt. Gox to process. CoinDesk’s Emily Spaven reported that BitStamp, a UK-based exchange, has been seeing impressive exchange volume numbers. I’ve used BitStamp myself; the interface is intuitive and has a zen-like simplicity to it.

I’m sure Mt. Gox is very aware of its competition, and despite its detractors it still has an advantage. This is because of their volume numbers and the fact one can sell bitcoins for the best price on that exchange. The only question is if they can rise to the challenges that they face: a lawsuit from CoinLab, performance issues and the withdrawal issue. There’s a lot at stake for them. Yet the opportunity to capitalize upon their past mistakes is there, should they be ready to handle the challenges ahead.

At the time of press, Mt. Gox had not responded to CoinDesk's request for comment.

What do you think about Mt. Gox? Will they be able to continue to be the largest bitcoin exchange in the world, or will their problems continue to plague them indefinitely?

Featured Image Source: Flickr

DISCLOSURE

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.